With a week to go until the Ethereum Shanghai and Capella updates on April 12, all eyes are on Ether (ETH). The second-largest cryptocurrency by market cap shrugged off rumors and regulatory action against exchanges to hit a seven-month high of $1,922 on April 5.

The ether price has momentum, and here are three strong reasons why.

Multiple positive price achievements

According to data from Cointelegraph Markets Pro and TradingView, the Ether price has posted gains on the seven-day, one-month, and three-month timeframes despite market volatility. Ether price gains are also notable from a year-to-date perspective, showing 59% growth.

Ether’s ability to break through resistance levels is leading some analysts to believe that a $3,000 price target is on the horizon in Q2 2023. The trend shows whale accumulation remains strong, growing 0 .5% in March, according to data from analytics provider Santiment.

The bullish buying activity may prove the on-chain data correct that the selling pressure on Ether after the Shanghai hard fork will not be an event.

Related: US Enforcement Agencies Are Increasing Pressure on Crypto-Related Crimes

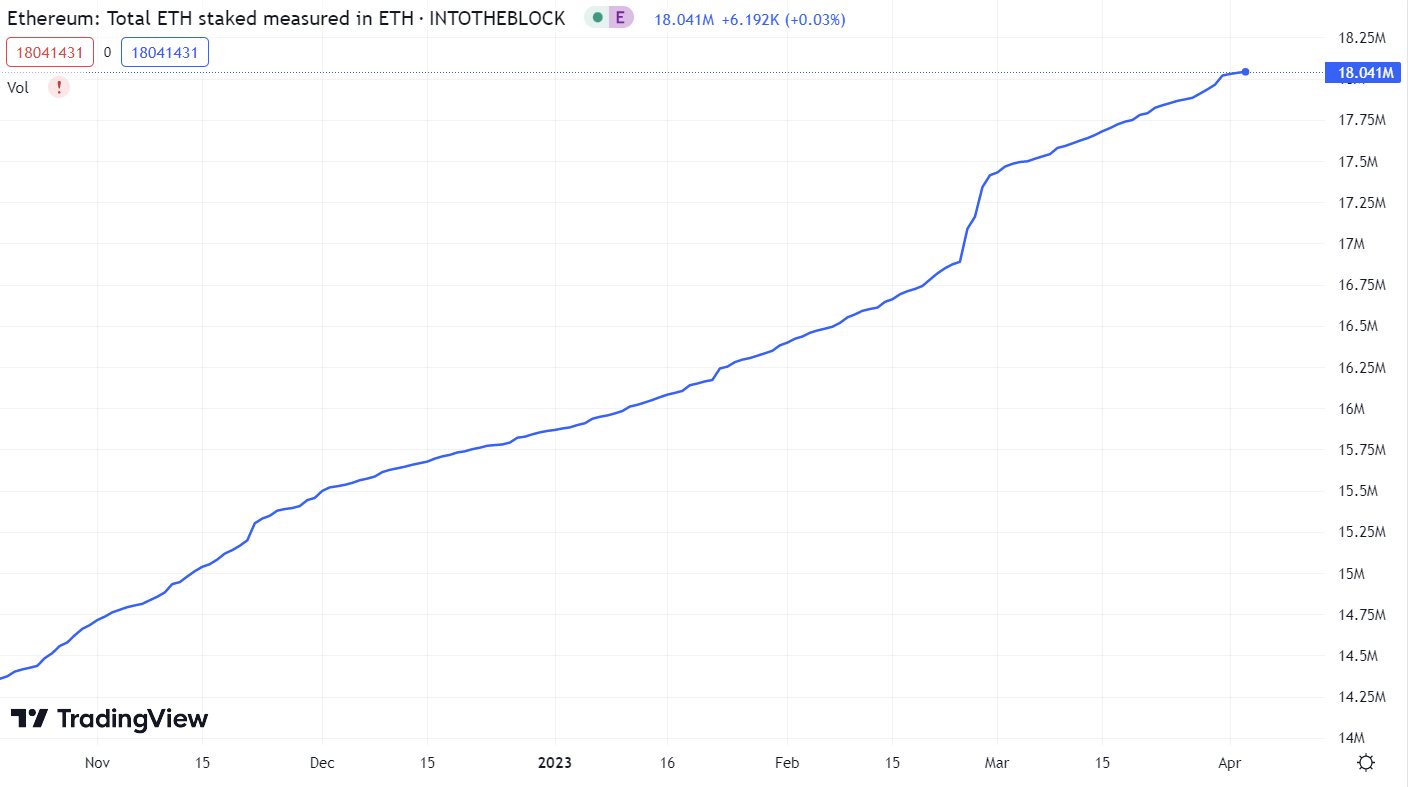

The increase in proof-of-stake validation when placing Ether in staking contracts is bullish for the Ethereum ecosystem. Since its launch on August 4, 2021, the Ethereum network has seen more than 18 million ETH staked on the blockchain.

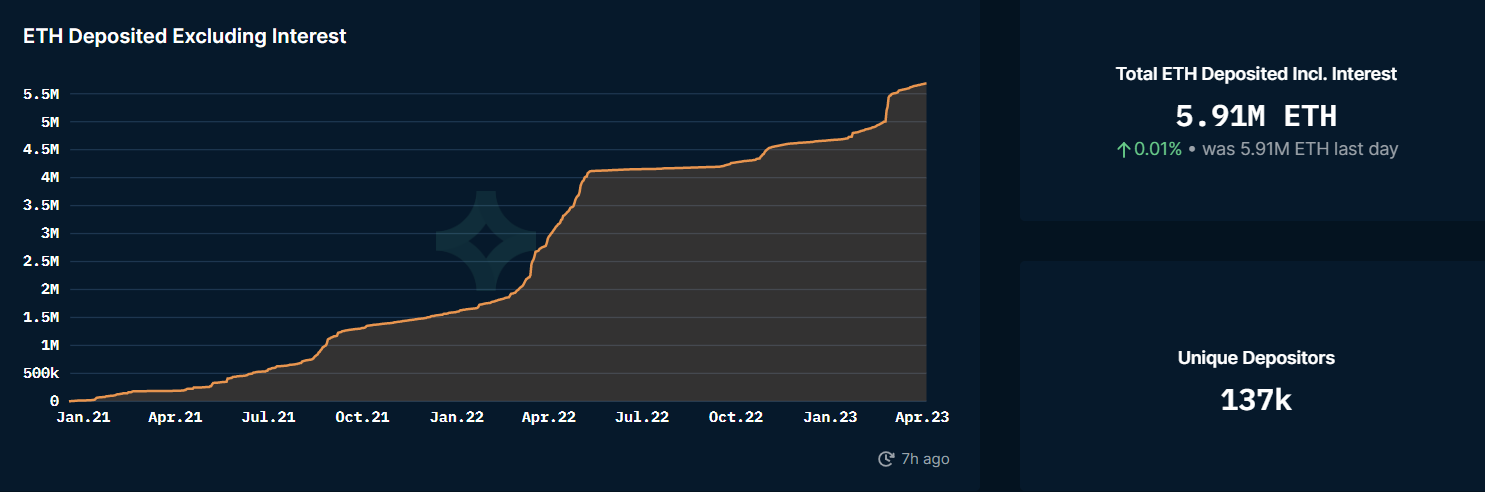

The advent of liquid staking derivatives has lowered the barrier to entry for participating in Ether staking. Lido, the leader in LSD and the largest single entity by value, has close to a third of all EtTH staked. Including the interest received, the Lido contracts have 5.9 million ETH from 137,000 unique depositors.

The Ethereum TVL network emerges

The total value locked on the Ethereum network is also increasing, partly as a result of the Lido protocol comprising 22.4% of the TVL on the Ethereum network. Despite the fact that the TVL began to fall on March 10 due to regulatory and macroeconomic hurdles, the decentralized financial market appears to be on the mend.

Related: 3 Key Ethereum Price Metrics Cast Doubts on the Strength of ETH’s Recent Rally

On April 5, TVL hit $50.8 billion, nearly hitting the yearly high of $51.4 billion on February 21.

Ether price strength ahead of the Shanghai and Capella updates is visible on-chain through increased usage, whale accumulation, and a steady increase in stakes. With only seven days left until the update, traders expect continued volatility in the Ether price.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.