Bitcoin (BTC) continues to tread water at the Wall Street open on April 10, but crypto market participants are betting on a serious breakout below.

After a late rise sent BTC/USD to its highest weekly close since June 2022, there is new optimism about a push to $30,000.

Data from Cointelegraph Markets Pro and TradingView shows a good start to the macro trading week, with $28,200 currently forming a focus.

However, with formidable resistance overhead, Bitcoin has spent much of the last week in a firmly established but ever narrowing trading range.

The longer this holds, according to the theory, the more intense the eventual breakout should be, either higher or lower.

Cointelegraph takes a look at the perspectives of some popular analysts in regards to what BTC price action will do next.

Material Indicators: Will Bitcoin “Bop or Crash”?

Order book data plays a key role in determining lightning price movements, and the latest figures from Binance warn of volatility ahead.

A snapshot uploaded to Twitter by tracking the Resource Material Indicators shows that both buy-side and sell-side liquidity are being washed out of the spot price near lower and higher levels, respectively.

This, in turn, gives the market room for more erratic moves within its range, increasing the potential for a more substantial trend break.

“It’s going to be an interesting week. FireCharts shows that the paths to volatility are clearing in both directions. The question is, will BTC explode or fall after all this chopping? material indicators commented.

“This week’s CPI and PPI reports could be catalysts, but so is liquidity, as we saw yesterday before the W candle closed.”

Credible Crypto: BTC Price Copy 2020 Breakout

For the popular Credible Crypto trader, Bitcoin is recreating a bullish preparatory structure just before breaking its old all-time high of $20,000 in late 2020.

$26,000-$29,000 today is “incredibly similar” in terms of price action to the $8,000-$10,000 range in the summer of that year, he argues.

In a perfect world, BTC/USD would fall to around $27,500 to consolidate that area as support before a bullish surge, the accompanying chart illustrates.

As Cointelegraph reported, Credible Crypto is not the only market participant seeing similarities to Bitcoin bull runs of yesteryear, with 2019 also forming a focus.

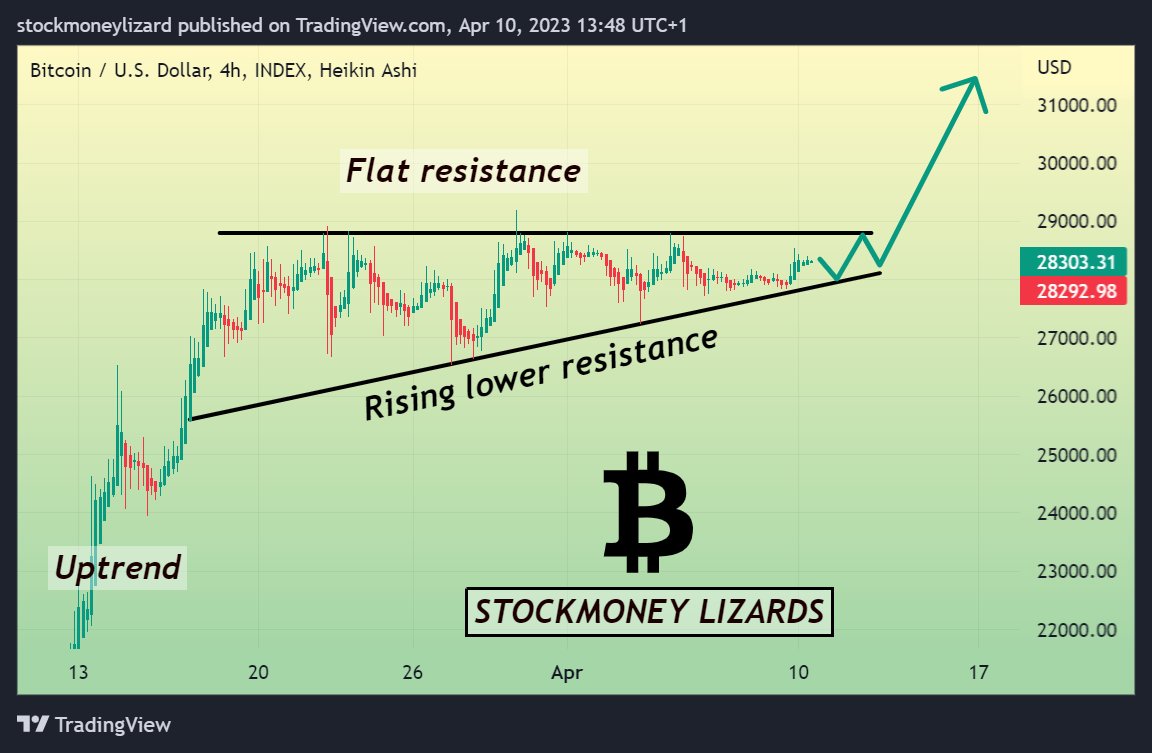

Stockmoney Lizards: “Decision Point” for Bitcoin

Meanwhile, financial information resource Stockmoney Lizards believes the overwhelmingly likely outcome of the current range period is “up.”

Related: IPC Will Cause a Dollar ‘Slaughter’: 5 Things to Know About Bitcoin This Week

In his latest graphical prediction, highlighted BTC/USD making a series of higher lows while retaining the same resistance cloud near $30,000.

This, he believes, will result in the bulls winning, as Bitcoin reaches a “decision point.”

Analysis released the same day reinforces the idea that if a resistance level “has been tested x times and not broken, it may be a sign that the level is weakening and is more likely to be broken.”

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.