Ethereum’s native token Ether (ETH) is forecast to rise to $3,000 in Q2 2023 after closing the previous quarter with 55% gains.

ETH Price Nears Potential Breakout

The price of Ether has more than doubled after bottoming out in June 2022 at around $880, weathering a series of negative events, including the FTX currency market crash, interest rate hikes, and tighter US regulations.

In doing so, ETH/USD has painted an ascending triangle, confirmed by its rising trendline support and horizontal level resistance. The pattern suggests aggressive buying as the lows steadily rise while the highs hold at the same level, indicating further selling pressure at the given level.

As of April 2, ETH price is testing its horizontal level resistance range ($1,700-1,820) for a potential breakout move.

A breakout will be confirmed if the price closes above the resistance range while riding higher volumes. Also, the ascending triangle breakout target is measured with the length equal to the height of the triangle.

In other words, the bullish price target for ETH is in the range of $3,350-3,900, depending on where traders see the rising trend line support of the triangle, as shown at T1 and T2 on the chart above. This would suggest gains of 80% by June 2023.

Conversely, a pullback from the $1,700-1,820 range risks delaying the bullish setup and resulting in a broader price correction.

Ethereum Whale Accumulation Still Strong

From an on-chain perspective, Ether’s short-term and long-term trends appear skewed towards the bullish.

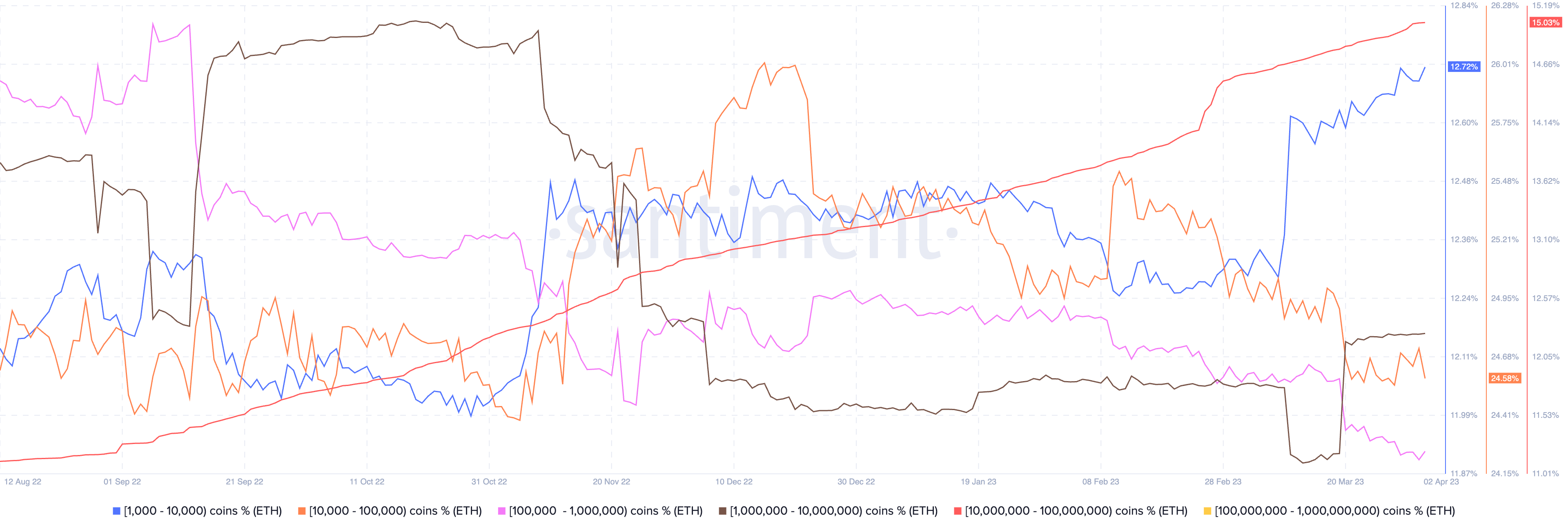

Most of the Ethereum whale cohorts have increased their accumulation of ETH in recent weeks, according to the latest data from Santiment. For example, the supply of Ether held by addresses with a balance of 1,000-10,000 ETH (blue in the chart below) has grown by 0.5% in March.

Similarly, the 1M-10M ETH (brown) and 10M-100M ETH balance cohorts have seen increases of 0.4% and 0.5%, respectively.

The growth came amid what appears to be absorbing selling pressure introduced by the 100,000-1M ETH (pink) and 10,000-100,000 ETH (orange) address cohorts.

At the same time, the growth could be attributed to the network’s proof-of-stake contracts, directly or through the use of third-party participants such as Lido DAO (LDO).

Net Ether deposited to the official Ethereum 2.0 address surpassed 18 million ETH after rising 3.5% in March.

Related: Analysts Debate ETH Price Results From Ethereum’s Upcoming Shapella Update

Deposits grew ahead of Ethereum’s Shanghai and Capella updates on April 12, which would allow participants to withdraw ETH from the PoS smart contract. Currently, this is not possible.

MVRV Z-Score: Ethreum Price Bottom Reversal

More bullish arguments stem from Ethereum’s MVRV Z-Score entering a stage that previously preceded long-term ETH price rallies.

The MVRV Z-Score assesses when Ethereum is overvalued and undervalued relative to its “fair value”. As a general rule of thumb, the MVRV Z-score indicates a market top (red zone) when market value rises above realized value, while the opposite indicates a market bottom (green zone).

Ether’s previous price rallies coincide with its MVRV Z-Score rebounding from the green zone, suggesting the same could happen in the next three months.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.