Nomadic Homesa marketplace for residential real estate listings in Europe and the Middle East, closed on $20 million in Series A extension capital. This comes two years after raising a $20 million Series A.

Acrew Capital led the round and was joined by new and existing investors 01 Advisors, HighSage Ventures, Abstract Ventures, Partech, Precursor Ventures, Potluck Ventures, Knollwood and several undisclosed hedge funds.

Nomad Homes, co-founded by Helen Chen, Daniel Piehler and Damien Drap in 2019, currently operates in France, Spain, Portugal and the United Arab Emirates. They created an infrastructure, similar to the US Multiple Listing Service, for countries where buying and selling homes is complicated.

These regions represent about $2 trillion in sales transactions annually; However, the absence of an infrastructure to guide smooth transactions leaves buyers unrepresented and agents not working together. Nomad aims to improve the efficiency of real estate transactions.

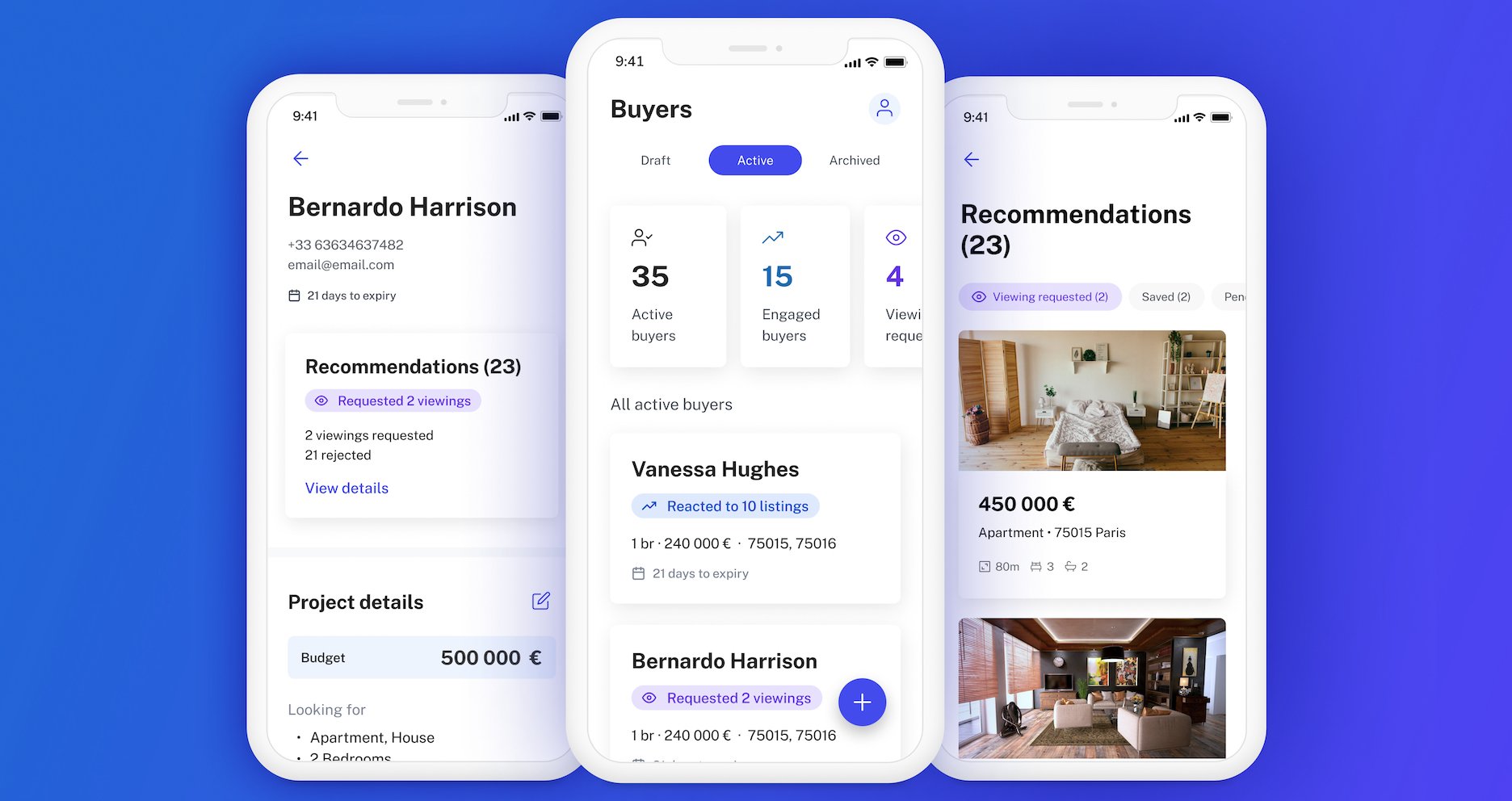

Nomad Agent product from Nomad Homes. Image credits: Nomadic Homes

In February, the company added a business-to-business component called Nomad Agent, which provides a network for real estate agents to collaborate with each other and standardize commission sharing to increase earning potential, CEO Chen told TechCrunch.

“A number of prop technicians in our markets and in our space are downsizing and closing lines of business, but we’re actually doing the exact opposite by launching Nomad Agent,” Chen said. “Our company, overall, has done incredibly well. “We have grown our revenue six-fold year over year, grown 24-fold since our Series A, and have grown to a team of over 100 people.”

The new funding will be used to accelerate the development of Nomad Agent, expand the company’s mortgage capabilities and further develop its ai-powered co-pilot tool for buyers to provide automated recommendations.

Next, the company plans to reach profitability early next year, and Chen noted that Nomad Homes’ “gross margin is already above 80% and projected to increase, which is helping drive our path to profitability.” “.