In the dark corners of the digital world, where the glow of computer screens illuminates faces with an eerie light, there are stories of lost fortunes. These stories act as a frightening reminder of the unpredictable nature and volatility present in the cryptocurrency markets and the need to adopt strict security measures.

1. James Howells and the lost 7,500 btc

A British man named James Howells accidentally threw away a hard drive in 2013 containing 7,500 bitcoin (btc), currently valued at more than $258 million. The hard drive is still buried; He can’t figure out where it is, even after making several desperate attempts to retrieve it from the New Port, Wales landfill. Howell’s story serves as a reminder that digital gold can turn to digital dust.

James Howells makes new appeal to excavate the landfill where his discarded hard drive containing 7,500 bitcoin?src=hash&ref_src=twsrc%5Etfw”>#bitcoin probably resides. https://t.co/93AYMQEnrn

— Cointelegraph (@Cointelegraph) January 14, 2021

2. Stefan Thomas and the enigma of the 7,002 btc

San Francisco-based programmer Stefan Thomas (former CTO of Ripple) found himself plunged into a Kafkaesque nightmare after losing the password to his digital wallet. Thomas was left with just two password attempts before the security system encrypted his fortune forever, leaving it unusable and unreachable, with 7,002 btc at stake.

The hard drive, called Iron Key, features an impenetrable design designed to resist all types of attacks. Users are allowed only ten incorrect password attempts before the unit is permanently locked.

“I would lie in bed and think about it,” Thomas technology/bitcoin-passwords-wallets-fortunes.html” target=”_blank” rel=”noopener nofollow”>said The New York Times. “Then he would go to the computer with some new strategy, it wouldn’t work, and he would be desperate again.”

On October 25, cryptocurrency recovery company Unciphered issued an open letter, offering to unlock an IronKey hard drive owned by Thomas, containing 7,002 btc. Despite the offer, Thomas has yet to take any action on the matter.

A painful memory. I hope others can learn from my mistakes. Test your backups regularly to make sure they continue to work. A dash of foresight could have avoided a decade of regret.

That said, I’ll do what I always do, which is focus on building things, e.g. @Interledger. https://t.co/pCgObeAf4Z

-Stefan Thomas (@justmoon) January 12, 2021

3. Mt. Gox’s Mysterious 850,000 btc Disappearing Act

Mt. Gox, the world’s largest bitcoin exchange at the time, filed for bankruptcy in 2014 after a hacker stole 850,000 btc, which was estimated to be worth $450 million at the time. The catastrophic collapse, veiled in intrigue, sent shockwaves throughout the crypto community, making investors and enthusiasts fearful and desperate.

The unexplained circumstances surrounding the loss added even more mystery to the story of the Mt. Gox collapse. For a long time it was not known exactly how the bitcoin was stolen and who was behind the hack. The incident sparked investigations, legal disputes, and rampant speculation within the crypto community.

On October 9, the US Department of Justice charged Russian nationals Alexey Bilyuchenko and Aleksandr Verner with laundering around 647,000 btc from the Mt. Gox hack. Bilyuchenko is also accused of operating the illicit btc-e exchange from 2011 to 2017.

Almost 10 years later, the victims of Mt. Gox are still waiting for compensation.

4. Gerald Cotten and the $215 million puzzle

In December 2018, Gerald Cotten, CEO of QuadrigaCX, embarked on his honeymoon in India with his wife, a trip that would take a tragic turn. While in India, Cotten, who suffered from Crohn’s disease, faced complications from his disease and passed away, leaving the cryptocurrency world in shock.

Cotten was the only individual who had the keys to the QuadrigaCX crypto vault, meaning he had exclusive access to millions of dollars in client funds.

Unlike other cryptocurrency exchanges, Cotten had not established a safety mechanism to ensure the transfer of these assets to others in the event of his death. This meant that when he died, users were left with their funds stranded in the exchange’s wallets.

The public remained unaware of Cotten’s situation. crypto-mystery-review-he-took-their-fortunes-to-the-grave-dead-mans-switch-a-crypto-mystery-discovery+-gerald-cotten-bitcoin-11640116201″ target=”_blank” rel=”noopener nofollow”>death for 36 days until January 2019, when the news came to light. After Cotten’s death, QuadrigaCX requested protection from creditors, acknowledging the dire financial situation of the exchange, with debts. totalizing $215 million in cash and bitcoin is owed to its 115,000 investors. Investors, already worried about their investments, were now faced with a sad reality: their funds could be irretrievably lost due to lack of access to stock market holdings.

As investigations progressed, suspicions arose about the authenticity of Cotten’s death. However, the emerging truth was equally shocking: the Ontario Securities and Exchange Commission revealed that before his death, Cotten had depleted the majority of the funds through fraudulent trading. This revelation shattered investor confidence.

5. The Enigmatic Journey of the $1.06 Billion bitcoin Heist

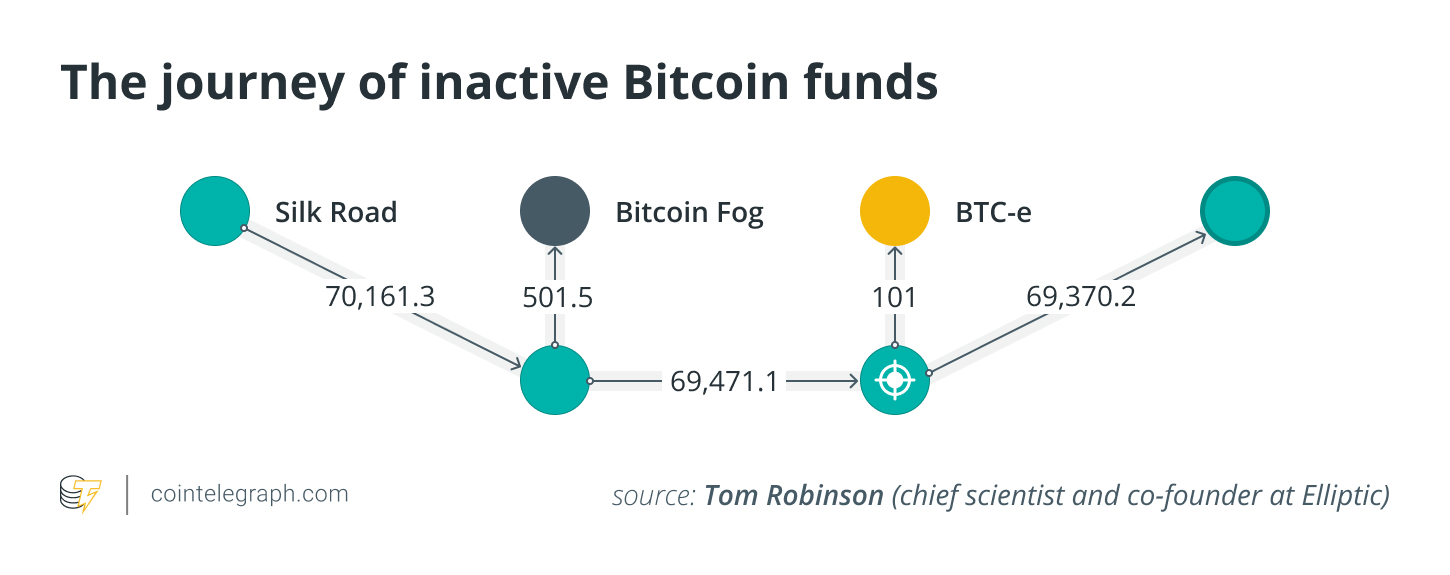

In 2018, the seventh-largest bitcoin wallet at the time, containing 69,000 btc, was unexpectedly discovered in a less explored corner of the Internet.

bitcoin had been dormant since April 2013. The wallet’s origins date back to the closed Silk Road darknet market. The market was closed in late 2013 due to illicit activities, and in 2015 its founder, Ross Ulbricht, received a double sentence of life in prison plus 40 years without the possibility of parole.

Notably, the funds had remained dormant for years after their initial deposit. Then, for the first time in seven years, $1 billion worth of btc was witnessed bitcoin/transaction/3f036ff88bb851b57a1e28780dbce35a6457a8b57995c095b55b3b0cf48ba9fd” target=”_blank” rel=”noopener nofollow”>motion in 2018 out of bitcoin address 1HQ3Go3ggs8pFnXuHVHRytPCq5fGG8Hbhx.

According to Tom Robinson, chief scientist and co-founder of Elliptic, an encrypted file had been circulating among hackers. forums since its discovery, supposedly containing the cryptographic keys necessary to seize the btc at this address. If it were genuine, decrypting the password to this file would have allowed the btc to be moved.

Aside from this move, 101 btc were sent to btc-e in 2015, a cryptocurrency exchange known to be favored by money launderers that was subsequently shut down by US authorities in 2017.

According to Robinson, the btc transfer could have been initiated by Ulbricht or by a Silk Road provider who accessed his funds. However, the possibility of Ulbricht conducting a bitcoin transaction from prison seemed unlikely. Alternatively, the encrypted wallet file could have been genuine and the password could have been successfully cracked, allowing the btc to be moved.

Following deeper scrutiny of bitcoin address, US Attorney’s Office and Internal Revenue Service criminal investigation agents discovered his connection with Individual Later, after investigating the hacking, the authorities confiscated several thousand bitcoin on November 3, 2020, valued at around $1.06 billion at the time.

6. Brad Yasar’s Cryptocurrency Enigma

Brad Yasar, a Los Angeles-based entrepreneur, has spent numerous hours trying to regain access to his wallets containing thousands of bitcoin he mined during the early days of the technology, now valued at hundreds of millions of dollars. Unfortunately, he lost the passwords a long time ago and kept the hard drives in vacuum-sealed bags, keeping them out of sight.

“Over the years, I would say I’ve spent hundreds of hours trying to get those wallets back,” Yasar said. The New York Times. “I don’t want to be reminded every day that what I have now is a fraction of what I could have and what I lost,” he said.

7. Gabriel Abed’s loss of 800 Bitcoins in a laptop accident

In 2011, Gabriel Abed, founder and president of Abed Group and co-founder of Bitt, suffered a significant loss when a colleague accidentally reformatted his laptop. This laptop contained the private keys to a bitcoin wallet, which resulted in the loss of approximately 800 bitcoin.

“The risk of being my own bank comes with the reward of being able to freely access my money and be a citizen of the world; That’s worth it,” Abed said. technology/bitcoin-passwords-wallets-fortunes.html” target=”_blank” rel=”noopener nofollow”>said The New York Times.

Abed said he had been disheartened by the incident, stating that the transparent nature of bitcoin gave him full access to the digital financial realm for the first time.

Like many in the industry, I made a lot of mistakes with my wrenches in the early days. In this latest New York Times article about people who lost their keys, I summarize a story of how a reformatted computer would result in a loss,…https://t.co/VNGtRDrPAI https://t.co/cmzxufUWsi

– Gabriel Abed (@Gabriel__Abed) January 12, 2021

8. The unfortunate erasure of Davyd Arakhmia’s cryptocurrency fortune

Davyd Arakhmia, a Ukrainian politician, accidentally deleted an encrypted file from his hard drive containing 400 btc, unknowingly discarding his private key. Before his political career, Arakhmia ran a company that accepted bitcoin payments. In an attempt to create more storage space on his hard drive, he deleted the file along with some movies.

Cryptocurrency Security: The Key to Protecting Digital Wealth

In the volatile world of cryptocurrencies, protecting digital assets is essential. Stories of lost bitcoin fortunes highlight how important it is to implement strong security measures. Safeguarding cryptocurrency holdings and ensuring access to private keys should be top priorities for all investors.

Essentials include secure connections, frequent backups, and a trusted, self-custodial wallet. Additionally, two-factor authentication provides an additional line of protection, while distributing assets across multiple wallets protects against loss. Additionally, it is equally important to remain vigilant for phishing efforts and stay up to date with the latest developments in security procedures.