Electronic Export Information (EEI) came into existence in the United States to collect export data. No matter how big or small your business is, if you’re exporting goods overseas with shipments valued at over $2,500, you’ll need to file an EEI.

Since its introduction, EEI has significantly impacted businesses that export goods. It helps to track the movement of goods, ensures border security, and allows the US Department of Commerce to regulate the flow of goods in and out of the country.

If you want to get into the export business, it’s essential to understand the basics of EEI. In this article, we’ll answer some common questions about EEI and provide resources to help you navigate the filing process.

What is Electronic Export Information?

Electronic Export Information (EEI) is a declaration form businesses must file with the US Census Bureau to report and track international exports.

It is usually filed through the Automated Export System (AES), an online platform allowing exporters to submit and update their EEI. Every shipment valued at over $2,500 requires an EEI, regardless of the type or destination of the goods.

There are exceptions to filing, such as when shipping to Canada or when the shipment is valued under $2,500 and not subject to ITAR or the “600 series“.

The EEI gathers essential information about the shipment, including (but not limited to):

- Email address of the exporter

- Shipper’s name and address

- Intermediate consignee name and address

- Ultimate consignee name and address

- Port of Export

- The Employer Identification Number (EIN) or Data Universal Numbering System (DUNS) number of the exporter

- Export Control Classification Number (ECCN) (if applicable)

- License information

- Destination control statement

- Commodity classification

- Schedule B number

- Value of the goods

- Country of origin

- Destination country

- Mode of transportation

When does one need to file an electronic export information form?

Filing an Electronic Export Information form is necessary when the value of the exported goods exceeds $2,500 per Schedule B number or if the items fall under specific regulations, such as those of the Department of State, Department of Defense, or Nuclear Regulatory Commission, regardless of value.

This includes items that are classified under the International Traffic in Arms Regulations (ITAR) or the “600 series” of the Commerce Control List.

The deadline for filing Electronic Export Information varies based on the transportation method used for the shipment. Here’s a quick rundown:

- If the cargo is transported by air, including Air Express Couriers, the EEI must be filed no less than two hours before the aircraft’s scheduled departure.

- For mail, the EEI must be filed no less than two hours before the exportation.

- The EEI must be filed for all other transportation methods no less than two hours before exportation.

Additionally, approved USPPIs (US Principal Parties of Interest) are granted a “post-departure” privilege to file their EEI up to 10 calendar days after the date of export.

It is important to note that the filing must be done from one to 24 hours before the actual export of the shipment depending on the method of transportation.

What is AES?

The Automated Export System (AES) is an online platform operated by the US Census Bureau for the electronic filing of Electronic Export Information. It is the central point through which export shipment data related to transactions is filed and subsequently used by US Customs and Border Protection (CBP), the Foreign Trade Division (FTD), and other federal agencies.

AES simplifies the filing process by allowing you to submit your EEI online, reducing the need for paper documents 24/7. You can file EEI directly through AES or use third-party software that communicates with AES.

This system is designed to streamline the export reporting process, improve trade statistics, and ensure compliance with US export laws.

What is the Shipper’s Export Declaration?

The Shipper’s Export Declaration (SED) was the predecessor to the Electronic Export Information. Before implementing the Automated Export System, exporters were required to fill out a paper SED form for each international shipment. The SED contained similar information to that in EEI, including details about the exporter, consignee, and the goods being exported.

The transition from SED to EEI was made to modernize and streamline the export reporting process. The use of AES for filing EEI electronically has significantly reduced paperwork, increased efficiency, and improved the accuracy of export statistics.

What is the ITN number?

The Internal Transaction Number (ITN) is a unique transaction number assigned by the Automated Export System when you file your EEI. It serves as proof of filing and compliance with US export regulations.

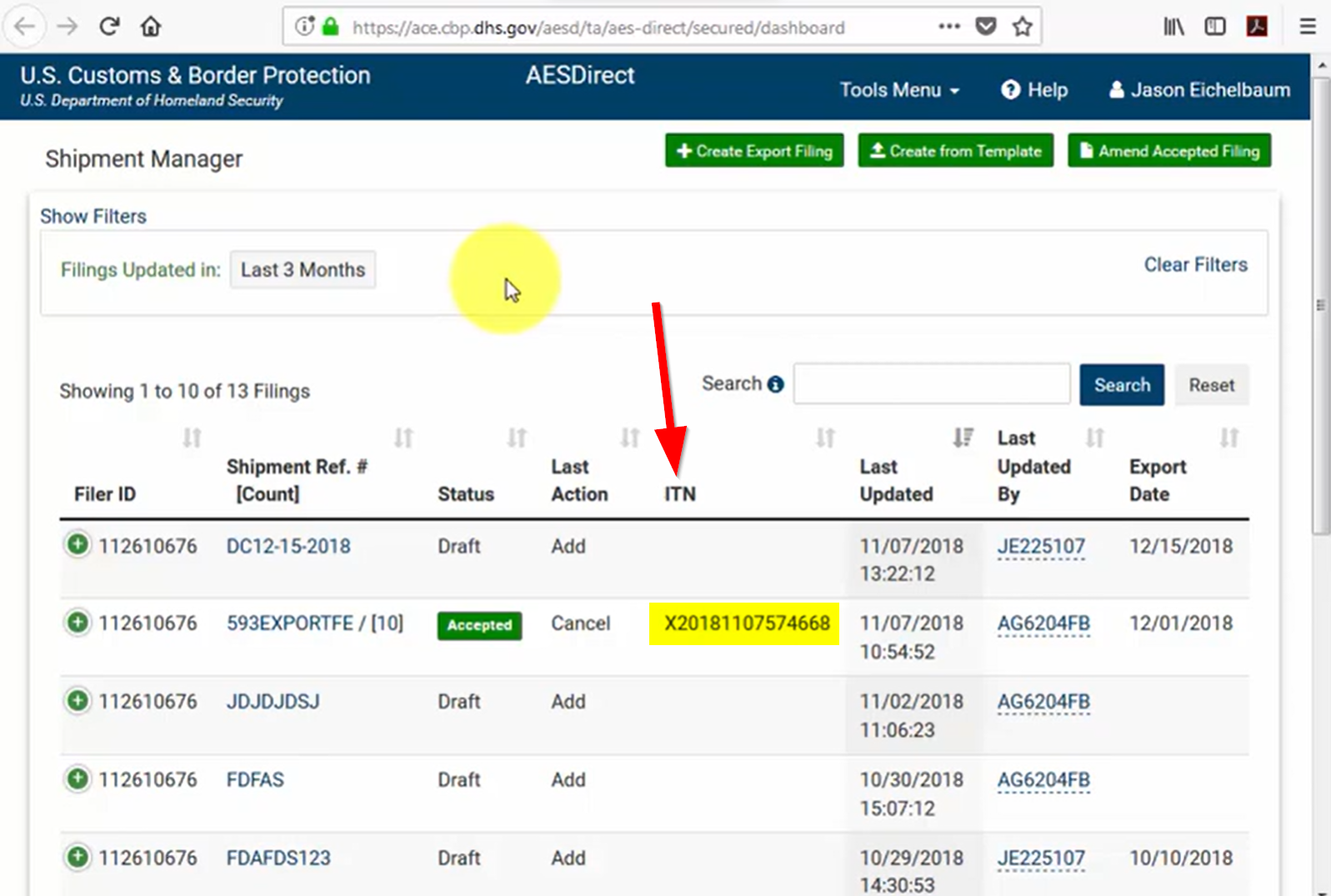

The ITN is unique for every shipment and must be provided to the US Customs and Border Protection (CBP) at the port of export. Typically, it is a 15-digit alphanumeric code that begins with the letter ‘X’ followed by the year, month, and day of acceptance and ends with six unique numbers. For example, an ITN for an accepted filing on July 1, 2023, could be ‘X20230701000001’.

The ITN is required for all shipments that require an EEI. Ensure to include it on all shipping documents, such as the bill of lading, the Shipper’s Letter of Instruction, and any others required. The absence of an ITN can result in delays or even fines.

How does EEI work?

The first step is to understand whether you need to file an EEI. To do that, you must determine if your shipment meets the criteria outlined by the US Census Bureau. Review your HTS Code and the Schedule B number of the goods you export.

Once you’ve determined whether to file an EEI, you can file it online through the Automated Export System (AES) or by using an authorized agent.

To file online, you must have your export control classification number, foreign principal party, shipper’s export declaration, and Schedule B number on hand. The AES also requires you to provide information on the value of the goods, their country of origin, their destination country, and the mode of transportation used to ship them.

The AES is then used to validate the information and generate an ITN, which serves as proof of EEI filing. It’s important to note that the AES is a secure and encrypted platform, and all sensitive information is protected in transit and at rest.

What are the requirements for filing EEI?

The requirements for filing EEI vary depending on the context. However, here are some general requirements to consider:

1. Determine if EEI filing is required based on the value, destination, and nature of the goods being exported. Exports over $2,500 or requiring a license/permit need EEI filing.

2. Individuals or businesses exporting goods need an EIN issued by the IRS.

3. Register with the AES, the electronic system for filing EEI, and obtain an AES filing account.

4. Gather necessary information about the goods being exported, such as description, value, quantity, and destination country. Additional details may be required depending on specific regulations.

5. File the EEI through the AESDirect portal or an authorized agent. Ensure that the EEI is filed within the required time frame.

7. Obtain the 15-digit ITN (Internal Transaction Number) from AES as proof of filing. This number should be included in all shipping documents.

8. Keep records of all EEI filings for at least five years, as required by US export regulations.

Where to apply electronic export information to get an internal transaction number?

You can apply for Electronic Export Information (EEI) and obtain an Internal Transaction Number (ITN) through the Automated Export System (AES).

Follow these steps:

1. Access the portal through the Automated Commercial Environment.

- Once in the portal, click Create Export Filing.

3. Fill out all the necessary information about the exported goods, including their value, destination, and other relevant details.

4. After filling out the EEI, submit the filing for processing.

5. Once AES accepts the filing, you’ll receive an email with the ITN.

Always include the ITN in the bills of lading and the Shipper’s Letter of Instruction (SLI). It informs the forwarder and US Customs and Border Protection that the filing has already been made. The ITN is also required to complete customs forms.

Please note that if you encounter any difficulties or need additional help, contact the US Census Bureau.

What is FTR?

The Foreign Trade Regulations (FTR) govern the filing of export information in the US and are required under US law. They outline the requirements for filing the Electronic Export Information in the Automated Export System.

The FTR plays a crucial role in preventing the export of certain items to unauthorized destinations or end users by aiding in targeting and identifying suspicious or illegal shipments prior to exportation. Exporters need to comply with the FTR to facilitate legal international trade operations.

What is an FTR Exemption?

An FTR exemption is a provision in the Foreign Trade Regulations that allows certain types of exports to be exempt from filing Electronic Export Information. These exemptions are typically based on the value, destination, or type of goods being exported.

Here are some FTR exemptions:

1. If the shipment is going to Canada and is worth $2,500 or less per Schedule B/HTSUSA classification

2. If the item is subject to the International Traffic in Arms Regulations (ITAR)

3. If the goods are temporarily exported and expected to be returned to the US in the same condition

4. If the shipment is worth $2,500 or less per Schedule B/HTSUSA classification

It’s important to note that even if an exemption applies, the exporter must still comply with all other applicable export regulations and laws. Some exemptions may also require additional documentation or reporting requirements.

What are the consequences of not filing EEI on time?

Failure to file Electronic Export Information (EEI) on time can have significant consequences. These may include:

1. Penalties: The US Census Bureau can impose civil and criminal penalties for violations of the Foreign Trade Regulations (FTR). Civil penalties can be up to $14,000 per violation, while criminal penalties can be up to $10,000 in fines and/or imprisonment for not more than five years per violation.

2. Delays: Not filing EEI on time can delay the shipment of your goods. This can disrupt your business operations and potentially lead to lost sales or customers.

3. Loss of export privileges: Repeated violations of the FTR and non-compliance with EEI filing requirements can result in the loss of export privileges.

4. Reputational damage: Non-compliance with export regulations can harm your business reputation, leading to loss of trust from customers and partners.

5. Legal action: Non-compliance with EEI filing requirements can lead to legal action being taken against the exporter.

To avoid these consequences, it is crucial to understand the requirements for filing EEI and ensure compliance with all applicable export regulations. Regular training and audits can help ensure that your business remains compliant.

How can you streamline your EEI filing?

EEI filings can be rejected due to errors or missing information, leading to unexpected delays and extra costs. Moreover, manually completing the forms can be tedious and time-consuming, especially when dealing with large shipments.

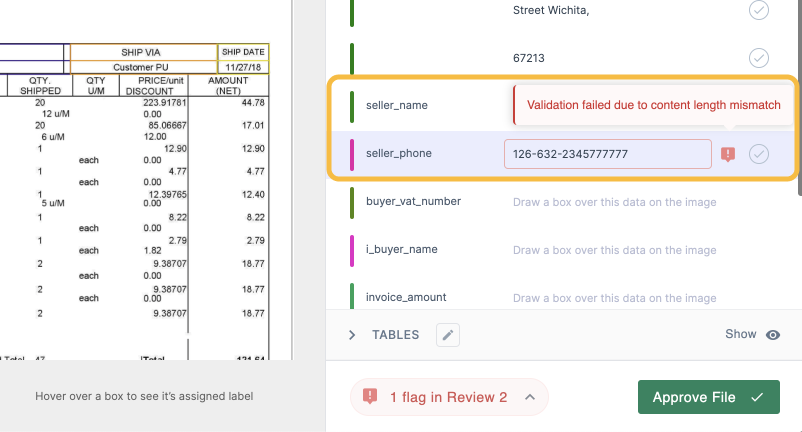

With Nanonets’ OCR technology, you can automate the process of extracting data from export documents, reducing the chances of errors and speeding up the process. Here’s how you can streamline your EEI filing with Nanonets:

1. Automate data extraction: Upload your export documents in bulk and extract relevant data fields required for EEI filing. The accuracy improves over time since the AI learns from your documents and actions. This significantly reduces manual data entry and the potential for human error.

You don’t need to worry about creating templates either, as our AI-powered system can automatically recognize the form and extract the relevant data from all types of export declaration forms.

2. Validate data: Ensure the accuracy of the extracted data by validating it against predefined rules and standards. You can also set up custom approval processes for data validation. This helps to eliminate errors and inconsistencies in the data before it’s used for EEI filing.

3. Route data automatically: Collect documents from multiple channels and send them to the platform automatically. This eliminates the need for manual sorting and uploading of documents, saving you time and effort.

4. Integrate with existing systems: Seamlessly integrate with your existing systems, such as ERP or CRM. This allows for easy data transfer and helps maintain a single source of truth for all your export information.

The bottom line is that, with Nanonets, you can save time and eliminate the risk of errors. Our technology can help you maintain compliance with EEI requirements, reduce costs, and improve your overall workflow. Don’t let manual data entry slow down your business operations.

Final thoughts

EEI filings can be a complex and time-consuming process. You may struggle to keep up with changing regulations and manage the large volumes of data required to file.

But if you’re looking to succeed in the export business, understanding and complying with Electronic Export Information requirements is crucial. Automate the process and make it easier for yourself with Nanonets.

Sign up now and use Nanonets’ AI-powered OCR and machine learning solution to file your Electronic Export Information form quickly and efficiently. With our solution, you can save time, reduce errors, and maintain compliance with EEI requirements.