This week’s featured stories

Opening arguments begin in Sam Bankman-Fried trial

The trial of former FTX CEO Sam “SBF” Bankman-Fried began on October 4 in New York after jury selection began the day before. Assistant U.S. Attorney Thane Rehn told jurors that SBF used FTX client funds to enrich himself and gain credibility among politicians through donations. “The defendant blamed a crash in the cryptocurrency market. But he had committed fraud. That is what the evidence in this trial will show. You will hear from his inner circle. His girlfriend will tell him how they stole money together,” Rehn said. SBF lawyer Mark Cohen said the “girlfriend,” former Alameda Research CEO Caroline Ellison, and Changpeng Zhao, CEO of rival cryptocurrency exchange Binance, share some of the blame for FTX’s downfall. Check out our detailed recap of the first week of Sam Bankman-Fried’s trial.

Alex Mashinsky’s jury trial scheduled for September 2024

Alex Mashinsky, former CEO of cryptocurrency lender Celsius, will stand trial on fraud and market manipulation charges in September 2024, a judge decided on October 3. Mashinsky will remain free on $40 million bail, subject to financial and travel restrictions, in the meantime. Celsius filed for bankruptcy in July 2022 and Mashinsky was arrested in July of this year. He is accused of defrauding investors of billions of dollars. The U.S. Commodity Futures Trading Commission, the Securities and Exchange Commission and the Federal Trade Commission also have active lawsuits against Mashinsky. Former Celsius chief revenue officer Roni Cohen-Pavon pleaded guilty to four criminal charges in September.

Binance Spot Market Share Falls for Seventh Consecutive Month

Cryptocurrency exchange Binance continues to lose market share for the seventh consecutive month. Analysts say HTX (formerly Huobi), Bybit and DigiFinex were the beneficiaries of Binance’s downfall. According to a CCData analysis reported by Bloomberg, Binance’s share of the spot market fell from 38.5% in August to 34.3% in September. In the derivatives market, Binance’s share fell from 53.5% to 51.5% in the same period. The ongoing fights with regulators in the United States were identified as one of the causes of Binance’s falling market share, but also signaled the end of zero-fee trading promotion for major trading pairs and the withdrawal of Binance from the Russian market, which made up 7% of its traffic.

Alameda Sent $4.1 Billion in FTT Tokens to FTX Before Collapse: Nansen Report

A report shared with Cointelegraph by blockchain data analyst Nansen shows that FTX moved $4.1 billion in its native FTT tokens to Alameda Research between September 28 and November 1, 2022. FTX and Alameda Research controlled about 90% of FTT supply. Nansen suggested that companies were using them to shore up each other’s balance sheets. FTX also transferred $388 million in stablecoins to Alameda Research during the same period. The data implied that Alameda Research would not have been able to carry out its offer to Binance CEO Changpeng Zhao to buy that exchange’s FTT holdings at $22 on November 6. Alameda Research CEO Caroline Ellison made the offer on X (formerly Twitter) as The two entities struggled to control the turmoil sparked by revelations of irregularities in their balance sheets. FTX filed for bankruptcy days later.

Valkyrie backs off purchases of Ether futures contracts until ETF launch

Asset management company Valkyrie said in a filing with the US Securities and Exchange Commission (SEC) on September 29 that it will not purchase Ether before receiving approval for its exchange-traded fund (ETF). Valkyrie had previously told Cointelegraph that it planned to allow investors exposure to ETF futures before launching its combined bitcoin and Ether Strategy ETF in early October. Not only that, Valkyrie said it would sell the eth futures it had already purchased. Valkyrie is among several financial companies that are expected to soon begin offering eth futures ETFs. The SEC has delayed decisions on several of them. Observers say it may be due to concerns about a US government shutdown.

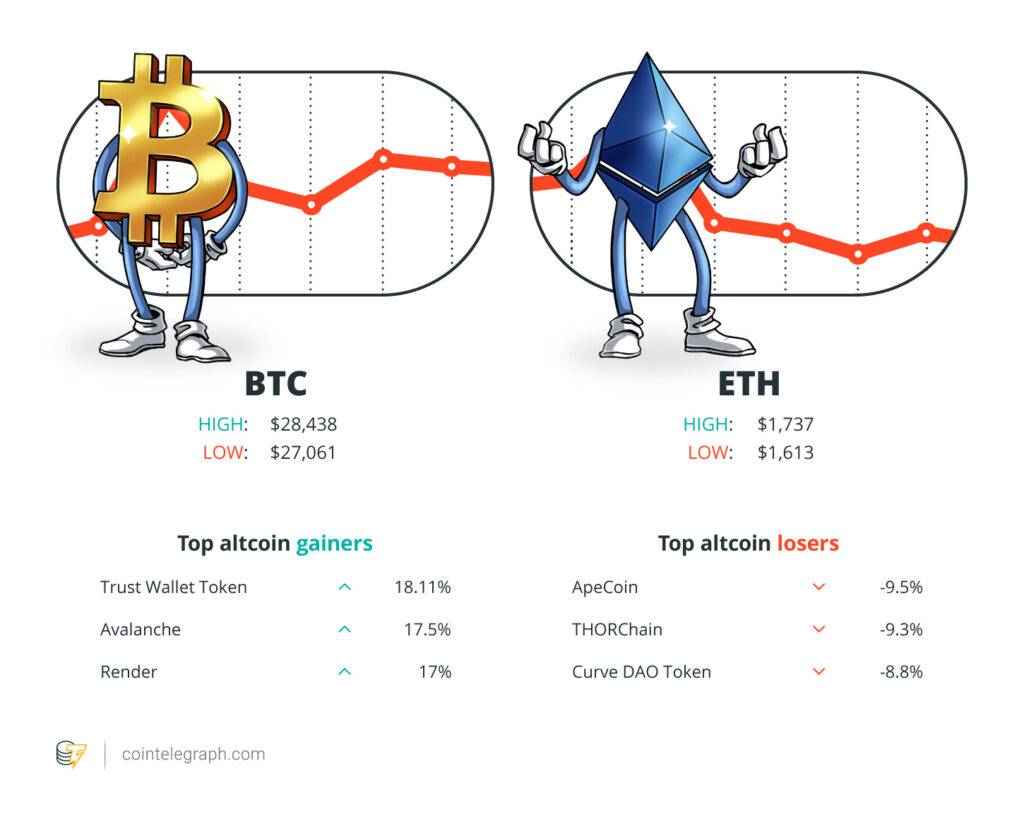

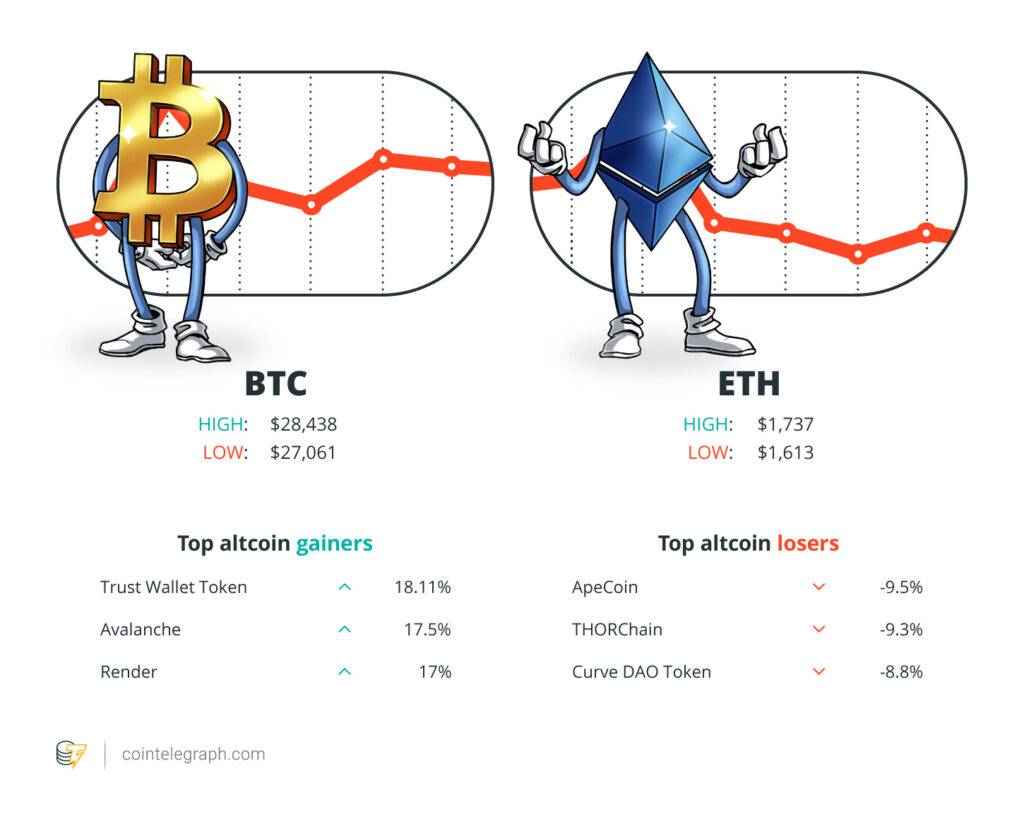

Winners and losers

At the end of the week, bitcoin (btc) is at $27,880, Ether (eth) at $1,640 and XRP at $0.52. The total market capitalization is $1.07 trillion. according to CoinMarketCap.

Among the 100 largest cryptocurrencies, the three altcoins with the biggest gains of the week are Trust Wallet Token (Twitter) at 18.11%, Avalanche (AVAX) at 17.5% and Render (RNDR) at 17%.

Top Three Altcoin Losers of the Week Are ApeCoin (BUN) at -9.5%, THORChain (RUNE) at -9.3% and Curve DAO token (CRV) at -8.8%.

For more information on cryptocurrency prices, be sure to read Cointelegraph’s market analysis.

Read also

Most memorable quotes

“We allowed Alameda to withdraw unlimited funds.”

Gary Wangco-founder and former CTO of FTX

“He told me to use Signal. She told the entire company. It also had automatic deletion. (…) She said that (automatic deletion) was a disadvantage for preserving messages. “If regulators found things they didn’t like, it could be bad for the company.”

Adam Yedidiaformer FTX employee and SBF roommate

“Macroeconomic headwinds are limiting our ability to generate revenue and, in response to current market conditions and business realities, we must reduce roles across the global business.”

Pascal GauthierCEO and President of Ledger

“The gravitational pull of cryptocurrencies for the moment remains on btc, with a promising event horizon ahead still favoring aggressive accumulation.”

Vetle LundemK33 senior analyst

“It is relatively difficult to innovate in traditional finance. In cryptography, it is much better and more efficient. And in terms of cost, it is much cheaper. So you can see that the pace is much faster and we can serve an even larger audience than traditional finance at this point.”

Lennix LaiOKX global commercial director

“Banks have trillions of dollars in transactions with each other at the end of the day, but there is a threshold point in time when international transactions simply cannot take place. “It’s a big problem and it’s also expensive and inefficient.”

Akshay Chopravice president, head of innovation and design of CEMEA at Visa

Prediction of the week

bitcoin bull market awaits as US faces ‘steep bearish’ – Arthur Hayes

With bond yields hitting 30-year highs, financial markets are set to receive “massive injections of liquidity” in the near future. bitcoin-bull-market-us-faces-bear-steepener-arthur-hayes” target=”_blank” rel=”nofollow”>according to BitMEX founder Arthur Hayes. This should provide the next catalyst for the cryptocurrency bull market, he said.

“Why do I love these markets right now when yields are screaming higher? Banking models do not have the concept of a downward trend occurring,” Hayes argued. A “bear riser” describes the phenomenon that long-term interest rates rise more rapidly than short-term interest rates.

“The faster this bearish rally goes up, the faster someone goes bankrupt, the faster everyone recognizes that there is no other way out than printing money to save the government bond markets, the faster we get back into the cryptocurrency bull market,” Hayes said .

FUD of the week

<h2 class="wp-block-heading" id="h-crypto-suffered-153-yoy-increase-in-hacks-and-scams-in-q3″>Cryptocurrencies suffered a 153% year-over-year increase in hacks and scams in the third quarter

Immunefi blockchain security platform crypto-suffered-153-percent-yoy-increase-hacks-scams-q3-immunefi” target=”_blank” rel=”nofollow”>published a new report on cryptocurrency scams and hacks for the third quarter. According to the report, the number of hacks and scams increased by more than 153% from July to September 2023 compared to the same period last year. In the third quarter of 2022, there were only 30 incidents, while in the third quarter of 2023 there were 76 incidents. A total of more than $680 million in cryptocurrency was lost during the quarter due to scams and hacks. The largest hack of the quarter was the Mixin protocol hack, resulting in a loss of over $200 million, while the Multichain hack of over $126 million was the second largest. The two most attacked networks were BNB Chain and ethereum.

<h2 class="wp-block-heading" id="h-bitcoin-analysts-still-predict-a-btc-price-crash-to-20k”>bitcoin Analysts Still Predict btc Price Drop to $20,000

bitcoin holders rejoiced when the coin started October with a six-week high, but technical analysts warn it could soon fall to $20,000. According to pseudonymous bitcoin trader CryptoBullet, the current chart shows a classic “head and shoulders” pattern that usually means the price is about to fall. The bottom of the left shoulder of this pattern is around $20,000, implying that the price will drop to that point before recovering. Joao Wedson, founder and CEO of cryptocurrency trading resource Dominando Cripto, went even further and stated that bitcoin may fall below $20,000. According to Wedson, the current price action is forming a fractal similar to the 2020-2022 period. The last time this happened, the price rose a lot at first, but then fell back to lower levels at the end of the fractal. In Wedson’s view, this implies that we may be in the early stages of a move below $20,000.

<h2 class="wp-block-heading" id="h-us-treasury-sanctions-crypto-wallets-as-authorities-crack-down-on-fentanyl”>US Treasury Sanctions crypto Wallets as Authorities Crack Down on Fentanyl

The Office of Foreign Assets Control of the United States Department of the Treasury announced that it has sanctioned multiple agencies related to manufacturers and traffickers of the illicit drug fentanyl. According to Treasury Undersecretary Wally Adeyemo, the wallets have “received millions of dollars in hundreds of deposits” as payment for various fentanyl-related criminal activities. The wallet sanctions were initiated as part of an indictment targeting some China-based chemical manufacturers. Valerian Labs, Hanhong Pharmaceutical and Hebei Crovell Biotech were three of the parties named in the indictment.

<h2 class="wp-block-heading" id="h-the-truth-behind-cuba-s-bitcoin-revolution-an-on-the-ground-report”>The truth behind the bitcoin revolution in Cuba: a report from the field

bitcoin-revolution-adoption-embargo/” target=”_blank” rel=”nofollow”>From addressing rampant inflation to providing a safe way to save money, bitcoin can be a vital economic tool for Cubans.

Singer Vérité’s fan-centric approach to Web3, music NFTs, and community building

Is music the next frontier of blockchain adoption? Some musicians believe technology can help them build a sustainable career in the industry.

Six questions for JW Verret, the blockchain professor who tracks money

He crypto/” target=”_blank” rel=”nofollow”>A Harvard-educated lawyer answers questions about cryptocurrency adoption and regulation.

Subscribe

The most interesting readings on blockchain. Delivered once a week.