Bitcoin (BTC) price recaptured the $30,000 support on April 18 after briefly testing $29,130 the day before. However, traders question whether the recovery is sustainable given increased regulatory scrutiny, especially in the United States.

Rostin Behnam, chairman of the Commodity Futures Trading Commission (CFTC), said on April 14 that Binance intentionally violated US rules regarding futures and commodity trading. For example, he said that he knowingly allowed US citizens to trade on the exchange through the use of obfuscation tools. The comments stem from the CFTC’s March 27 lawsuit against Binance and its CEO, Changpeng “CZ” Zhao, for alleged trading violations.

Also on April 14, in an open meeting with US Securities and Exchange commissioners and staff, SEC Chairman Gary Gensler said the agency will review the proposed redefinition of an “exchange.” The SEC intends to subject certain brokers to additional regulatory scrutiny and explicitly include decentralized applications.

On April 17, the US Securities and Exchange Commission charged crypto asset trading platform Bittrex and former CEO William Shihara with allegedly operating an unregistered stock exchange, broker, and clearing agency. Separately, Bittrex Global is paying to operate a shared order book with Bittrex.

Bittrex had already announced its intention to shut down US trading on April 30 after receiving a notice from Wells in March warning of impending regulatory action.

Other countries are taking different approaches

The regulatory environment in Hong Kong appears to have improved after China’s state-affiliated banks began to incorporate cryptocurrency companies. In addition to the Bank of Communications, ZA Bank, the largest virtual bank in Hong Kong controlled by a Chinese Internet insurer, will also act as a settlement bank for some crypto companies.

According to a Wall Street Journal report, these banks will serve as settlement banks to allow token deposits on licensed exchanges to be withdrawn in Hong Kong dollars, Chinese yuan, and US dollars.

Argentina’s securities regulator also approved a Bitcoin-based index futures on April 12. The regulated derivatives contract will offer qualified investors a safe and regulated way to gain exposure to BTC. All operations will be settled in the national fiat currency, and merchants will be required to deposit Argentine pesos via bank transfer.

To understand how professional traders position themselves, traders need to analyze the options markets.

Options traders lean towards bearish structures

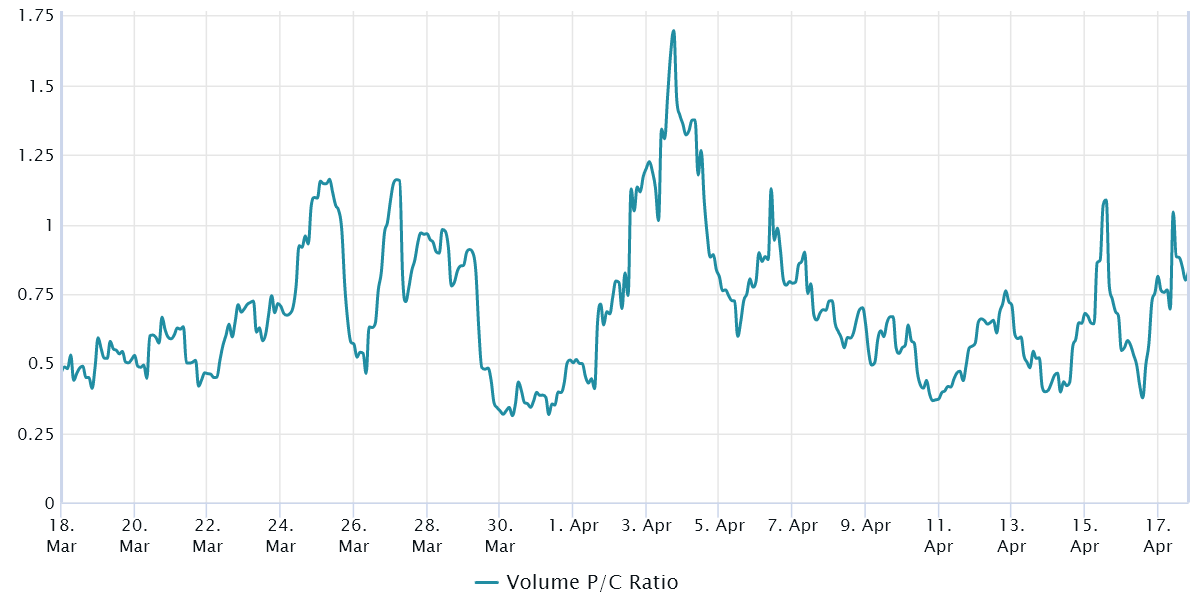

Traders can gauge market sentiment by gauging if there is more activity through call options or put options. Generally speaking, call options are used for bullish strategies while put options are for bearish strategies.

A put to call ratio of 0.70 indicates that the put option open interest lags behind the largest number of call options. Conversely, a 1.40 indicator favors put options, which is a bearish sign.

Since April 5, Bitcoin’s put-to-call ratio has either balanced or favored protective puts. The current gauge of 0.60 shows slightly higher demand for neutral to bearish options strategies, though nothing out of the ordinary.

To confirm if the traders did indeed turn bearish, the Bitcoin futures markets should also be analyzed.

Bitcoin Futures Metrics Remain Neutral to Bearish

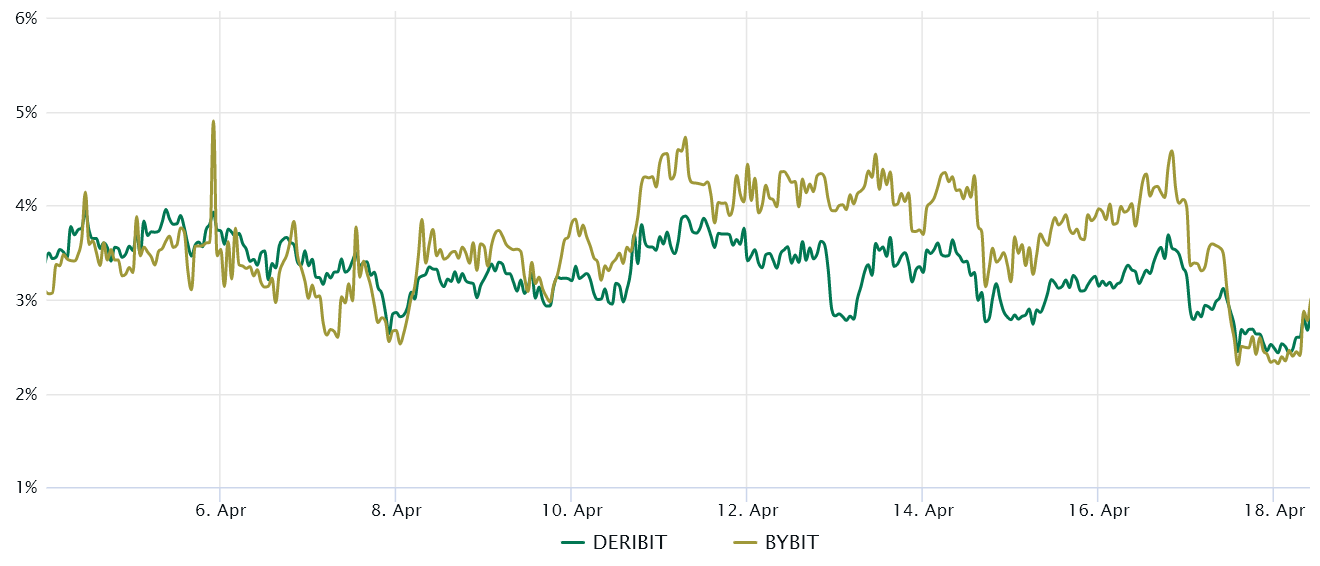

Bitcoin quarterly futures are popular with whales and arbitrage desks. These fixed-month contracts typically trade at a slight premium on the spot markets, indicating that sellers are asking for more money to delay settlement for a longer period of time.

As a result, futures contracts in healthy markets should trade at a 5-10% annualized premium, a situation known as contango, which is not unique to crypto markets.

Related: Bitcoin ‘Mega Whales’ Send BTC Price To $30,000 As Volatility Hits Crypto

The chart shows that traders have been neutral to bearish for the past two weeks as the basic indicator ranged from 2.4% to 4.3%. This data should come as no surprise given that the Bitcoin price remains 56% below its all-time high of $69,000.

Bitcoin margin and futures markets reflect neutral to bearish sentiment, but nothing exaggerated. The reduction in demand from the bullish strategies is likely to reflect the 50% gains in the price of Bitcoin since March 11.

However, investors fear that regulatory action could dampen demand from retail and institutional clients, so unless there is more clarity on that front, the chances of Bitcoin breaking above $31,000 remain slim.

The views, thoughts, and opinions expressed herein are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.