lucky photographer

Jefferies analyst Steven DeSanctis argued that concerns about the small-cap space, as evidenced by the Russell 2000 (RTY) that recently fell to a new low in 2023, have been overstated, as many companies in this category have strong balance sheets, which should allow them cushion the impact of higher rates.

“We believe one of the biggest concerns investors have with small caps is the impact of rising rates on borrowing costs,” DeSanctis said in a weekend report. “We’re not that worried, as balance sheets have near-record levels of cash, the high-yield market is holding up very well with spreads still below their long-term averages, and companies appear to have access to capital.”

The Russell 2000 is currently trading just near the 1,640 level and Jefferies indicates that the index will advance to 1,800 by the end of the year.

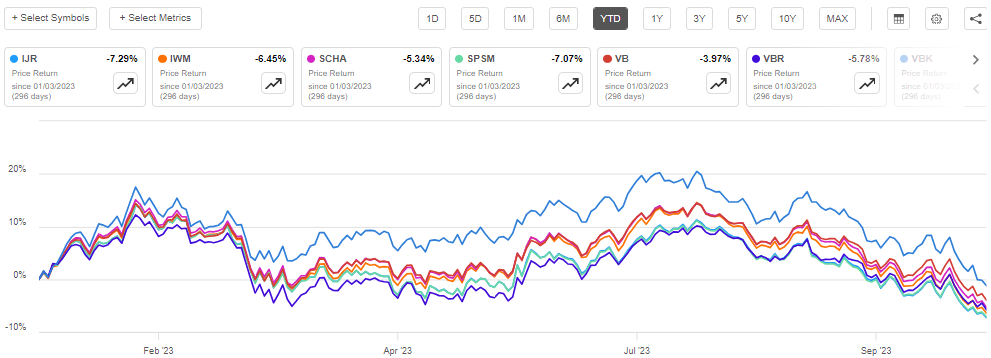

Small Cap Exchange Traded Funds:

- iShares Core S&P Small Cap ETF (NYSERCA: IJR)

- iShares Russell 2000 ETF (NYSERCA: IWM)

- Schwab US Small Cap ETF (NYSERCA: SCHA)

- SPDR S&P 600 Small Cap ETF Portfolio (SPSM)

- Vanguard Small Cap ETF (VB)

- Vanguard Small Cap Value ETF (VBR)

- Vanguard Small Cap Growth ETF (VBK)