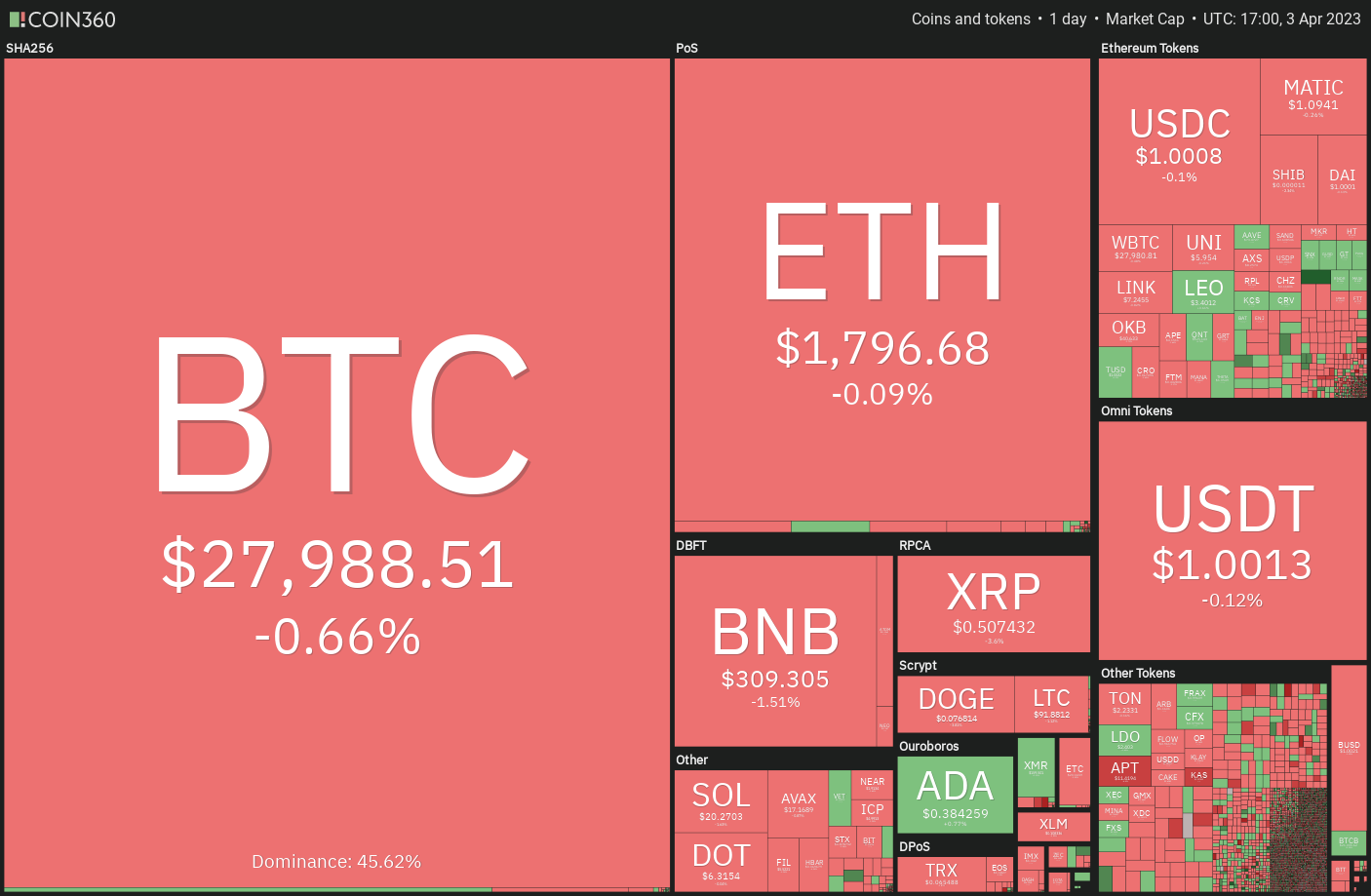

Macroeconomic headwinds continue to pressure the crypto market, but bulls appear adamant in holding $28,000 as support and this could provide tailwinds for altcoins.

Bitcoin (BTC) price initially fell but then rallied on April 3. The volatility came after several OPEC+ members announced plans to cut oil production by a total of 1.65 million barrels per day through the end of the year. Some analysts expect this move to reduce supply, which will result in higher prices at the pump. That, in turn, can boost inflation, justifying continued hawkish stance by central banks.

Initially, the US Dollar Index (DXY) rose but was unable to sustain the intraday rally. This suggests that market participants believe that the event will not cause any major deviation in Federal Reserve policy. A weaker DXY is generally considered positive for risk assets.

Cryptocurrencies have held strong in the face of adverse macroeconomic news and regulatory actions against cryptocurrency companies in recent days. When the price of an asset does not break on negative news, it shows that traders are not panicking and selling their assets.

Could Bitcoin break the $30,000 hurdle and start a bull run? Will altcoins join the party too? Let’s study the graphs to find out.

S&P 500 Index Price Analysis

The S&P 500 Index (SPX) gained momentum after breaking out of the wedge pattern. The buyers will try to push the price up to 4,200, which is likely to act as a strong barrier.

If the price turns below 4,200 but bounces off the 20-day exponential moving average (4,002), it will suggest that sentiment has turned bullish. That could increase the possibility of a break above the 4200-4325 resistance zone.

Rather, the bears will try to protect the upper resistance zone and push the index below the moving averages. If they do, several aggressive bulls can get trapped. The index can then collapse to the crucial support at 3,764.

US Dollar Index Price Analysis

The US Dollar Index broke below the 20-day EMA (103) on March 17, indicating that the rally is fading.

The buyers tried to push the price above the 20 day EMA on April 3, but the long wick of the candle shows that the bears did not budge. The bears will try to further strengthen their position by taking the price to the horizontal support of $100.82.

On the other hand, the bulls will try to push the price above the 20 day EMA. If they manage to do that, the index could rally to the 200-day SMA (106). The bears are expected to mount a strong defense at this level.

Bitcoin Price Analysis

The bears could not even push Bitcoin to the 20-day EMA ($27,105) on April 3, which suggests that the bulls are buying the intra-day dips.

The rising 20 day EMA and the RSI in the positive zone indicate that the bulls are in control. Buyers will try to clear the overhead hurdle at $29,185. If they can pull it off, the BTC/USDT pair could rally to $30,000.

This level could see strong defense from the bears, but the possibility of a break above remains high. Then the pair can gradually move up to $32,500.

If the bears want to stop the move higher, they will have to pull the price below the 20 day EMA. If they do, several short-term traders may rush out. That could drag the price down to the breakout level of $25,250.

Ether Price Analysis

Ether (ETH) once again turned up from the 20-day EMA ($1,753) on April 3, indicating that the sentiment is positive and traders are buying on dips.

The vital level to watch upside is $1,857. If the buyers clear this hurdle, the ETH/USDT pair is likely to pick up momentum. The $2,000 level can act as strong resistance, but it is likely to be crossed. The pair may then attempt a rally to $2,200. This level is likely to attract heavy selling from the bears.

The first major support on the downside is the 20 day EMA. If this level is broken, the pair can fall to $1,680. A break and close below this support can tip the advantage in favor of the bears.

BNB Price Analysis

The bulls tried to push BNB (BNB) above the downtrend line, but the bears held their ground. This suggests that the bears are selling on every minor rally.

The 20-day EMA ($315) is flat and the RSI is just below the midpoint, indicating a balance between supply and demand. This balance will tilt in favor of the bears if the price falls below $306. The BNB/USDT pair could dip as far as the 200-day SMA ($290).

Alternatively, if the price rises above $318, it will suggest that the lower levels continue to attract buyers. Then the pair can jump to the upper resistance zone between $338 and $346.

XRP Price Analysis

Buyers are trying to stop XRP (XRP)’s correction near the 38.2% Fibonacci retracement level of $0.49, while bears try to sink the price below it.

If the price rises from the current level, it will improve the prospects for a rally above the $0.56 to $0.58 overhead resistance zone. There is minor resistance at $0.65 but it is likely to be crossed. The XRP/USDT pair could move towards $0.80.

Conversely, if the price continues lower and falls below $0.49, it will suggest that short-term traders may be taking profits. Next, the pair could turn down to the 20-day EMA ($0.46). This is an important level for the bulls to defend because a break below can sink the pair to $0.43.

Cardano Price Analysis

Cardano (ADA) rallied from the 20-day EMA ($0.36) on April 3, signaling a shift in sentiment from selling on rallies to buying on dips.

The rising 20-day EMA and the RSI in the positive zone increase the probability of a break above the neckline. If that happens, the reverse H&S pattern will be completed. The ADA/USDT pair could signal the start of a new uptrend. The pattern target of this reversal setup is $0.60.

If the bears want to avoid the move higher, they will have to push the price below the 200-day SMA ($0.35). If they do, the pair may drop to $0.30.

Related: Bitcoin liquidity falls to a 10-month low amid US bank run.

Polygon Price Analysis

Polygon (MATIC) has been holding on to the 20-day EMA ($1.11) for the past few days, indicating that every minor dip is being bought.

The 20 day EMA is flattening out and the RSI is just below the midpoint, which indicates that the selling pressure is easing. If the buyers push the price above the $1.15 resistance, the MATIC/USDT pair could rally to the upper resistance zone between $1.25 and $1.30.

Conversely, if the bulls fail to hold the price above the 20-day EMA, it will suggest that the bears are fiercely defending the level. The sellers will have to sink the price below the 200-day SMA ($0.97) to regain control.

Dogecoin Price Analysis

Dogecoin (DOGE) broke above the 200-day SMA ($0.08) on April 1, but the bulls were unable to hold the higher levels. The bears sold aggressively and pushed the price below the 200-day SMA on April 2.

One minor positive for the bulls is that the DOGE/USDT pair has not broken below the 20-day EMA ($0.07). This suggests that the lower levels continue to attract buyers. If the price bounces off the 20-day EMA, the bulls will try again to push and hold the price above the 200-day SMA. If they succeed, the pair could rally to $0.10 and then $0.11.

This positive view could be invalidated in the short term if the price turns down and breaks below the crucial support at $0.07. Next, the pair can plummet to the support near $0.06.

Solana Price Analysis

Solana (SOL) continues to trade near the 20-day EMA ($20.83), which indicates that both the bulls and the bears are not making big bets.

Generally, periods of low volatility are followed by a spike in volatility, but it is difficult to predict with certainty the direction of the breakout. Therefore, it is better to wait for the price to make a decisive move before establishing trading positions.

If the price breaks out of the downtrend line, the SOL/USDT pair could quickly rally to $27 and then rally to $39. Instead, if the price turns down and falls below $18.70, the pair can drop to $15.28 and then $12.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.