Ethereum (ETH), the second largest digital asset in the cryptocurrency sector, is currently captivating traders’ attention as volatility indicators indicate an intriguing change in market dynamics.

Contrary to the usual pattern, these indicators suggest that Ether may experience relatively smaller short-term price fluctuations compared to Bitcoin. according to Bloomberg.

This unexpected change has injected a new element of anticipation and curiosity among investors, who are now closely following the evolving cryptocurrency landscape.

The Bitcoin Volatility Index. Source: T3 Index.

Decreasing the gap between the volatility of Ethereum and Bitcoin

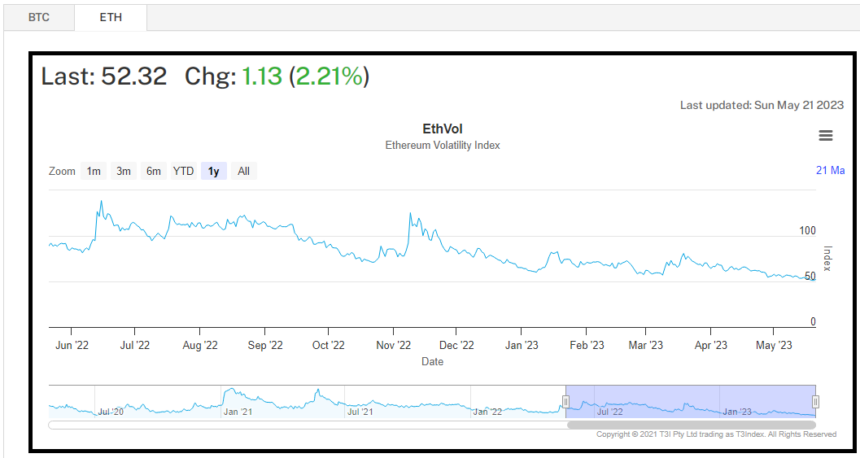

He Ether T3 Volatility Index, an innovative tool, is at the center of this phenomenon. It has become an indispensable barometer for evaluating and forecasting price volatility in the Ether market.

Data compiled by Bloomberg reveals that the difference in volatility between Ether and Bitcoin, as measured by 180-day realized or historical volatility, is currently at its lowest level since 2020. Furthermore, this difference is only marginally positive, which indicates a remarkably close alignment. between the volatility of Ether and Bitcoin.

The Ether Volatility Index. Source: T3 Index.

Caroline Mauron, co-founder of crypto derivatives platform OrBit Markets, told the publication:

“Lower volatility generally helps institutional investors allocate more capital to cryptocurrencies as it becomes cheaper to buy protection and manage exposures… volatility spread compression can result in higher Ether exposure by long-term investors.

Implications of Ethereum price fluctuation

The changing flow of Ether’s volatility behavior has significant implications. In particular, the implied volatility indices for Bitcoin and Ether, which are based on the price of options, have seen declines after hitting recent highs in March.

However, Ether’s implied volatility has declined at a faster rate. Additionally, a broader measure of cross-asset fluctuations in global markets has also seen a decline.

The implications of Ether’s changing volatility behavior are multifaceted. The faster drop in Ether’s implied volatility suggests that market participants have become less insecure or less anxious about Ether’s future price movements compared to Bitcoin. This could be influenced by various factors, such as regulatory developments, market maturity, or increasing investor confidence in Ether’s long-term potential.

ETHUSD trading at $1,812. Chart: TradingView.com

In addition, the broader decline in asset crossovers indicates a possible reduction in risk aversion among investors as they perceive a more stable and predictable market environment. This could affect investment decisions and trading strategies, as market participants may adjust their risk management approaches and resource allocation based on the evolving volatility landscape.

The change ether volatilityas reflected in the implied volatility indices for Bitcoin and Ether and the broader measure of cross-asset swings, highlights the evolutionary nature of the cryptocurrency market.

-Coinnounce Featured Image