Vitaly Sova

Bitcoin (BTC-USD) is on track for the week gains of more than 3.5%with the world’s largest cryptocurrency by market cap briefly crossing the $29K mark earlier in the week to hit its highest level since June last year.

The advance has been due to a combination of factors, among which a renewed interest among investors in risk assets and growth areas such as technology shares stands out after the loss of confidence in the traditional banking sector. Hopes that the Federal Reserve will possibly end its rate hike cycle have also helped sentiment.

However, bitcoin (BTC-USD) started the week on a negative note, as regulators continued to crack down on cryptocurrencies and exchanges. The most recent target was Binance, with the world’s largest crypto exchange and its co-founder and CEO Changpeng “CZ” Zhao being sued by the Commodity Futures Trading Commission over allegations of violating certain trading rules. and derivatives.

“It is impossible to ignore crypto right now given the way it has traded during the mini-banking crisis, especially when you consider the direct impact of crypto and of course all the regulatory attention the industry has attracted,” said the OANDA Analyst. Craig Erlam.

“Bitcoin is slightly lower today, but that doesn’t really matter considering it’s hovering around recent highs. As to where it’s next, no one knows. Recent moves may not make sense to many people and most explanations can be nonsense, but you can never ignore the power of a crypto rally,” Erlam added.

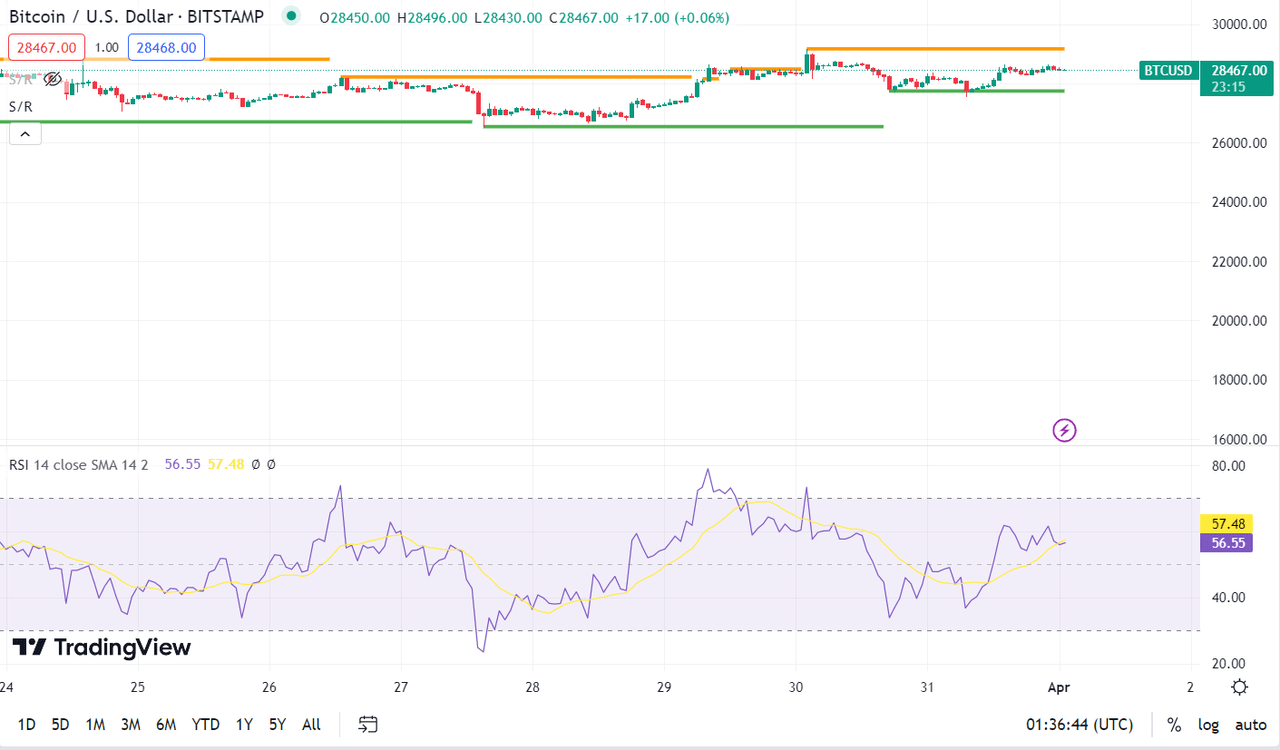

Bitcoin (BTC-USD) briefly touched a 10-month high of ~$29.2K on Thursday. It traded within the $27.5K-$28.5K range this week.

Total crypto market capitalization currently stands at $1.19 trillion, a 0.71% increase Thursday, according to CoinMarketCap.

bitcoin price

- Bitcoin (BTC-USD) rose 1.02% to $28.46K at 2145 ET and ether (ETH-USD) rose 1.23% at $1.83K.

- Read why SA contributor Jason Appel believes that despite the tremendous volatility displayed by bitcoin (BTC-USD), the cryptocurrency has shown “incredible resilience and is set up for potential big gains over the next 18 months” .