Decentralized finance (DeFi) protocol Aave has launched its US dollar-pegged algorithmic stablecoin GHO on the Ethereum mainnet, with $2.19 million worth of GHO minted so far.

Aave announced the launch of the new stablecoin in a blog post on July 16, describing the new GHO stablecoin as a “decentralized, overcollateralized” asset. The stablecoin is backed by a “multitude” of digital assets, including Ethereum’s native coin Ether (ETH) and Aave’s native token AAVE (AAVE).

Let’s go GHO! Congratulations to the @AaveAave community at the Mainnet launch. https://t.co/vI7JbMLYb4

—GHO (@GHOAve) July 15, 2023

The launch of GHO on the mainnet came after a community governance vote, in which almost 100% of the 424 participating addresses voted in favor of the new stablecoin.

Unlike centralized stablecoins like Tether’s USDT (USDT), which have received some criticism for an apparent lack of transparency around their reserves, the assets that back GHO are transparent and verifiable and can be confirmed by on-chain data. , according to Aave.

“All transactions are done via self-executing smart contracts, and all data related to GHO transactions is available and auditable directly from the blockchain or through numerous user interfaces,” Aave wrote.

Furthermore, Aave said that the proceeds from GHO would further bolster its DAO treasury, with governance entrusted to AAVE and stkAAVE token holders.

The GHO stablecoin is currently available to the public:

“Anyone can mint GHO using the assets they supply on the Aave Protocol V3 Ethereum market as collateral, ensuring that GHO is over-collateralized by a multitude of assets.”

Related: Circle CEO spells doom scenario for US dollar in warning to Congress

The launch of GHO marks another addition to the growing ranks of DeFi-native algorithmic stablecoins. On May 4, DeFi protocol Curve launched its flagship crvUSD algorithmic stablecoin.

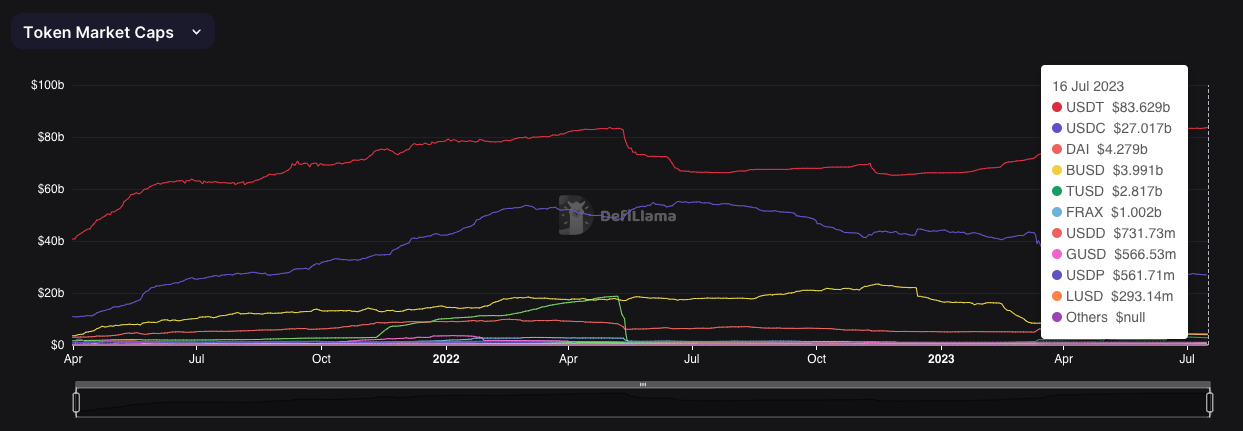

At press time, DAI, MakerDAO’s Ethereum-based stablecoin, is the largest algorithmic stablecoin in circulation, with a market capitalization of $4.28 billion according to data by DeFillama.

However, the total stablecoin market remains dominated by centralized issuers, including Tether and Circle.

Currently, Tether’s USDT and Circle’s USD Coin (USDC) account for 87% of the total circulating supply of all US dollar-pegged stablecoins.

At press time, GHO is trading slightly below the desired parity of $1 at $0.9927 and has fallen as low as $0.9814 on July 16, based on price. data from CoinMarketCap.

Cointelegraph has reached out to Aave for comment but has yet to receive an immediate response.

Magazine: Unstable currencies: decouplings, bank runs and other risks loom