MF3d/iStock via Getty Images

The Select Industrial Sector (XLI) gained for the second week in a row and for the week ending March 31 rose (+4.41%). YTD XLI has risen +3.02%. Enovix led the winners, but this week’s list also included manufacturers of aerospace products. Meanwhile, earnings impacted some declines (in our segment).

The SPDR S&P 500 Trust ETF (SPY) also gained (+3.45%) helped, among other things, by a lack of recent news on the banking crisis and February personal spending data that could drive the case for the Federal Reserve to halt its rate-hike run. To date, SPY is +7.05%.

The top five gainers in the industrial sector (stocks with a market capitalization of more than $2 billion) earned more than +12% each this week. YTD, 3 of these 5 stocks are in the green.

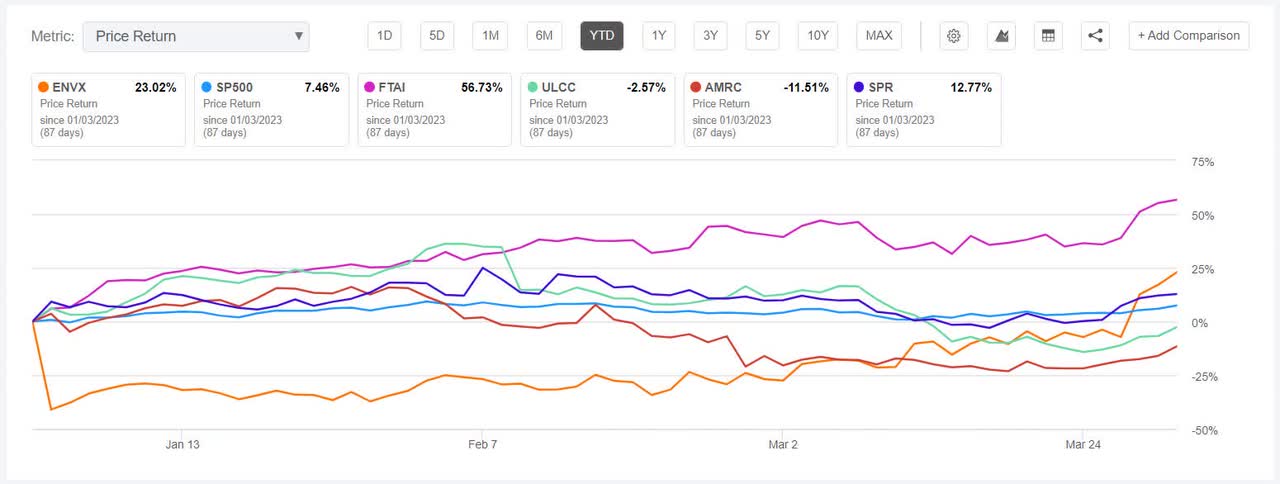

Enovix (NASDAQ:ENVX) +32.65%. Shares of the Fremont, California-based company rose on Wednesday (+21.44%) after he said Malaysia’s YBS International Berhad will likely take a financial stake in his manufacturing line at Fab-2.

ENVX has an SA Quant Rating, which takes into account factors such as Momentum, Profitability and Valuation, among others, of Hold. The stock has a factor rating of D for Profitability and C+ for Growth. The rating contrasts with the average Strong Buy rating from Wall Street analysts, in which 10 of 12 analysts view the stock as a Strong Buy. YTD +19.86%.

FTAI Aviation (FTAI) +14.83%. The New York-based company, which makes and leases aircraft products, saw its shares soar further this week on Wednesday (+8.76%). YTD, FTAI has risen +63.32%the most among this week’s top five earners for this period.

The SA Quant rating on FTAI is Buy with a score of A+ for Momentum and C+ for Valuation. The average Wall Street analyst rating is a Strong Buy, with 7 out of 10 analysts labeling the stock as such.

The chart below shows the YTD price-performance ratio of the top five gainers and SP500:

Border Group (ULCC) +13.63%. Shares of Frontier rallied throughout the week even as one of the first signs of a possible weakening in airline demand came on Monday.

The SA Quant rating on ULCC is Hold with a score of A for growth and C- for momentum. Wall Street analysts’ average rating differs with a Strong Buy, with 7 out of 12 analysts viewing the stock as a Strong Buy. THE LAST YEAR, -4.19%.

Ameresco (AMRC) +13.15%. The Framingham, Massachusetts-based provider of energy efficiency solutions also saw its shares rise throughout the week. However, YTD shares have fallen -13.86%, the most among this week’s top five earners for this period. The SA Quant rating on AMRC is a Sell, which is in stark contrast to the average Strong Buy rating from Wall Street analysts.

Spirit AeroSystems (SPR) +12.59%. The Wichita, Kansas-based company also saw green all week, with the most on Tuesday (+6.42%). YTD, the manufacturer of air defense products has skyrocketed +16.66%. The SA Quant rating on SPR is Hold, which differs from Wall Street analysts’ average Buy rating.

This week’s top five decliners among industrial stocks (market capitalization over $2 billion) lost more than -1% each. YTD, 2 of these 5 stocks are in the red.

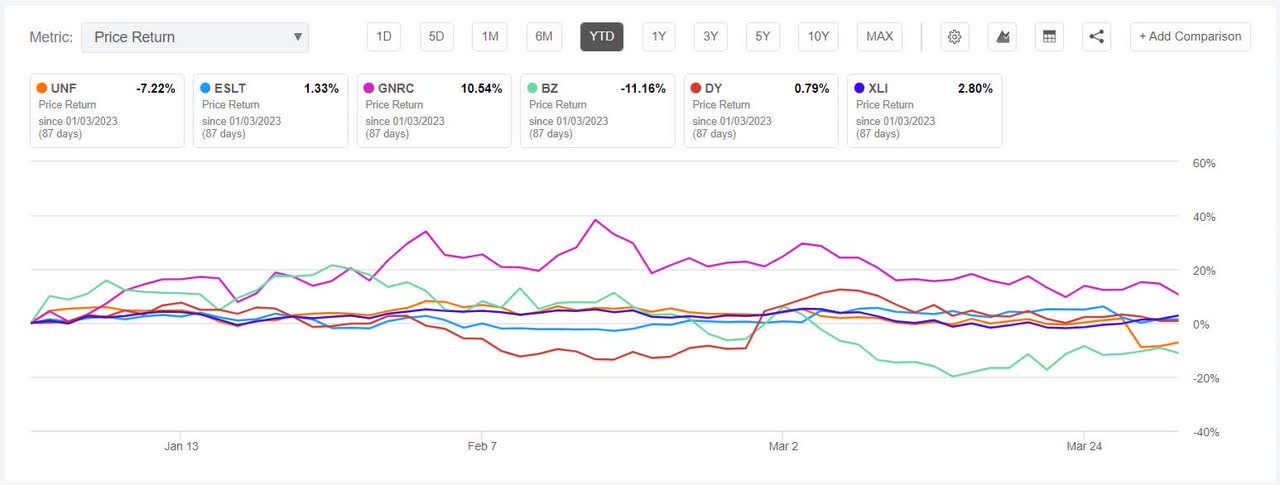

Unifirst (New York Stock Exchange: UNF) -7.45%. The company’s shares were affected on Wednesday (-10.42%) after the mixed results of the second quarter. The specialty apparel maker also provided a revised outlook for fiscal 2023.

The SA Quant rating on UNF is Hold with a score of C- for both profitability and growth. Wall Street’s average analyst rating is in line with a self-hold rating, in which 2 out of 4 analysts view the stock as such.

Elbit Systems (ESLT) -3.51%. Shares of the Israeli air defense company fell the most this week on Tuesday (-3.84%) after its fourth quarter results at a time when the country is experiencing protests over judicial reforms. However, YTD the stock is up +3.76%.

The SA Quant rating on ESLT is Hold, with a score of D- for Valuation and D+ for Momentum. The average Wall Street analyst rating is a Buy, with 1 in 3 analysts seeing the stock as a Strong Buy, while the other 2 see it as a Hold.

The chart below shows the YTD price-earnings performance of the five worst decliners and XLI:

The SA Quant Rating on GNRC is Sell, with a score of C for Profitability and D- Growth. The rating contrasts with the average Buy rating from Wall Street analysts, in which 8 of 27 analysts label the stock a Strong Buy. THE LAST YEAR, +7.30%.

Kanzhun (BZ) -2.86%. The Beijing-based online recruitment platform continued to show its volatility, as shares posted losses this week after being among the gainers the week before. The company’s stock had experienced such ups and downs throughout 2022. YTD, BZ is -6.58%.

The SA Quant rating on BZ is Hold, while Wall Street analysts’ average rating differs with a Strong Buy rating.

Dycom Industries (DY) -1.41%. The Florida-based company rounded up the five worst results of the week. However, YTD, the stock is still in the green (+0.05%). The SA Quant rating on DY is a Buy, while the average Wall Street analyst rating is a Strong Buy.