The cryptocurrency market was in a bear market for most of 2022. However, a new report revealed that the total number of cryptocurrency owners globally increased over the year by 39%. This number increased from 306 million in January to 425 million at the end of the year.

ETH had a higher adoption rate than BTC

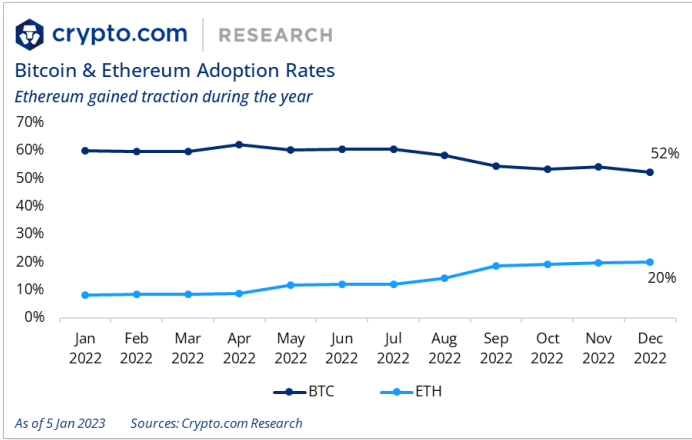

While the number of cryptocurrency owners has increased globally, Crypto.com notes in the report that ethereum registered a higher adoption rate than bitcoin. Throughout the year, ethereum accumulated 263% more owners, with 24 million registered in January and 87 million in December, representing 20% of total cryptocurrency owners.

By comparison, bitcoin saw 20% growth from 183 million in January to 219 million in December, representing 52% of cryptocurrency owners globally.

The significant adoption experienced by ethereum was mainly attributed to The Merge, which launched last September. The merger changed the consensus algorithm on the Ethereum blockchain from proof-of-work to proof-of-stake.

Another reason could have been increased interest from institutional investors, as the Crypto.com report claims. That, coupled with NFT pushes and increased interest in liquid ETH staking, led to more adoption of Ethereum over Bitcoin.

Thus, the ethereum adoption rate increased from 8% to 20% over the year, but the most significant increase was around August and September. On the other hand, bitcoin’s adoption rate skyrocketed in April, but gradually dropped to 52% by the end of the year.

The rise in mainstream adoption saw the rise of BTC

Despite having a lower adoption rate than ethereum, bitcoin still rose. Its 219 million adopters accounted for more than half of cryptocurrency owners globally.

The largest adoption was probably contributed by the Central African Republic (CAR) which adopted BTC as legal tender. The move made them the second country, after El Salvador, to convert cryptocurrency into legal tender, allowing its use for transactions.

Goldman Sachs’ offer of its first BTC-backed loan could have led to further adoption.

Additionally, there was a spike in adoption during the 2022 FIFA World Cup Qatar. Around that time, there was also a spike in financial institutions offering crypto services to their customers. These included institutions such as MoneyGram, UnionBank of the Philippines, and Fidelity.

During that year, both ethereum and bitcoin fell in price. ETH fell more than 68%, while BTC dropped 65% after several exchanges crashed and stablecoins decoupled, leading to mistrust in the crypto market.