Ether (eth) price rose 6.2% from November 3 to 5, but the altcoin faces difficulties in breaking the $1,900 resistance. Despite the current bullish trend, Ether’s 17% return over the past 30 days falls short of bitcoin‘s (btc) impressive 27% gain over the same period.

Regulatory obstacles and criticism of the centralization of the ecosystem persist

Analysts attribute part of Ether’s underperformance to the uncertainty surrounding Consensys, a key player in the ethereum ecosystem. Former employees have filed a lawsuit against the company and its co-founder, Joseph Lubin. More than two dozen shareholders of Swiss-based holding company Consensys AG claim that Lubin, who is also a co-founder of ethereum, violated a “non-dilution pledge” made in 2015.

Consensys is responsible for developing and hosting crucial infrastructure projects for the ethereum network. It was founded in October 2014, about nine months before the launch of the ethereum blockchain in mid-2015. Additionally, the High Court of Zug in Switzerland ruled in favor of the plaintiffs, exacerbating the current uncertainty.

Regulatory challenges have hampered the growth of the ethereum ecosystem. The latest concern centers on PayPal’s US dollar-pegged stablecoin, PYUSD, which operates on the ethereum network. This token is designed for digital payments and Web3 applications. On November 2, PayPal disclosed a subpoena it received from the US Securities and Exchange Commission (SEC).

In addition to regulatory pressures, there has been notable criticism of the decentralization of financial (DeFi) applications within the ethereum network. Chainlink, a preferred solution for oracle services, quietly reduced the number of participants in its multi-signature wallet from 4 out of 9 to 4 out of 8. Analysts have highlighted the lack of governance by regular users as a major problem .

Ether’s poor performance against altcoins is evidence of other problems

Several major altcoins, including Solana (SOL), XRP, and Cardano (ADA), have outperformed Ether with returns of 75.5%, 37%, and 35% in the last 30 days, respectively. This discrepancy suggests that the factors holding back eth are not solely related to regulatory pressure or reduced demand from the DeFi and nft markets.

A pressing issue for the ethereum network is the high gas fees associated with transactions, including those executed using smart contracts. The latest 7-day average transaction fee was $4.90, which negatively affected the usage of decentralized applications (DApps).

Additionally, total deposits on the ethereum network, measured in Ether, have fallen to their lowest levels since August 2020. It is essential to note that this analysis does not consider the effects of native ethereum staking.

According to data from DefiLlama, ethereum DApps had a total value locked (TVL) of 12.7 million eth on November 5, down 4% from 13.2 million eth two months earlier. In comparison, the TVL on the Tron network increased by 13% during the same period, while Arbitrum deposits remained at 1 million eth. Data on DApp activity on the ethereum network supports the notion of reduced activity.

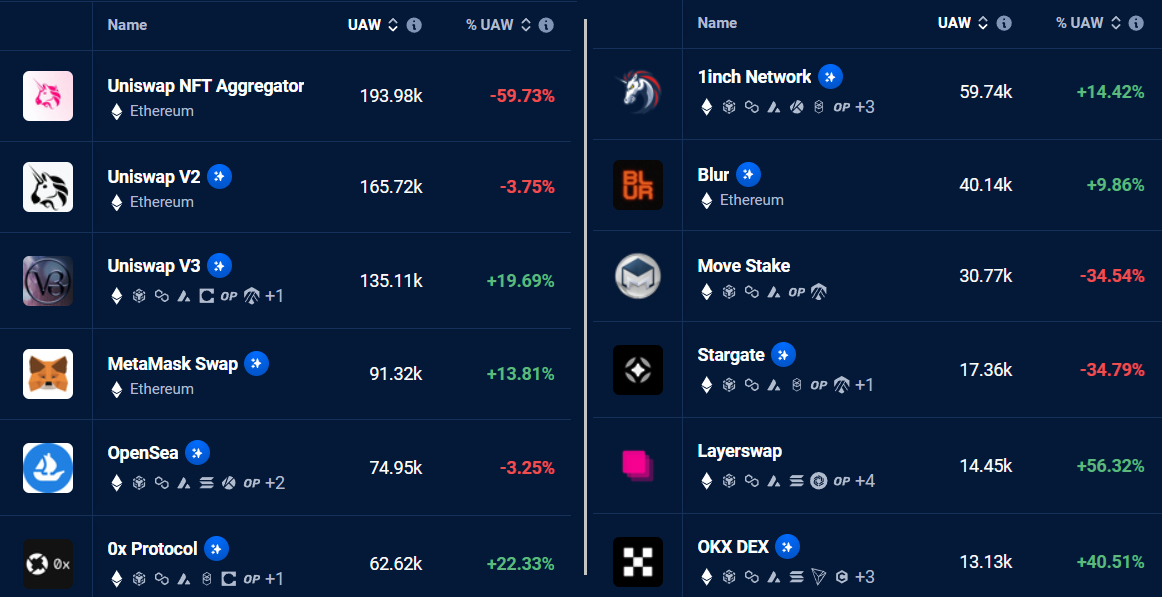

Even excluding the significant 60% drop in the Uniswap nft aggregator, the average number of active addresses on the top DApps on the ethereum network decreased by 3% compared to the previous month. By contrast, Solana’s top apps saw an average 18% increase in active users over the same period, according to data from DappRadar.

Related: Aave halts several marketplaces after reports of feature issues

Finally, on-chain activity indicates an increase in user eth deposits on exchanges. While this data does not necessarily indicate short-term selling, analysts often view the mere availability of coins as a precautionary measure.

The current average daily eth deposits of 255,614 represents a 30% increase from two weeks prior, indicating that holders are more inclined to sell as the price of Ether approaches $1,900.

The data suggests that declining TVL, declining DApp activity, and a higher eth exchange deposit rate are negatively impacting the likelihood of Ether breaking the $1,900 resistance. The price level could be more challenging than initially expected and for now, Ether bears can take a breather.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts and opinions expressed here are solely those of the author and do not necessarily reflect or represent the views and opinions of Cointelegraph.