cbies for iStockphoto; Canva

In just a few months in early 2020, the entire world changed.

Outbreaks of an unnamed, acute respiratory illness had emerged in China at the end of 2019, and by the first few months of 2020, infections of the highly contagious virus had spread around the world. The World Health Organization (WHO) officially named the SARS-CoV-2 virus “COVID-19” and declared a global health emergency on March 11, 2020. Within a week, U.S. government officials instituted social distancing measures in an effort to contain the virus, imposing mandatory lockdowns of businesses, schools, and nearly all other public places.

On Wall Street, the stock markets became extremely volatile—the Dow Jones Industrial Average lost 37% and the S&P 500 fell 34%, triggering a stock market crash. The airline industry petitioned the government for a $50 billion bailout, saying it would go bankrupt otherwise. The National Restaurant Association asked for $145 billion, predicting up to 7 million employees would lose their jobs. Over 3 million Americans filed for unemployment benefits in the third week of March 2020 alone. The government needed to take quick action.

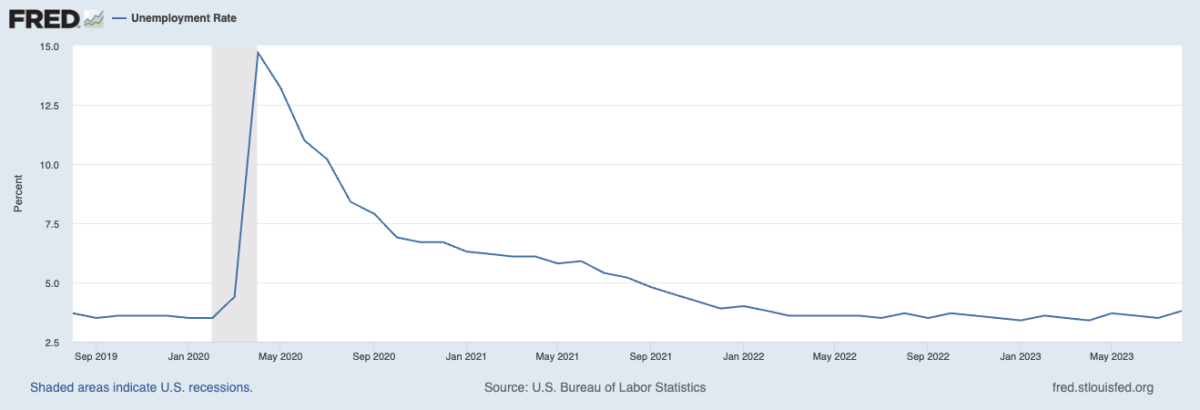

U.S. Bureau of Labor Statistics, Unemployment Rate [UNRATE], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/UNRATE, September 12, 2023.

What is the CARES Act?

The CARES Act, or the Coronavirus Aid, Relief, and Economic Security Act, was the U.S. government’s response to this unprecedented economic crisis. Congress passed the Act on March 25, 2020, and it was signed into law by President Donald Trump on March 27, 2020.

CARES was a mammoth, $2.2 trillion relief package that provided direct payments to millions of American families and forgivable loans to small businesses and corporations, to name just a few.

What are the components of the CARES Act?

The CARES Act provided trillions of dollars of aid to millions of Americans in a variety of forms such as unemployment benefits, foreclosure assistance, student loan relief, and payroll loans:

| CARES ACT Recipients | Amount |

|---|---|

|

Corporations |

$454 billion |

|

Small businesses |

$349 billion |

|

Households |

$301 billion |

|

Unemployment insurance |

$250 billion |

|

Tax deferrals |

$221 billion |

|

Other |

$198 billion |

|

States |

$117 billion |

|

Hospitals |

$117 billion |

|

Airlines |

$61 billion |

|

Public transit |

$25 billion |

|

Total |

$2.093 trillion |

Individual and family assistance

Single taxpayers received one-time stimulus payments of $1,200, and families that earned less than $150,000 received $2,400 plus $500 per child. These payments were considered tax-free.

Unemployment benefits

The CARES Act provided an additional $600 per week to those receiving unemployment benefits through July 26, 2020, along with 13 more weeks of assistance to those who had already claimed the maximum amount (26 weeks) of regular unemployment benefits.

Foreclosure relief

The CARES Act placed a temporary moratorium on eviction filings and provided certain other protections to tenants of federally assisted rental properties. This moratorium was eventually extended through August 26, 2021.

Student loan relief

Under CARES, federal student loan repayments (and interest accumulation) were suspended through September 1, 2023, and employer-funded loans and interest were tax-free through December 31, 2020, for up to a maximum of $5,250 per employee. In addition, a $14 billion relief fund was established to help both students and universities with the cost of course materials, technology, food, and other services.

Medicare increases

Medicare services moved online during the COVID-19 pandemic; through CARES, Medicare coverage expanded to include telehealth appointments. In addition, Medicare prescriptions were expanded to include refills of up to 90 days.

Business assistance

Funding initiatives under the CARES Act included treatment, diagnosis, and protection measures for hospitals and community health centers. It also established a “Ready Reserve Corps.” of frontline healthcare workers and increased Medicare payments to medical providers in the year 2020.

Additional government funding was aimed at the research and development of a COVID-19 vaccine (the Coronavirus Preparedness and Response Supplemental Appropriations Act) as well as unemployment compensation (the Families First Coronavirus Response Act), which also took effect in March 2020.

But research labs and hospitals weren’t the only ones who received government assistance. The U.S. Department of Defense Received $1 billion, which it ultimately used for non-pandemic-related purposes.

Small businesses were eligible for funding under the $669 billion Paycheck Protection Program, which provided forgivable loans to businesses, nonprofits, and faith-based organizations with less than 500 employees. Employers were also eligible to defer Social Security tax payments for two years, along with other tax benefits, such as increased tax deductions on businesses that claimed net operating losses of 80%–100% in the 2018–2020 period. It also raised the limit on tax-deductible contributions from 10% to 25%.

Who benefitted from the CARES Act? How equitable was it?

The CARES Act provided more than $2 trillion in relief to individuals, families, small businesses, and critical sectors of the U.S. economy, such as airlines and transportation. However, an August 2020 report from the Brookings Institution, a nonpartisan think tank, revealed that individuals experienced confusion and delays surrounding both unemployment benefits as well as stimulus payments—and the lowest-income households experienced a significantly longer delay than higher-income households.

Much of this was due to the method in which these payments were delivered: If the IRS did not have an individual’s direct deposit information on file for their tax refunds, payments went through the mail, where they could languish for weeks at a time.

Black and Hispanic populations were especially vulnerable to the economic shocks caused by the pandemic, since they had lower rates of emergency savings and had a higher likelihood of facing eviction, skipped bills, and food insecurity. These same demographics experienced 8% and 11% longer delays, respectively, in receiving their stimulus payments than white demographics.

In addition, the Justice Department has been investigating hundreds of individuals for exploiting the CARES Act by fraudulently receiving relief payments through the Paycheck Protection Program and COVID-19 Economic Injury Disaster Loans. This includes instances of bank fraud, wire fraud, identity theft, and money laundering. As of December 2021, nearly 100 individuals were sentenced to prison for falsifying documents and using fake identities in order to obtain payments.

Did the CARES Act help the economy?

Seen through a number of metrics, CARES is considered a success. The U.S. unemployment rate fell from 14.7% in April 2020 to 3.6% by August 2020. According to Sharon Parrott, the President of the Center of Budget and Policy Priorities, a nonpartisan policy organization, there were actually 10 million fewer Americans below the poverty line in 2020 than in 2019, if you include government assistance. Medicaid enrollments over the period also increased by 16 million people, and there was no reported surge in evictions, either.

But the CARES Act also created negative outcomes, such as adding at least $1 trillion more to the federal deficit, according to the Congressional Budget Office. Eviction rates actually surged over 40% in 2023 due to the end of the moratorium period on federally backed mortgages as well as national rent increases in the double-digits: The national average was 14%, or $250 per month more between 2019 and 2023.

Did the CARES Act expire?

CARES Act funds expired on September 30, 2021.

A second round of stimulus payments, known as the Coronavirus Response and Relief Supplemental Appropriations Act of 2021, took effect on December 27, 2020. This $900 billion package included a one-time payment of $600 per taxpayer, with an additional $600 per dependent under age 16. In addition, taxpayers who did not initially receive a stimulus payment were eligible to claim one on their 2020 tax returns.

Soon after President Joe Biden was sworn into office, he signed the American Rescue Plan, a $1.9 trillion act, in March 2021, giving taxpayers up to an additional $1400.