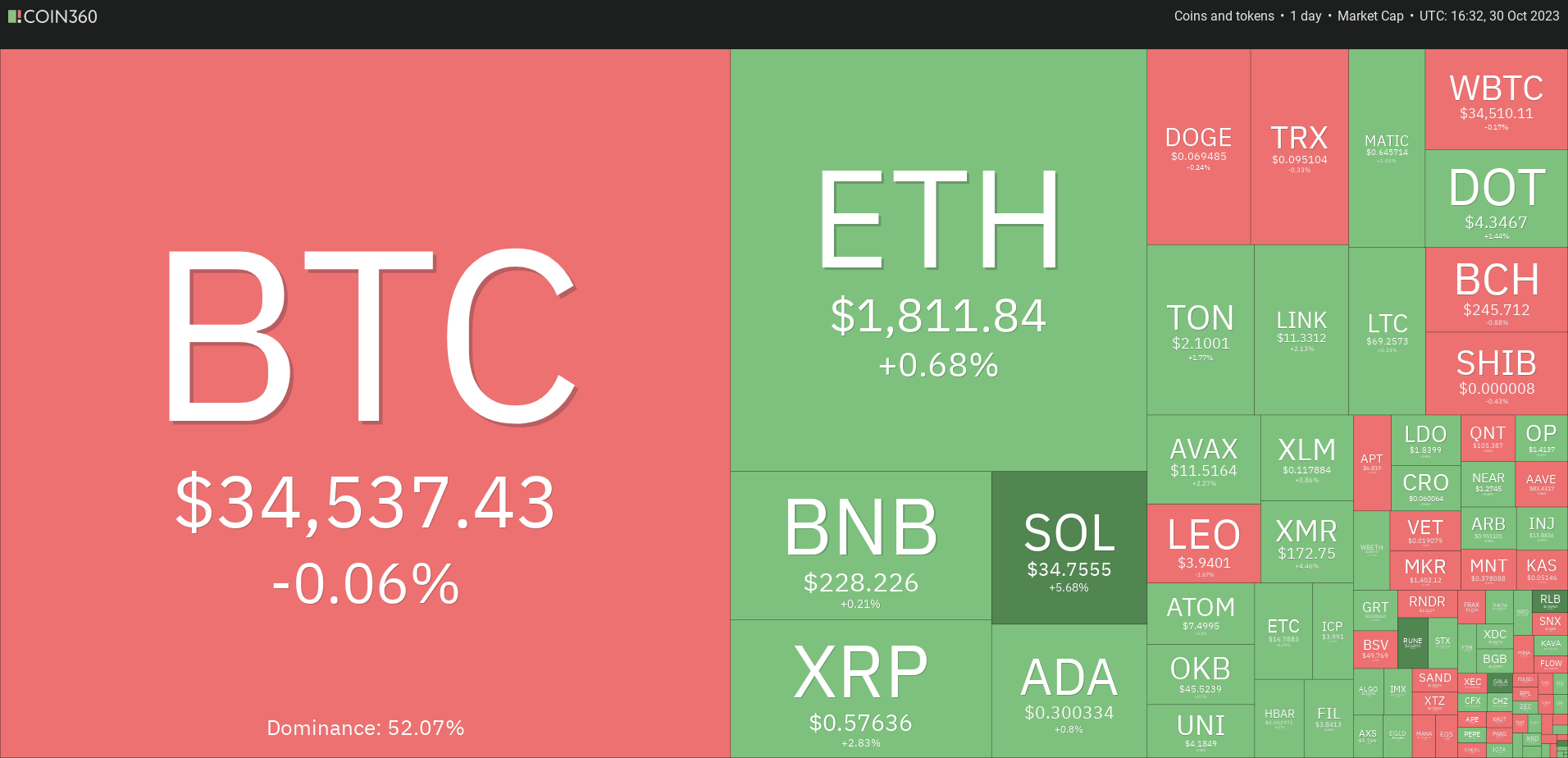

bitcoin‘s reluctance to give ground has attracted strong buying in select altcoins.

The price of bitcoin (btc) rose 15% last week and 10.45% the week before. The S&P 500 index fell 2.53% last week and 2.39% the week before. This shows that bitcoin has decoupled from the S&P 500 index in the near term and can chart its own course.

However, the road up may not be easy. The Federal Open Market Committee meeting on November 1 may cause some volatility, but it will be short-lived as no surprises are expected. CME’s FedWatch tool projects a 98% probability of rates remaining unchanged.

A large portion of bitcoin‘s gains have been driven by expectations that the United States Securities and Exchange Commission will approve a spot bitcoin exchange-traded fund in the near future. Any adverse news in this regard can be a major setback for the bulls. When traders start to push prices higher, the risk of a short-term pullback increases.

What are the important support levels for bitcoin and altcoins that need to hold for sentiment to remain bullish? Let’s analyze the graphs to find out.

S&P 500 Index Price Analysis

The S&P 500 Index (SPX) remains in a strong downward trend. The price is close to the strong support zone between 4,050 and 4,100.

The sharp decline in recent days pushed the Relative Strength Index (RSI) into oversold territory, suggesting that a pullback is possible. On the upside, the bears are expected to sell near the 20-day exponential moving average (4,255).

If the price falls sharply from the 20-day EMA, it will suggest that sentiment remains negative and traders are selling on rallies. The bears will again try to sink the price below the support zone. If they succeed, the index could fall to 3,800. This negative view will be invalidated in the short term if the price rises and sustains above the 20-day EMA.

US Dollar Index Price Analysis

The US Dollar Index (DXY) rebounded from the 50-day simple moving average (105) on October 24, indicating that lower levels are attracting buyers.

Rising moving averages indicate upside for buyers, but negative divergence on the RSI suggests bullish momentum may be weakening. That could keep the index range-bound between 105.36 and 107.35 for some time.

If buyers hold the price above the 20-day EMA (106.23), the bulls will try to push the index above 107.35. If they succeed, the index can rise towards 111. If the bears want to avoid the rise, they will have to drag and hold the price back below 105.36. Then the index could fall to 104.50.

bitcoin price analysis

After the strong rally, bitcoin has entered a consolidation phase between $33,390 and $35,380. This is a positive sign as it suggests that the bulls have no urgency to aggressively book profits.

Although the overbought RSI levels warrant caution, the rising moving averages suggest that the bulls remain in control. If buyers push the price above $35,280, the btc/USDT pair could rise towards $40,000. This level is likely to act as a formidable resistance.

On the way down, if the bears sink the price below $33,390, the pair risks falling to $32,400 and then $31,000. This zone is likely to witness solid buying by the bulls because if it breaks, the selling could intensify and the pair could fall to $28,143.

Ether Price Analysis

Ether (eth) has held above the breakout level of $1,746, but the bulls have failed to extend the recovery. This suggests that demand dries up at higher levels.

The eth/USDT pair may remain range-bound between $1,746 and $1,865 for a few days. The rising moving averages and the RSI in overbought territory indicate that the bulls have the upper hand.

If buyers push the price above $1,865, the pair could rise to $2,000. The bears are likely to protect this level vigorously.

Important support on the downside is $1,746 and then the 20-day EMA ($1,705). Sellers will take control again if they sink and hold the price below the 20-day EMA.

BNB Price Analysis

BNB (BNB) has been stuck within a wide range between $235 and $203 for the past few days. The rising 20-day EMA ($219) and the RSI in positive territory indicate that the bulls have a slight advantage.

If the price sustains the bounce of $223, the bulls will again try to push the price above the overhead resistance of $235. If they can achieve this, it will signal the start of a sustained recovery to $250 and eventually $265.

Meanwhile, the bears likely have other plans. They will try to get the price back below the 20-day EMA. Such a move will suggest that the BNB/USDT pair may extend its stay within the range for a while longer.

XRP Price Analysis

After remaining in a tight range between $0.56 and the 20-day EMA ($0.53) for the past few days, XRP (XRP) cleared the hurdle on October 30.

The bullish 20-day EMA and the RSI in the overbought zone indicate that the bulls have the upper hand. There is minor resistance at $0.59. If the bulls break this barrier, the XRP/USDT pair is likely to rise to $0.66.

However, the bears are unlikely to give up easily. They will try to get the price back below the 20-day EMA. If they manage to do so, they can catch several aggressive bulls. The pair may then remain stuck between $0.46 and $0.56 for a few more days.

Solana Price Analysis

In an uptrend, corrections are shallow and short-lived. That’s what happened in Solana (SOL). After a small pullback, the bulls have asserted their supremacy.

The SOL/USDT pair resumed its uptrend on October 30 with a break above $33.90. Next, the bulls will try to push the price to $38.79. This level is expected to act as a major resistance, but if buyers bulldoze their way in, the pair may reach $48.

The important support to watch on the downside is the $31 level. If the pair falls below this level, it will suggest that the bulls may be exiting their positions quickly. That could push the price down to the 20-day EMA ($28.73).

Related: CME Becomes Second Largest bitcoin Futures Exchange as Open Interest Surge

Cardano Price Analysis

Cardano (ADA) has remained above the breakout level of $0.28 for the past few days, but the bulls are finding it difficult to overcome the overhead hurdle of $0.30.

Still, a positive sign is that the bulls have not given up much ground due to overhead resistance. This suggests that buyers have kept up the pressure. If they clear the $0.30 hurdle, the ADA/USDT pair could start a rally to $0.32 and then $0.34.

Alternatively, if the price turns down from $0.30, it will suggest that the bears are aggressively defending the level. The pair may then fluctuate between $0.28 and $0.30 for some time. A break and close below the 20-day EMA ($0.27) will tilt the upside back in favor of the bears.

Dogecoin Price Analysis

Dogecoin (DOGE) has witnessed a tough battle between bulls and bears near the $0.07 mark.

A minor positive is that the bulls are buying the dips below $0.07. This suggests that sentiment has changed from selling on rallies to buying on dips. The bulls will again try to overcome the $0.07 hurdle. If they can achieve this, the DOGE/USDT pair could begin its march north towards $0.08.

The important support to watch on the downside is the 20-day EMA ($0.06). If this support is broken, the pair could sink to the solid support of $0.06.

Toncoin Price Analysis

Toncoin (TON) broke below the moving averages on October 27, but the bears failed to take advantage. This suggests that sales dry up at lower levels.

The 20-day EMA ($2.07) has stabilized and the RSI is near the midpoint, indicating a balance between buyers and sellers. If the price rises above the moving averages, the bulls will try to push the TON/USDT pair above $2.31. If they do, the pair can begin its journey at $2.59.

On the contrary, if the price turns down from the moving averages, it will suggest that the bears are trying to take advantage. A break below $2 could clear the way for a drop to $1.89.

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.