John Deaton, pro-XRP legal expert has come for him crypto/sec-announcement-crypto/#:~:text=What%20The%20SEC’s%20Latest%20Announcement%20Means%20For%20The%20Crypto%20Industry,-by%20Scott%20Matherson&text=A%20recent%20announcement%20by%20the,actions%20have%20had%20on%20it.” rel=”nofollow noopener” target=”_blank”>US Securities Commission (SEC) after his comment regarding the false bitcoin ETF Approval Spot This was done by the Cointelegraph media outlet.

Deaton questions the credibility of the SEC

in a mail Shared on his platform According to him, the Commission’s “confirmation bias and self-serving statements” already disqualified it in this regard.

Here’s a surprise: I don’t agree with @SECGovThe last statement. The best source of information about the SEC is NOT the SEC. Confirmation bias and self-serving statements from the SEC disqualify him. Likewise, angry investors are too close to be objective. Therefore, we… https://t.co/8SPEI43ORM

– John E. Deaton (@JohnEDeaton1) October 16, 2023

The lawyer reacted to the Commission’s decision. x publicationwhere he warned the general public to be careful about what they read on the Internet (probably in relation to the Cointelegraph publication) and stated that “the best source of information about the SEC is the SEC.”

Deaton also seemed to suggest that the Commission could not be objective in making its decisions (possibly about the ethereum–eth-gate-explained/” rel=”nofollow noopener” target=”_blank”>eth Gate and the SEC’s conflict of interest), and that was why the crypto community looked to the judges that are independent and can verify the SEC excessesto help shape your vision of the Commission.

<img decoding="async" class="aligncenter size-medium" src="https://technicalterrence.com/wp-content/uploads/2023/10/Pro-XRP-Lawyer-Says-Dont-Trust-SEC-Following-Bitcoin-ETF-Fake" alt="bitcoin Price Chart from Tradingview.com (Spot bitcoin ETF Pro-XRP SEC Advocate)” width=”2670″ height=”1746″/>

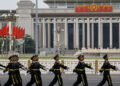

btc price resumes upward climb following fake approval debacle | Source: BTCUSD on Tradingview.com

The SEC’s Arbitrary and Capricious Nature Towards Spot bitcoin ETFs

Deaton was not finished yet as he continued referring to The victory of grayscale v. SEC, where the court noted that the Commission had acted arbitrarily and capriciously when it denied Grayscale’s application bitcoin/grayscale-met-with-the-sec-tried-to-convince-them-to-turn-the-gbtc-into-an-etf/” rel=”nofollow noopener” target=”_blank”>application to convert your GBTC fund to a bitcoin Spot ETF. The lawyer highlighted the incompetence of the Commission and pointed out how “easy” it was to defeat such a claim.

In what appeared to be him highlighting the court’s opinion on the Commission, he mentioned that the Court of Appeals in the Grayscale case “unanimously concluded” that the SEC’s denial of a Spot bitcoin ETF was “utter nonsense.” The Commission, until the Grayscale case, had stated that its main reservation on the merits was that it is susceptible to bitcoin-news/sec-prove-bitcoin-is-not-manipulated/” rel=”nofollow noopener” target=”_blank”>market manipulation.

However, the Court of Appeals adopted Grayscale’s argument that the spot and futures markets (of which the SEC approved bitcoin futures ETFs) were correlated. As such, there was no reason why I would deny a bitcoin spot ETF and bitcoin-etf-is-coming-no-sec-opposition/” rel=”nofollow noopener” target=”_blank”>approve a futures ETF when they appear to share the same risk of market manipulation.

Meanwhile, Deaton also alluded to the fact that a federal judge had once called SEC lawyers hypocrites and that they lacked faithful allegiance to the law. With this in mind, the legal expert has chosen to listen to the judges when it comes to issues related to the SEC.

His comments come at a time when the crypto community appears to be looking towards the courts for guidance on how the industry should be regulated in the wake of the SEC’s continued crackdown on various industry players.

Featured image of Binance, chart from Tradingview.com

NEWSLETTER

NEWSLETTER