How to estimate ROI in Forex?

ROI in Forex is a basic concept that you need to understand when entering the trading and business world.

Trading is a popular investment activity, given the ease of access to financial markets offered by forex brokers and binary options brokers.

This activity leaves you dreaming since speculating in the financial markets is open to everyone, it does not require a significant economic investment and only requires a computer connected to the Internet.

Thanks to brokers, it is possible to earn money by investing from home. But before you start, you need basic knowledge. Here we are talking about ROI in Forex, in case you want to start trading foreign currencies.

In addition, we will go over the general meaning of ROI, as well as the different calculation formulas you can find depending on the elements of the equation.

Return on investment: general definition

It is a metric that allows measuring and comparing the Return on investment based on the calculation: ratio of the benefits of the investment / cost of the investment.

ROI is a critical financial indicator for comparing various investments, not just Forex or stocks. This metric takes into account the amounts invested and the capital investment that has been lost or gained.

Although the time parameter does not appear obviously in the formula, the amounts won or lost are considered over a yearly period. We speak then of Annual Returns.

Also the Return on investment is an essential indicator to choose between several projects and determine which one will bring more money compared to the initial sums invested.

ROI is a basic measure of profitability and profitability in any business. It is also part of good money management in the investment industry, as it tells the investor how well the investment will perform over a given period.

The objective of Return on Investment is to know if an investment is efficient and profitable. It is true that in the more or less short term, an investment must be a source of profit for it to be profitable. However, we are going to explain what its other features are and what they are for.

How to Calculate ROI in Forex

The basic ROI calculation formula is quite simple. The following equation is the basic ROI calculation

ROI = (Present Value – Total Cost) / Total Cost

Furthermore, it can be written as follows:

ROI = Net Benefit / Net Cost

Therefore, the return on investment in Forex will be like in any other business ROI = (Investment profit – Acquisition cost) / Investment cost.

The limitation of the formula lies in the various parts of the equation. There are many variations regarding the ways to calculate ROI. The Return on Investment calculation will give you different results depending on how you define investment cost and profit, profit and loss.

The return on investment can be calculated as a final value but also as a simple profit projection. The latter is known as the Expected Return on Investment.

Limitations of ROI Analysis of Return on Investment

ROI is the profitability ratio that helps you in making investment decisions when it comes to trading Forex or any other business. So you should not ignore that it has its limits. As we already mentioned, the limitation of the ROI calculation can be a variety of elements that your equation can include.

The time horizon of the investment is a critical factor and the ROI calculation does not take it into account. The result of the calculation could be, say, 20% of the profit, but it could be in two years in six months. Therefore, it should be used in conjunction with other profitability calculations and measures.

These calculations may include the Internal Rate of Return (IRR), the NPV of the current net value, the Internal Rate of Return (IRR), the Return on Equity (ROE) and the Return on Assets (ROA).

ROI Variations

There are several methods that companies use to calculate ROI. These are total, annual, and percentage returns. Total return is the total investment produced, including all forms of income, such as capital gains, dividends, and interest income.

It usually ranges from a couple of months to decades. Percentage Yield gives you information about measuring the return on investment compared to the amount originally invested.

The equation here would be: Total return divided by the initial invested capital and multiplied by 100. It is a vital metric that can show you how effective your strategy is in trading.

Finally, the annual Return would be the Return of the investment that considers the periods of time and percentage of return. The calculation formula would be the following: Annual Return = (Simple Return Percentage +1) (1 / Number of Years Held). It is useful for long-term investors.

How to calculate an annual ROI with stock prices?

ROI = (benefit of the investment – the cost of acquisition) / Cost of investment. For dividends, the calculation would be Simple Dividend Adjusted Yield = (Current Stock Price-Dividend Adjusted Stock Purchase Price) / Dividend Adjusted Stock Purchase Price.

What is the realistic return on investment in Forex?

Every trader dreams at one time or another of investing their money and becoming a trading millionaire. The reality is that this dream is highly unlikely to happen if the trader’s initial investment in his trading account is low.

However, we must not lose hope. After a small deposit of money, a trader may well accumulate profits for several years and transform his small trading account into a large account that will produce large profits.

Keep in mind that many beginning retail traders and investors think differently. They are often tempted by high leverage and take reckless risks in the hope of achieving outrageous investment returns of around 500-1000%, not realizing that professional fund managers and traders often achieve a return on investment of 15% to 20% per year on portfolios of several hundred thousand dollars or more.

Becoming a profitable trader depends on many factors, and only over time will you succeed. You can make a lot of money trading, but it won’t happen overnight, stop believing the Forex myths!

Trading forex or binary options may seem relatively easy, but have realistic expectations. Aim for consistent earnings, say a 5% return on investment per month and not 100% or 200%, which means you expect to double or triple your trading account.

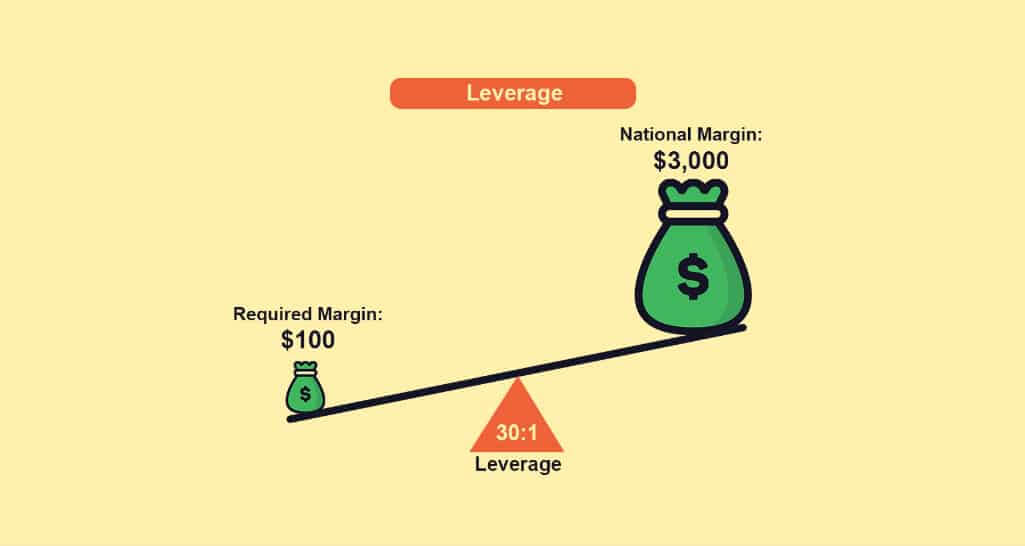

Does leverage increase ROI in Forex?

The answer is yes. Using leverage will increase your ROI in Forex. However, be careful with the various aspects of leverage.

Leverage offers high returns on investment, but unfortunately, the high risks that this also entails should not be ignored! Many traders do not control their investments properly as they do not want to see the risks of leverage but only its benefits. Traders should not risk more than 2% per trade, but often allocate up to 10-20% of their capital per trade and add leverage of 1:400 or more, taking reckless risk. Usually it leads to his downfall.

How much ROI on Forex investors should expect?

The realistic ROI in Forex is generally considered to be around 1-10% per month. But you should know that there are traders who lose money instead of making a profit since, as in any business, trading income cannot be constant.

As a merchant, you may experience some reductions. The amount you can earn on Forex depends on many factors. First, the initial business capital is very important. Also, having an efficient trading system also has a big impact. Also, you need to control your emotions and stick to a trading system that works with discipline. Finally, you need to have a great focus to achieve a decent ROI in Forex.

How to increase your ROI in Forex?

Successful traders in the forex market strategize in advance on how to enter the market. Without such a plan, trading amounts to arbitrarily guessing what the market is going to do.

In the forex market, various techniques are used to facilitate trading. These techniques help traders identify reliable additional gains in the forex market. Here are the strategies used by the most profitable traders.

- The London Breakout Strategy

- The Exponential Moving Average Crossover Strategy

- Gann’s trend following technique

- The support and resistance strategy.

- The “Bollinger Bounce” Strategy

- The “Bollinger Breakout” Strategy

The best combination of high profitability and low investment risk

CDFS, Stocks, Fixed Annuities, and Utility Stocks offer the best combination of high return and low risk. Stocks are generally high-return, high-risk investments. Bonds are, on the other hand, low yield and low risk. In short, both could be risky investments, but the average stock investment could be more complex compared to the average mutual fund investment.

In conclusion

In general, ROI in Forex provides important information

or in terms of the effectiveness of the negotiation over time. It helps traders to better shape their strategies to avoid negative ROI, implement investments in different asset classes. Once you understand trading principles, you can make smart decisions about when to place your funds to increase returns and decrease risk.

Frequently asked questions about ROI in Forex

What is the return on investment in trading?

It is a metric that allows measuring and comparing the Return on investment based on the calculation: ratio of the benefits of the investment / cost of the investment.

What is ROI in Forex?

ROI in Forex is a basic measure of profitability and profitability. It is also part of good capital management in the investment sector.

How to calculate ROI?

There are many ways to calculate ROI. The most common is the net profit divided by the total cost of the investment or ROI = Net profit / Cost of the investment x 100.

What are the limitations of ROI analysis?

The time horizon of the investment is a critical factor and the ROI calculation does not take it into account. The result of the calculation could be, say, 20% of the profit, but it could be in two years in six months.

What is the realistic return on investment in Forex?

Aim for consistent earnings, say a 5% return on investment per month and not 100% or 200%, which means you expect to double or triple your trading account.

Does leverage increase ROI in Forex?

The answer is yes. Using leverage will increase your ROI in Forex. However, beware of the negative and risky aspects of leverage.

The post How to estimate ROI in Forex? first appeared on FinanceBrokerage.