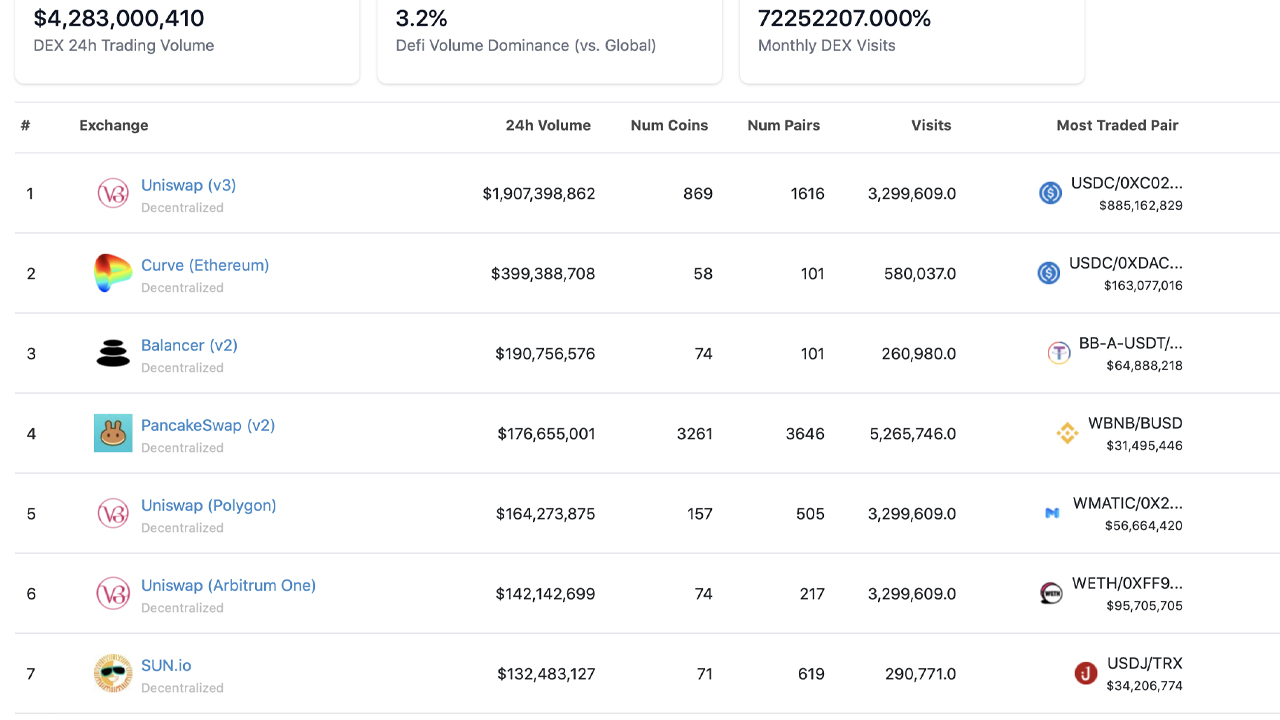

According to statistics, monthly decentralized exchange (dex) trading volumes have decreased significantly since January 2022. After a brief spike in volume in November 2022, dex trading volumes have been lackluster for the past 44 days . As of January 14, 2023, Uniswap version three (V3) has the highest trade volume over the last 24 hours at $1.9bn and the second highest Total Value Locked (TVL) at $3.57bn. Metrics show that Curve has the second largest trade volume on Saturday with $399 million in 24 hours and the highest TVL in terms of assets locked on dex platforms, with $4.19 billion locked.

Uniswap V3 dominates Dex trading as decentralized exchange volumes hold steady

After the first two weeks of January 2023 and as of January 13, 2023, the metrics indicate that there has been $15.33 billion in global swaps settled between decentralized exchange (dex) platforms. Last month, dex protocols saw roughly $43.65 billion in swaps, which means that for the first two weeks of the new year, 35.12% of last month’s volume was hit.

With the recent rise in the global cryptocurrency market prices, which increased by 6.24% in the last 24 hours, the volume of dex trading has increased in recent days. Uniswap V3 has captured the most volume over the past 24 hours with $1.9 billion in swaps.

Uniswap is followed by Curve ($399 million), Balancer ($190 million), Pancakeswap ($176 million), Uniswap Polygon ($164 million), Uniswap Arbitrum ($142 million), Sun.io ($132 million), Uniswap V2 ($91 million) and Uniswap Optimism ($77 million).

It is worth noting that the top five smart contract platform tokens have captured double-digit gains over the past week. Ethereum jumped 20.6%, Binance Coin (bnb) rose 16.6%, Cardano rose 25.4%, Polygon rose 23.2%, and Solana jumped 68.5% against the US dollar over the past seven days.

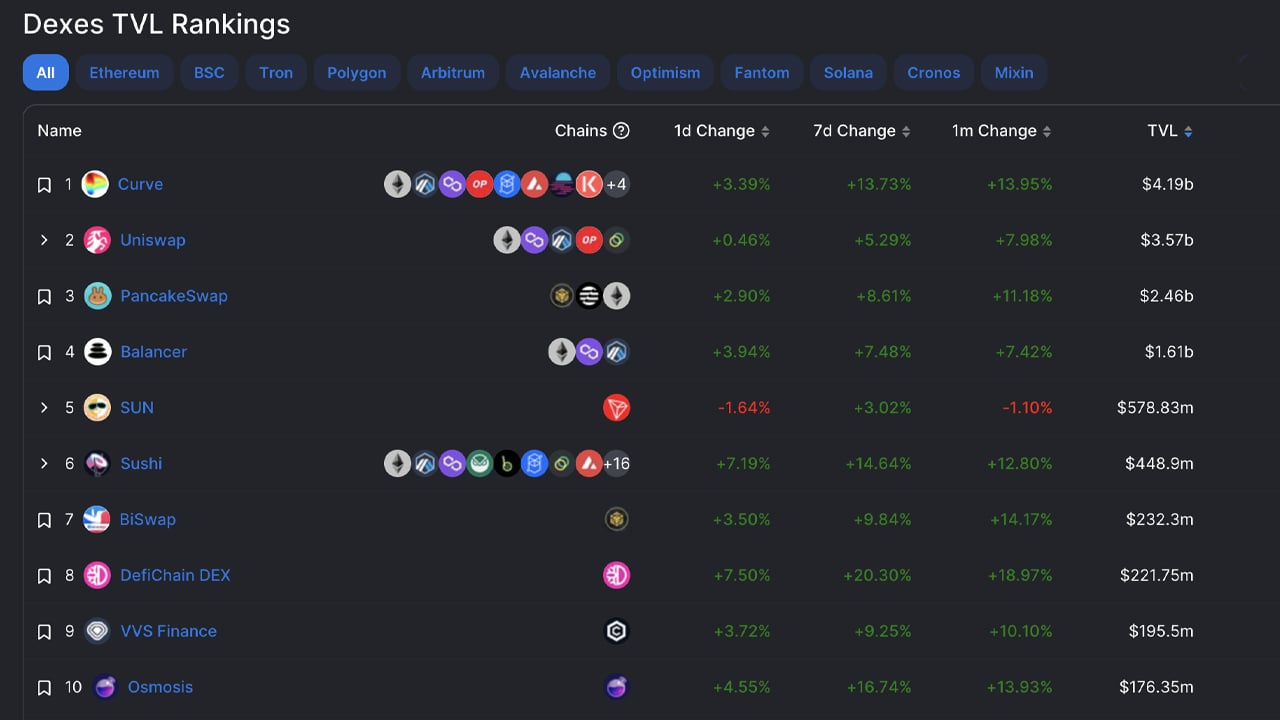

The entire smart contract platform coin economy has gained 8.5% against the US dollar in 24 hours. The data also shows that dex Curve is the top decentralized financial exchange with the highest total value locked as of Saturday afternoon at 3:00 PM ET.

As of this writing, Curve commands a $4.19 billion Total Value Locked (TVL) and Uniswap is just below the protocol at $3.57 billion. Curve and Uniswap are followed by Pancakeswap ($2.46 billion), Balancer ($1.61 billion), Sun.io ($578.83 million), Sushi ($448.9 million), and Biswap ($232.3 million).

Of the 671 dex platforms or protocols that allow a user to trade or trade cryptocurrencies, there is a total of $17.4 billion worth locked up among decentralized finance (defi) protocols. Non-custodial exchanges have become a mainstay in the world of crypto assets by allowing users to trade tokens without the need for a middleman.

While dex platforms have seen trading volumes decline, centralized spot market exchanges have also seen volumes slide During the last months. The crypto winter has taken no prisoners when it comes to centralized and decentralized exchange trading volumes, and December 2022 was especially disappointing.

What does the future hold for dex platforms in the ever-evolving world of cryptocurrency trading? Share your thoughts in the comments below.

image credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or a solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service or company. bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.