Everyone has heard about the 4-year cycle that bitcoin goes through, but have you ever thought about the idea that bitcoin could be going through a bigger cycle? And could this broader cycle reflect the way humans adopt new technologies? And is it possible that we have seen something similar before with other technology like the Internet? In this article, we will dive into a new theory that suggests that bitcoin is moving through a broader 16-year cycle that can help us predict the direction of bitcoin‘s price in the coming years.

The regular 4 year cycle

bitcoin tends to go through 4-year cycles that are divided into 2 parts, the uptrend and the downtrend. A normal 4-year cycle consists of a 3-year uptrend followed by a 1-year downtrend, also known as a bear market. So far, bitcoin has completed 4-year cycles and has demonstrated incredible accuracy that draws the attention of market participants.

The DOTCOM cycle

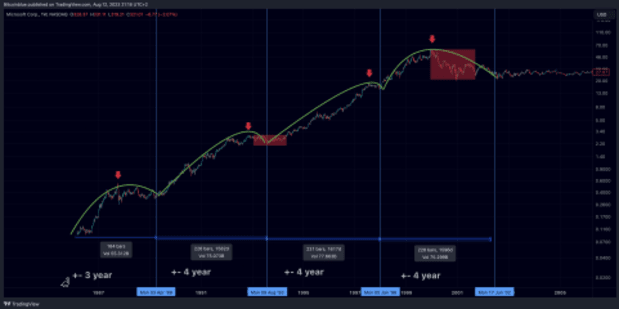

The similarities between the market structure of the S&P500 during the DOTCOM cycle and the bitcoin cycle cannot be ignored. Regular financial markets also went through clear 4-year cycles, with most of the cycle in an uptrend and the downtrend, also known as a bear market, short-lived. From my perspective, the DOTCOM cycle began around 1986, as this was the time when Microsoft went public, one of the largest companies in the DOTCOM cycle. bitcoin‘s first 3 4-year cycles are very similar to the S&P500’s first 3 4-year cycles starting in 1986.

This really piqued my interest as both periods are based on the adoption of a completely new technology that changes the way our society perceives and uses information. The personal computer and the Internet completely changed our lives to the point that it is almost unthinkable to be without an Internet connection for more than 24 hours. In the future, it will also be unthinkable not to own or use bitcoin, we are simply still in the early phase of its adoption.

So could the structure of the DOTCOM cycle help us determine a potential path for bitcoin? First of all, I would like to emphasize the fact that, in my honest opinion, market cycles are one of the best ways to use approximate price predictions and determine when to enter and when to exit a particular market. But I really want to emphasize the word “rough.” There is a saying, “the story

It doesn’t repeat but it does rhyme,” and I think this also applies to cycles. Nothing is ever a 100% replica of what happened before, but it can give us a rough estimate of what might happen.

As can be seen from the structure of the DOTCOM cycle, the first 3 4-year cycles are very similar: a long bull market followed by a short but sometimes shallow bear market or correction. The only thing that happens is that the last 4 year cycle is different, things are backwards. It begins with a price acceleration that does not last long and is followed by a multi-year bear market. Could bitcoin do something similar, disappoint those expecting a regular 4-year cycle and surprise most with a multi-year bear market?

Microsoft is following a similar path. It starts with 3 4-year cycles shifted to the right, followed by one 4-year cycle shifted to the left, i.e. a prolonged bear market in an asset that has been in a strong bull market for years.

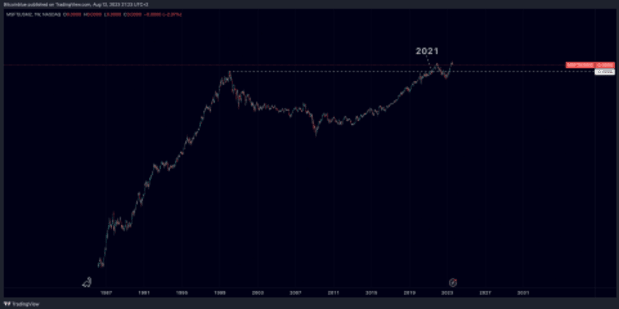

Microsoft rose to the top in 2000, setting a long-term high in price of approximately $60. And it was not until 2015 that that level was exceeded again. It took 15 years from that peak to fully recover and surpass that level again. If we took the money supply into account, it would actually take longer for Microsoft to recover and surpass the maximum 21 years later, in May 2021.

Both the Microsoft and S&P500 charts really demonstrate the magnitude of a correction after a prolonged bull market. It is a challenge to imagine from one’s own perspective a prolonged bear market for an asset that has seen a majority rise. Is it possible that we will see, broadly speaking, something similar with bitcoin?

Confluence between cycles

So let’s take a look at what these cycles predict for bitcoin and how we could potentially prepare for these results. First, it is interesting to note that one date predicts the same outcome in the regular 4-year cycle, the 16-year cycle.

A regular 4-year cycle would suggest that we will remain in an uptrend until 2025, followed by a 1-year decline. This is a typical 4 year cycle that we have seen 3 times in bitcoin history.

The 16-year cycle would suggest that we would follow a similar path to the DOTCOM bubble as mentioned above. bitcoin would peak in the first half of the cycle, so at the latest by the end of 2024, this would be followed by a multi-year decline until 2026 to form new lows.

How to spot a blouse

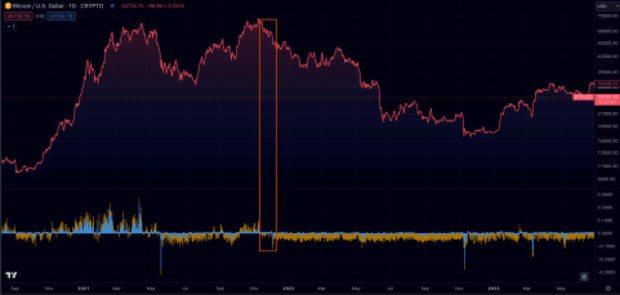

One of the best indicators a bitcoin trader can use is bitcoin funding rates. Funding rates basically show whether the majority of market participants in the derivatives markets are shorting or longing for bitcoin. I have found this indicator very useful for detecting a high in the price of bitcoin, since in a healthy bull market, when funding rates are negative, the price tends to rise. In a bear market, when financing is positive, the price tends to fall. Therefore, we can use this metric to detect what market conditions the market is trading in and if anything has changed. One of the first signs when bitcoin entered a bear market in 2022 was that the price of bitcoin was falling with negative funding rates, and that usually doesn’t happen in a healthy bull market.

Another way to look for the cycle top is timing, as long as bitcoin is in the topping period, say the 16-year cycle, and we break below a low, the chances of a cycle top being found increase. This would then be invalidated. breaking again above that specific level, to recover this level. To see the period of a possible cycle high, you can take a look at the bitcoin cycle progression bars. Once the yellow dot enters the red zone, it means that according to that specific cycle we are in the cap period. Once again, it is important to mention that cycles can help give a rough estimate of possible outcomes; are often not developed very precisely and there is room for

Additional considerations

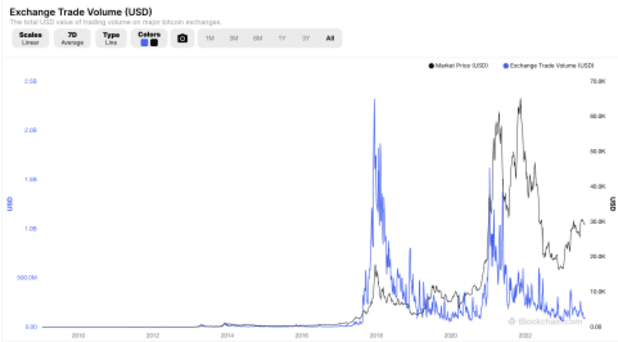

There are more factors at play here that influence the price of bitcoin than just these cycles. The fact that the Federal Reserve started printing huge amounts of money in 2020 really increased the risk appetite of many investors looking for a safe haven like the financial markets and bitcoin. It is very clear that the moment the Federal Reserve began pumping money into the economy, the price of bitcoin and the financial markets began to rise until the money printer stopped again in 2022 and the price of bitcoin entered a decline. 1 year descending phase. These fundamental changes in the economy are very likely to have an impact on bitcoin and how these cycles could play out.

This is a guest post byJeroen van Lang. The opinions expressed are entirely their own and do not necessarily reflect those of btc Inc or bitcoin Magazine.