© Reuters.

MGM Resorts International (NYSE:) has been named in a class action lawsuit following a major data breach that exposed its customers’ personal information and disrupted operations for ten days. The lawsuit, filed on Friday, September 22, 2023, alleges negligence on the part of MGM for failing to maintain adequate measures to prevent unauthorized disclosure of customer data.

The cyberattack began on September 7, 2023, when hackers posed as an IT administrator and obtained access credentials. The attack caused MGM’s network to crash, preventing resort guests from using their electronic room cards, Wi-Fi, ATMs, electronic gaming devices and other resort services. Two cybercriminal organizations, “The Scatter Spider” and ALPHV, claimed responsibility for the attack.

The class action lawsuit was filed by Emily Kirwan on behalf of herself and other MGM loyalty program members affected by the cyberattack. According to the lawsuit, MGM exposed full names, dates of birth, addresses, email addresses, telephone numbers, Social Security numbers and/or driver’s license numbers due to negligence and failure to follow “adequate and reasonable” procedures and policies. ” regarding encryption. of data.

In addition to the data breach, MGM’s operations were severely affected. The company’s reservation systems were compromised, leading to long lines in most lobbies of MGM properties as employees had to do much of the work manually. Normal operations were restored after a ten-day computer shutdown.

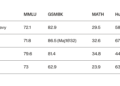

On Monday of last week (September 18), MGM announced that it had managed to bring most of its computers back online after suffering a ransomware cyberattack. However, there are many unknown factors about the cyberattack that pose significant risks to investors. Analysts have estimated daily revenue losses, but no cost increases have yet been reported. Liability for data loss is unknown, and the terms and amount of insurance coverage for cyberattacks are also unknown.

MGM Resorts International has an impressive recent record of buybacks, reducing its share count from nearly 500 million to just over 350 million in the last three years. However, MGM’s tangible book value is -$6.65 per share and they have over $19 of debt per share. Its earnings history is not impressive and shows a general upward trend, but nothing significant, and that is without taking into account the current situation.

The company has yet to estimate the increase in labor costs incurred due to the cyberattack. However, MGM Resorts International maintains insurance against cyberattacks according to its most recent 10-K filing. The extent of his coverage remains unknown at this time.

The class action follows a similar lawsuit targeting Las Vegas Strip heavyweight Caesars (NASDAQ:) Entertainment for a similar cyberattack.

This article was generated with the support of ai and reviewed by an editor. For more information consult our T&C.