The Ethereum Foundation has announced that it will work with New York-based banking consortium R3CEV on the creation of a new blockchain-based cryptocurrency, Lizardcoin, which aims to showcase the benefits of blockchain technology as well as the consortium’s ability to bring the technology to institutional clients and the regulation-loving masses by complementing it with a healthy dose of centralized control.

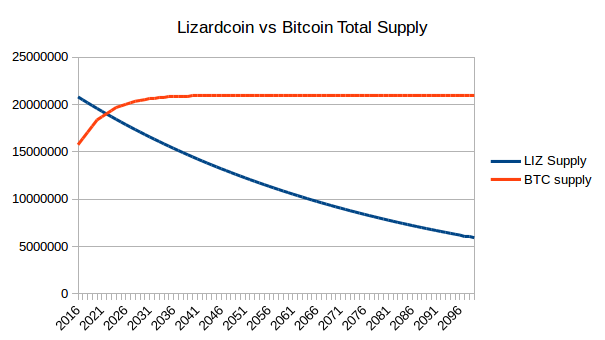

Lizardcoin aims to be a direct competitor to Bitcoin as a store of value, breaking the fixed 21 million Bitcoin supply limit with a first of its kind. deflationary model, starting with a peak supply of 20.9 million and then further reducing supply by 1.5% each year. It does so by taking advantage of one of the greatest innovations in modern central banking: negative interest rates. All accounts are charged a maintenance fee of 2.5% per annum, of which 1.0% will go to member banks to do as they please.

To use Lizardcoin, a user must first go through separate KYC verification processes with 28 of the 42 member banks. “It’s more decentralized that way,” explains Tim Grant; “even if a total of 13 banks are co-opted by the Goa’uld during the next Illuminati cabal summit, aliens will not be able to create an infinite number of new accounts, shut down the system, or go through unconnected subsets of member banks to create multiple accounts for the same person.” The mechanism has been approved by Byzantine fault tolerance experts Andrew Miller and Emin Gun Sirer, although Turkish Prime Minister Recep Tayyip Erdogan has declined to comment, saying it is highly offensive for computer scientists to use the former name Istanbul to refer to actors who are compromised or malicious.

IBM’s Paul Randomer has spoken favorably about the project, saying “At IBM we have a two-person team building on Lizardcoin technology, and we look forward to our willingness to include this platform in our portfolio of 37,125 internal research projects comprising almost every technology in every industry under the sun shows that This Is Huge™, and that we believe that Lizardcoin is definitely the future.” JP Morgan’s Bob Inthere adds: “For too long, banks have been threatened by decentralized technology. Now, we have a platform where we can use the power of cryptocurrency not to disrupt our core business lines, but to entrench them and to secure for us an income stream that will go on forever, and will best serve our true lizard head teachers.”

We are also in active discussions with the Department of Homeland Security regarding the development of a strategy for how Lizardcoin can be used to combat terrorism around the world. We hope the people behind us in the security line don’t mind too much; after all, we are building the revolutionary next-generation economy.

The Lizardcoin* crowdsale will start on two wooks, and ether and unicorns will be accepted as payment, at an exchange rate of 1 unicorn = 2,014 ETH = 4.712388 LIZ; Anyone in the world will be able to participate, though they will first need to go through the KYC process with 28 banks, including multiple in-person visits in multiple countries; We’ve partnered with Coindesk to host blockchain conferences in each of these countries over the next 12 months, so people can continue to attend the summit while getting their stamps of approval to buy what blockchain technology has to offer. offer.

*The Lizardcoin crowdsale carries no legal guarantees or promises; Neither R3CEV nor Ethereum accept any responsibility for the continued development of the Lizardcoin platform after the crowdsale is complete. In fact, because Ethereum is a public blockchain and therefore lacks firmness of liquidation, neither ether nor unicorns nor Lizardcoin will ever change hands; it will only get exponentially and probabilistically close to doing it; for this reason, the Lizardcoin crowdsale does not in fact legally constitute an offer of any kind.