Nuthawut Somsuk

Michael Craig, head of asset allocation at TD Asset Management, predicted Wednesday that the Federal Reserve will likely be aggressive when it begins cutting interest rates, although the timing of that change remains uncertain.

“When they start cutting, it won’t be little. “He will be strong,” Craig said. Craig aggregate that when rates start to fall “I wouldn’t be surprised to see cuts of 200 to 300 basis points.”

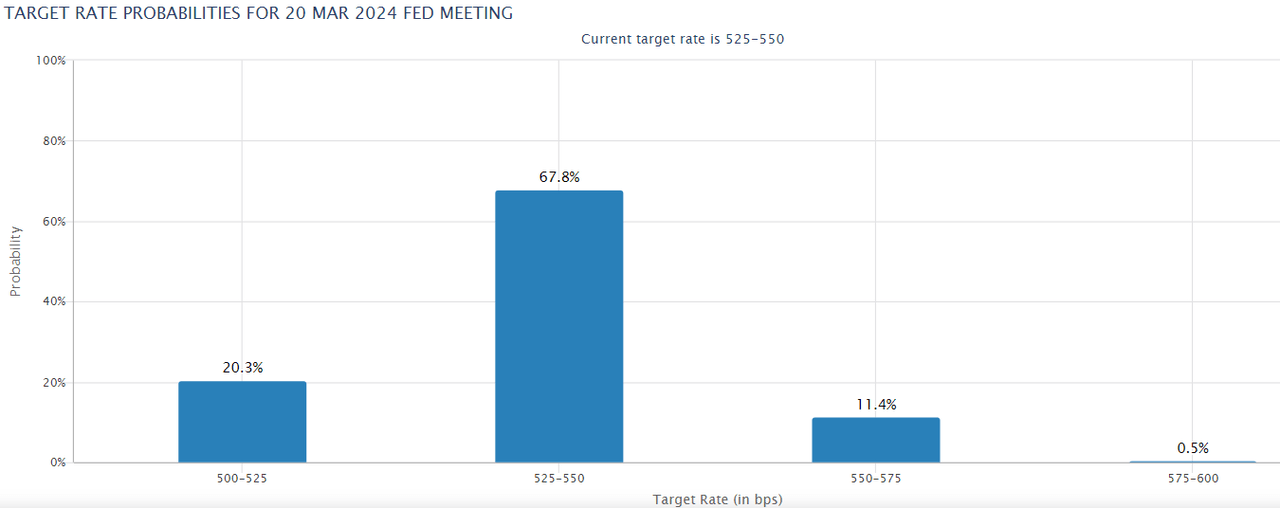

According to the Fed Watch Tool, the market now expects the earliest possible rate cut to occur at the March 2024 Federal Reserve meeting. Traders have priced in a 20.3% chance that the current rate of 5 .25%-5.50% drop to 5.00%-5.25%.

Even then, the market sees a nearly 68% chance that rates will remain at current levels after the March meeting. Meanwhile, trading also suggests the possibility that further rate hikes are on the way. The FedWatch tool shows an 11% chance of a 25 basis point hike by the March meeting, along with a slim 0.5% chance of a 50 basis point hike by the end of that meeting. See the chart below:

As for Wednesday’s trading, the Nasdaq Composite (COMP.IND), the S&P 500 (SP500), the Dow (DJI) and its exchange-traded funds (NASDAQ:QQQ), (NYSERCA:FLIGHT), (IVV), (NYSEARCA:SPY), and (NYSEARCA: SLIDE) are all in the red during the afternoon action.