After 2021, we entered an era of cryptocurrencies where people stopped just talking about financial decentralization and started broadly discussing the tokenization of everything, thanks in part to non-fungible tokens (NFTs).

This shift represents a critical perspective that will guide three theses for the next bull market. To fully understand these theses, it is essential to understand that everything is data. Money is data. Your commitment to a brand is data. Your credentials are data. The input to your favorite show is data.

Since 2021, the ecosystem has increasingly started storing a large portion of this data in the form of fungible tokens, NFTs, and timestamps on the blockchain, which acts as a data repository in this context.

Related: Expect New IRS crypto Surveillance to Come Accompanied by an Increase in Seizures

While not all data needs to be on the blockchain, the ability to put data on the blockchain radically transforms the way we store, share, and use data for secure, automated instructions and transactions.

Re: non-financial blockchain use cases. pic.twitter.com/lYZFprXAry

— vitalik.eth (@VitalikButerin) May 27, 2022

And it seems like this prospect of tokenizing everything is coming to bitcoin. This gives rise to the first thesis.

Ordinals and similar protocols continue to grow, as bitcoin becomes a network for multiple assets (or multiple types of data)

In January 2023, Casey Rodamor publicly launched the Ordinals protocol, which, in short, allows for the permanent insertion of any type of file into the bitcoin blockchain.

In less than a year, the community has already carried out experiments in which music, works of art, newspaper articles and even video games are inscribed on the world’s leading blockchain.

The Ordinals protocol was not the first to allow this, but it has gained the most traction. And everything indicates that it is a flame that will not go out.

More than just a technical protocol, a culture and mindset has been created where more and more builders see bitcoin as a canvas for the creation of other projects and applications, and nothing can stop well-established cultural movements.

But remember: it is not necessary to store everything 100% on-chain, as this is expensive and, for some applications, inefficient.

Therefore, protocols like Taproot Assets, which allow the creation of other assets, on the bitcoin network, but in a way that keeps most of the information off-chain, will be essential.

Speaking of storage costs in layer 1 blockchains, it seems that layer 2 blockchains are ready to shine.

Cryptocurrencies will break out of their bubble and finally reach the common person through layer 2 blockchains

Those who were active during the 2021 bull market remember that $50 for a transaction fee on ethereum was almost the norm, not to mention spikes, such as during Yuga Labs’ Otherside nft minting, where users paid up to six Ether (eth). ) per transaction.

It’s simple: if the blockchain is not invisible, it will not reach the mainstream. And expensive and slow transactions make the blockchain very notorious.

This is why Layer 2 blockchains, designed to scale Layer 1 blockchains, will be so crucial to the next bull market.

Although they have been around for years, neither they nor the market were mature enough to take advantage of them in the last cycle. On the one hand, many companies and developers were not convinced that Layer 2s were stable enough to handle a significant influx from the mainstream. On the other hand, there was also the problem that, in the emotion of the moment, people acted without studying or understanding much.

The number of unnecessary projects on ethereum was significant and the reasons varied: it was cultural, because some companies didn’t even know what sublayers were, or simply because everyone was building on top of ethereum.

Now, with all the lessons learned and the calm that has settled in with the bear market, it is clear that the mindset for building is much more mature, and the “jobs to be done” of blockchains have become much clearer to who are building. .

And the icing on the cake will be the implementation of EIP-4844, which is expected to happen in a few months on the ethereum network, and will further reduce the transaction costs of layer 2 networks, making them even more invisible and robust to attract. and retain the general audience.

But it’s pointless for infrastructure to be invisible if people can’t connect to it and companies can’t build on top of it. However, the solution is already here!

Abstraction solutions will be the main entry point and retention mechanism for traditional users and large companies on the Web3

The big problem is that with the tokenization of everything, in some cases decentralization is more of a hindrance than a help.

If the issue is bitcoin (btc) custody, the issue of decentralization is pertinent. However, when the topic turns to tokenized banknotes or a company’s loyalty credentials, the value does not lie in the decentralization of the system. Therefore, simplifying the user experience by abstracting complex processes, such as creating a semi-custodial wallet with social login or eliminating concerns about gas fees, makes a lot of sense and is necessary.

Related: bitcoin beyond 35K for Christmas? Thanks to Jerome Powell if it happens.

Abstraction solutions were the missing bridge so that the crypto universe does not continue to be an exclusive technical environment of technically trained people willing to face various challenges and complex journeys. But now they are ready to shine!

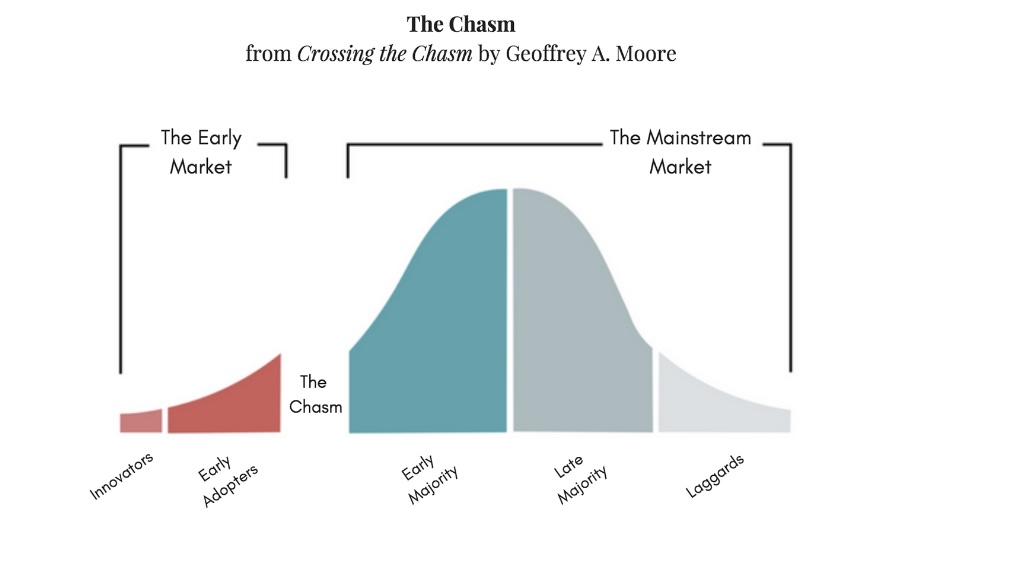

And it is not about ending decentralization, but about having a choice. Those who want to remain 100% decentralized can do so, but those who don’t now have an option. In this way, the crypto ecosystem is prevented from dying in the famous abyss of innovation. Because great infrastructure is meaningless if people can’t connect to it and navigate it easily in everyday life.

Something that is not often discussed is how important these abstraction solutions are for traditional businesses to effectively join Web3 as well. How many companies currently have a team of developers who can program in blockchain languages, such as Solidity? It is also essential to make it easier for builders to get started.

By dividing blockchain’s journey into the mainstream into four phases, we could say that account abstraction solutions, along with the advances mentioned in thesis two, will propel Web3 into its penultimate phase: with improved infrastructure, fewer technical builders and brands join the game. and the number of applications, projects and use cases are multiplying, attracting widespread attention.

As of today, it appears that major blockchains will increasingly be seen as platforms for multi-asset consensus in the next market cycle and less as currencies. The crown jewel will be the quest for scalability, which will make layers more invisible and less complex for users to navigate and companies to integrate. Welcome to phase 2 of ethereum and bitcoin.

Lugui Tillier is the commercial director of Lumx Studios, a Web3 studio that counts among its investors BTG Pactual Bank, the largest investment bank in Latin America. Lumx Studios has previous Web3 cases with Coca-Cola, AB InBev, Nestlé and Meta. The author has investments related to the Ordinal Protocol, although none are mentioned in this article.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts and opinions expressed here are solely those of the author and do not necessarily reflect or represent the views and opinions of Cointelegraph.