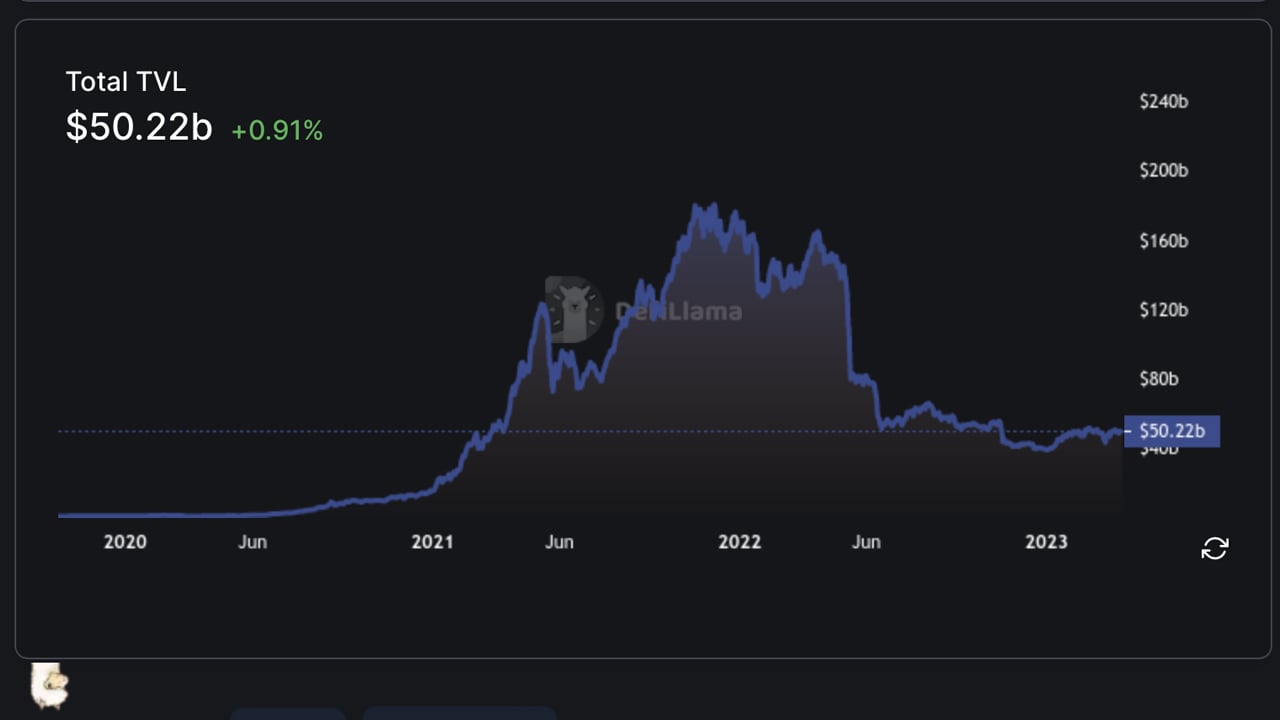

The total value locked (TVL) in decentralized finance (defi) during the first week of April is about $50 billion, roughly the same as March 1. The value locked fell to $42 billion on March 12, but has since rebounded as protocols like Lido Finance, Aave, and Justlend posted double-digit monthly gains.

After March 12 crash, value locked in decentralized finance recovers to $50 billion

According Statistics, the value locked in defi on April 2, 2023 is 50.220 million dollars, 0.91% more in the last 24 hours. The Lido Finance protocol mandates a TVL of around $10.94 billion as of Sunday. Lido dominates the $50 billion TVL at 21.77%, and the value locked in the protocol saw a 19.75% increase in March.

Makerdao’s TVL trails Lido’s by $7.7bn as it rose 9.66% last month. Aave’s TVL increased 16.94% to today’s $5.55 billion. Protocols that follow Lido, Makerdao, and Aave in TVL size include Curve, Uniswap, Convex Finance, JustLend, PancakeSwap, Coinbase Staked Ethereum, and Instadapp.

While Lido jumped more than 19% last month, Coinbase Staked Ethereum rose 22.29% and Rocketpool, another Ethereum (ETH) liquid staking protocol, saw its TVL increase by 18.47%. Other notable increases in terms of TVL on defi protocols include Liquity, up 27.12% in the last 30 days, and Bwatch, up 25.78%.

Of today’s $50 billion TVL, 58.6% of the value locked is in Ethereum. 10.69% is held on Tron, 10.15% is stored on Binance Smart Chain (BSC) and 4.4% is held on Arbitrum. Ethereum’s TVL is $29.39 billion, and Tron’s is currently $5.36 billion.

Ethereum and BSC TVLs were down in March, but Tron’s were up 2.8% and Arbitrum’s TVLs were up 13.93%. Notable gainers in March include Mixin (+16.32%), Defichain (+14.84%), and Kava (+18.52%).

Optimism’s TVL fell 9.68% in March, and Fantom’s fell 8.87%. Polygon and Avalanche also saw TVL reductions over the last 30 days. Ethereum has the most defi protocols at 720 while Tron only has 17. BSC has a total of 568 registered and Polygon has 399 defi protocols.

Statistics from Defillama show that Ethereum-based decentralized exchanges (dexes) have recorded a cumulative volume of $4.54 trillion. BSC has registered $1.46 billion and Avalanche has registered $215.220 million to date. Dex volume per chain is almost as high as it was in May 2022.

What do you think the future holds for value locked up in decentralized finance? Will we see continued growth or could there be another dip in the near future? Share your thoughts in the comments below.

image credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or a solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service or company. bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.