After a consolidation and correction phase, the Ethereum price has recently reached the crucial support level of the 50-day moving average. However, it is currently traversing a tight price range between the 50-day MA and the significant $2K resistance level.

Technical analysis

By Shayan

the daily chart

Looking at the daily chart, the price previously formed a higher pattern before experiencing a significant drop. The 50-day moving average acted as a support level at $1.8K, leading to substantial volatility on lower time frames and a significant shadow on the daily chart.

Currently, ETH is confined within a tight dynamic range between the 50-day moving average, which currently sits at $1,847, and the important resistance region of $2K.

If the price manages to break above the $2,000 resistance and its previous swing of $2,100, it could trigger a prolonged rally. Conversely, if it breaks below the 50-day MA, the 100-day moving average at $1.7K will become the major support level.

The 4 hour chart

Looking at the 4-hour chart, the price was rejected by the upper threshold of the ascending channel, creating a downtrend towards the middle trend line of the channel. Despite experiencing tremendous volatility after hitting the trend line, buying pressure in this critical region remains evident.

If the price falls below this essential level, the next stop for Ethereum would be $1,700. However, if ETH finds support in this region, the bulls could attempt another run towards the $2.1K mark.

chain analysis

By: Edris

The ETH price has recently plunged, following the bullish trend of the past few months. Looking at the futures market sentiment metrics, it appears that the long sell-off cascade is to blame.

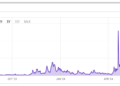

This chart shows Ethereum open interest, which measures the number of open futures contracts. Open interest generally rises when market sentiment is bullish, and higher values lead to more short-term volatility.

Taking into account the most recent price action and the open interest chart, it is clear that this metric has been increasing towards the end of the recent rally, but has also decreased significantly as the price has declined. This sudden decline in price is likely due to long positions being liquidated and adding to the selling pressure, further compounding the decline.

This event is called a sell-off cascade, and it typically occurs when open interest rises rapidly. However, this metric is now showing lower values as a result of the sell-offs, and less volatility could be expected in the near term.

Binance Free $100 (Exclusive) – Use this link to sign up to receive $100 free and 10% off your first month’s fees for Binance Futures (terms).

PrimeXBT Special Offer: Use this link to sign up and enter the code CRYPTOPOTATO50 to receive up to $7,000 on your deposits.

Disclaimer: The information found on CryptoPotato is that of the writers cited. It does not represent the views of CryptoPotato on whether to buy, sell or hold investments. You are advised to do your own research before making any investment decisions. Use the information provided at your own risk. Consult the Legal Notice for more information.

cryptocurrency charts by TradingView.