Many of the gold bug values overlap with Bitcoin, but they dismiss BTC without understanding the superiority of their digital ledger.

This is an opinion editorial by Luke Groom, civil engineer, JD-MBA student, and part-time strategy associate at Marathon Digital Holdings.

In recent years, Jordan Peterson has been plunging down the sound money rabbit hole, and for me it has been a pleasure to see it from a distance. Many of the values he espouses align with the values Bitcoin fosters, such as personal responsibility and truth-seeking, so it was only a matter of time before he became interested in Bitcoin.

has spoken with Saefidean Ammus and Robert BreedLove in recent years and, even as not Bitcoin per se, wowed the audience at the Bitcoin conference in Miami in 2022. A most recent conversation with Roy Sebag He was also fun to listen to, although he did illustrate to me the need to discuss the differences between gold and bitcoin, not just their properties as units of currency, but also the properties of their ledgers.

Surely gold bugs like Sebag and Peter Schiff shares many beliefs with Bitcoiners. I respect them and their work. There is a lot of overlap in the problems and solutions that both gold diggers and Bitcoiners address. But the arguments in favor of bitcoin as a superior unit of account have been widely discussed.

The fact that gold has other tangible uses is not relevant to global money

Sebag and Schiff argue that gold is valuable in part because it has other uses, such as mobile phone parts and dentistry, while Bitcoin has no other uses. This is true; however, I’m not sure how this is relevant.

Why do we need our money to have other characteristics besides being money? Where is that written? If the monetary premium of gold were to disappear and it was only used for its other tangible purposes, the price of gold would completely collapse. Also, if gold were to become the global unit of account as gold fanatics want, gold would be used even less for non-monetary purposes due to cost constraints. Your money premium would increase, thus weakening your own argument about having other valuable uses.

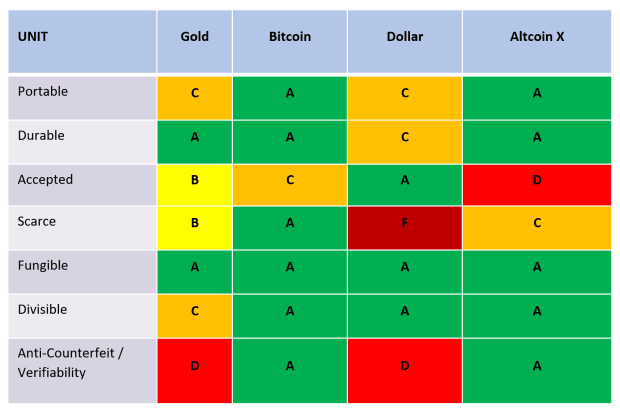

A monetary unit just needs to have good monetary properties and interact well with your ledger. As the the generally accepted properties of money dictatean ideal currency unit would be portable, durable, accepted, scarce, fungible, divisible, and resistant to counterfeiting.

As a unit, bitcoin equals or exceeds gold in all of these characteristics, with the exception of acceptability. (The market capitalization of gold is still about 20 times that of Bitcoin, which means that it is even more widely accepted). However, talking about units is only a fraction of the conversation. We must also look at the ledger.

Bitcoin Ledger Is Superior

Our modern society requires the use of ledgers to conduct money transactions. Moving physical dollars or physical gold around the world is simply too expensive, dangerous, and logistically challenging. Instead, we rely on the ledgers of credit card companies, banks, and central banks to facilitate the “movement” of money. Our entire system, except for the relatively few physical dollars that exist, is a fully ledger-based money system.

Because ledgers have become necessary in modern commerce, and because no one is advocating a return to a society in which all commerce is conducted exclusively through face-to-face money exchanges, when analyzing systems monetary, we shouldn’t just look at the units in our ledgers. but also the accounting books themselves. Bitcoin’s properties as a ledger are what make it a monetary system far superior to anything in existence.

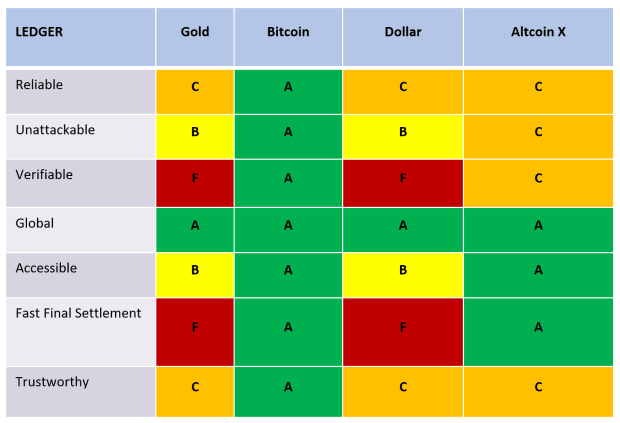

If we were to think of the properties that make up an ideal ledger, they would be: reliable, unassailable, verifiable, global, accessible, trustworthy, and capable of providing quick final settlement. While gold’s money strengths versus bitcoin’s were relatively similar when considering the units behind the ledger, when comparing the ledgers themselves, Bitcoin is far superior.

From a currency unit perspective, bitcoiners and gold fans agree that a gold-based system could encourage monetary responsibility and limit inflation. However, gold bugs have not provided any frequent suggestions for improving the US dollar accounting system. That current system is flawed in that it is not human verifiable, inaccessible for people to directly interact with, and slow to process final settlement. How would a gold-based ledger be better?

Furthermore, gold lovers have not provided any meaningful suggestions on how to avoid degradation problems, which have been a constant for centuries.

We have already done the experiment of a gold-based ledger for the last 800 years. He Medici family popularized gold-backed ledger-based banking in Italy and throughout Europe as early as the 12th and 13th centuries. Europeans, in effect, used ledgers to “transfer” their gold over great distances. People and governments continued to use the gold-backed overlay book system for centuries and each of those countries saw a corruption of the ledger, the failure of its currency, or the gold degradation. So what mechanisms do the gold bugs suggest to prevent corruption and degradation of a gold-based ledger in the future? I haven’t heard any.

Bitcoin is beautiful because it provides an elegant solution to both unity and the ledger. The unit provides all the characteristics of sound money and the ledger is reliable, unassailable, verifiable, global, accessible, provides fast final settlement, and is trustworthy. One person can personally interact with the ledger and provide a global verified final settlement in a matter of minutes on a ledger that does not require a trusted intermediary.

I have a lot of respect for gold bugs, and even have a modest amount of gold. With that respect in mind, I ask Peterson, Sebag, Schiff, and the other gold lovers to look at both the unit and the ledger when comparing monetary systems, and then come to their own conclusions.

This is a guest post by Luke Groom. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.