The price of Ether (ETH) plunged 7% between June 14-15, hitting its lowest level in three months and affecting investor sentiment that the altcoin was on track to turn at $2,000 as support. .

It’s worth noting that the $1,620 fund represents a market cap of $196 billion for Ether, which is higher than PetroChina’s $186 billion, and not far from the chipmaker’s $198 billion. AMD.

Being the 66th largest global tradable asset in the world is no small feat, especially considering that the cryptocurrency is only 8 years old and does not generate any kind of direct benefit for the maintenance of the project. On the other hand, stocks enjoy the benefits of corporate profits and eventual government subsidies, so perhaps investors should be concerned about Ether’s recent price decline.

Pressured ether price succumbs to regulation and declining network activity

Regulatory pressure helped subdue investor appetite for Ether, as the Securities and Exchange Commission (SEC) proposed a rule change regarding the definition of an exchange. Paul Grewal, legal director of the Coinbase exchange, has rejected the proposed change, claiming it violates the Administrative Procedure Act.

More worryingly, the use of decentralized applications (Dapps) on the Ethereum network failed to gain momentum despite gas fees plummeting by 75%. The 7-day average transaction cost dropped to $4 on June 14, down from $16 the previous month. Meanwhile, active Dapp addresses decreased by 18% in the same period.

Keep in mind that the decline was across the board, affecting decentralized finance (DeFi), NFT markets, gaming, and collectibles alike. Interestingly, Total Value Locked (TVL), which measures deposits locked in Ethereum smart contracts, decreased just 2% from mid-May to 14.6 million ETH, according to DefiLlama.

To analyze the odds of Ether price breaking below the $1,650 support, one should check for a reduced ETH futures premium and higher costs for hedge put options.

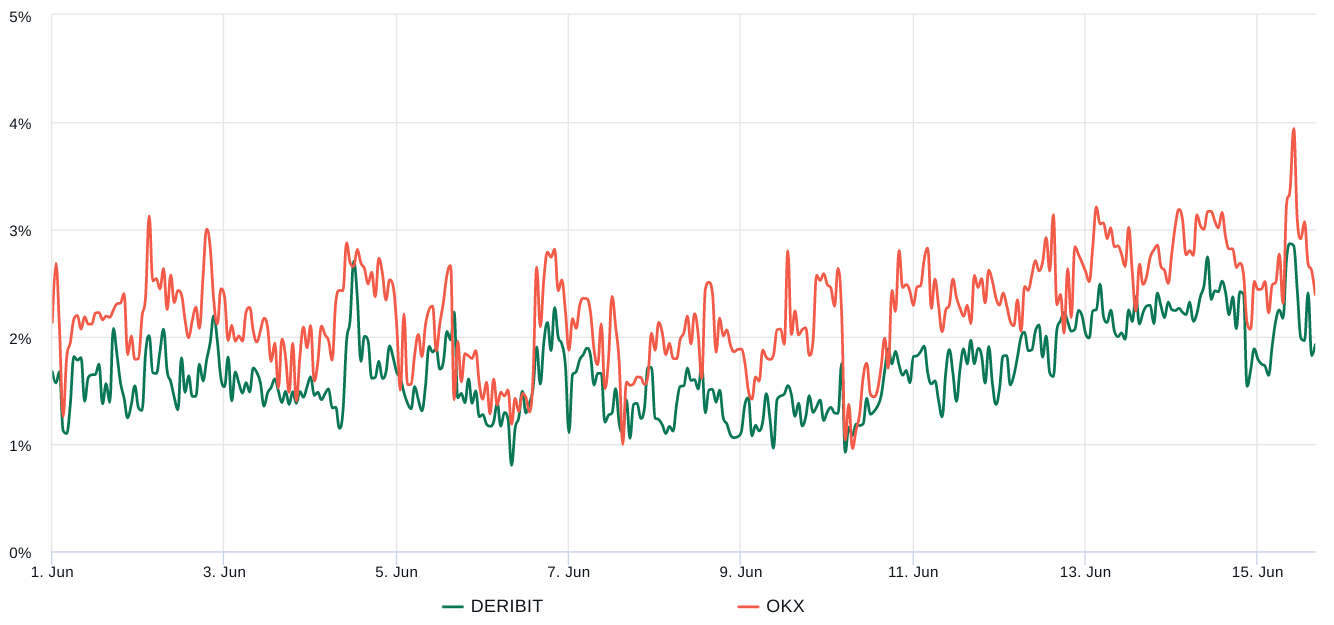

Ether quarterly futures are popular with whales and arbitrage desks. However, these fixed-month contracts are generally trading at a slight premium in the spot markets, indicating that sellers are asking for more money to delay settlement.

As a result, ETH futures contracts in healthy markets should trade at a 5-10% annualized premium, a situation known as contango, which is not unique to crypto markets.

According to the futures premium, known as the basis indicator, professional traders have been avoiding leveraged long positions (bullish bets). Despite the modest improvement to 2%, the indicator remains far from the neutral threshold of 5%.

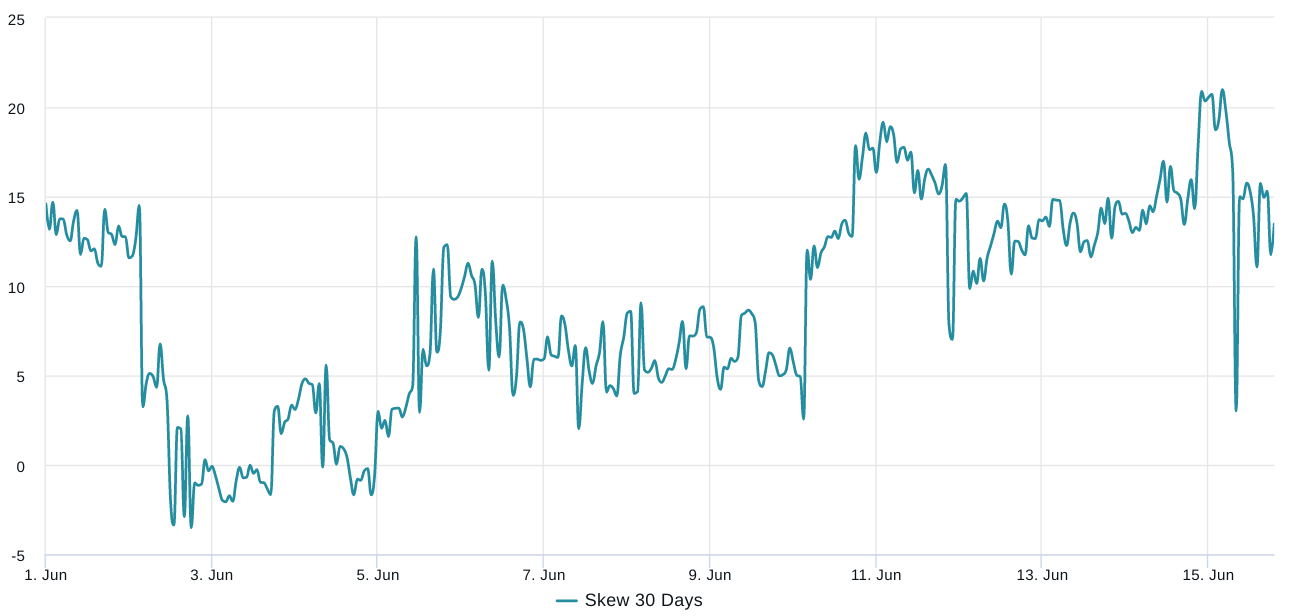

To exclude externalities that might have affected only Ether futures, the ETH options markets should be analyzed. The 25% delta bias indicator compares similar call and put options and will turn positive when fear prevails because the protective put premium is higher than call options.

The bias indicator will move above 8% if traders fear an Ether price drop. On the other hand, general enthusiasm reflects a negative bias of 8%. As shown above, the delta bias has been signaling fear since June 10 and peaked at 21% on June 15, the highest level in three months.

Related: This is what happened in crypto today

Ether price looks set to drop to $1,560

Investors tend to focus solely on short-term price movements, forgetting that the price of Ether is up 37% year-to-date in 2023. Also, by relying too heavily on the 24 Total Value Locked (TVL) 000 million dollars from the Ethereum Network, traders may have missed signs of weakening demand for Dapp usage.

For now, the bears have the upper hand considering ETH derivatives metrics, so a retest of the $1,560 support is the most likely outcome. That doesn’t mean 2023 gains are at risk, but until the regulatory FUD wears off, bulls will have a hard time moving Ether above the $1,750 resistance.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts and opinions expressed herein are those of the author alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.