Bitcoin (BTC) set new nine-month highs overnight on March 30 as traders continued to be cautious.

“Deviation” Brings BTC Price Closer to $30.0

Data from Cointelegraph Markets Pro and TradingView showed that BTC/USD rose to $29,170 on Bitstamp.

A rejection came in almost immediately, sending the pair back to its starting point and causing already suspicious market participants to call it a “fake”.

#Bitcoin – What a beautiful fake. This is why you don’t chase green candles. pic.twitter.com/oJzrMoRi20

– IncomeSharks (@IncomeSharks) March 30, 2023

“Nothing has changed, yes we did get a nice little rise above the highs, but this was to be expected,” popular trader Credible Crypto wrote in part from a reaction from Twitter, calling the move a “deviation.”

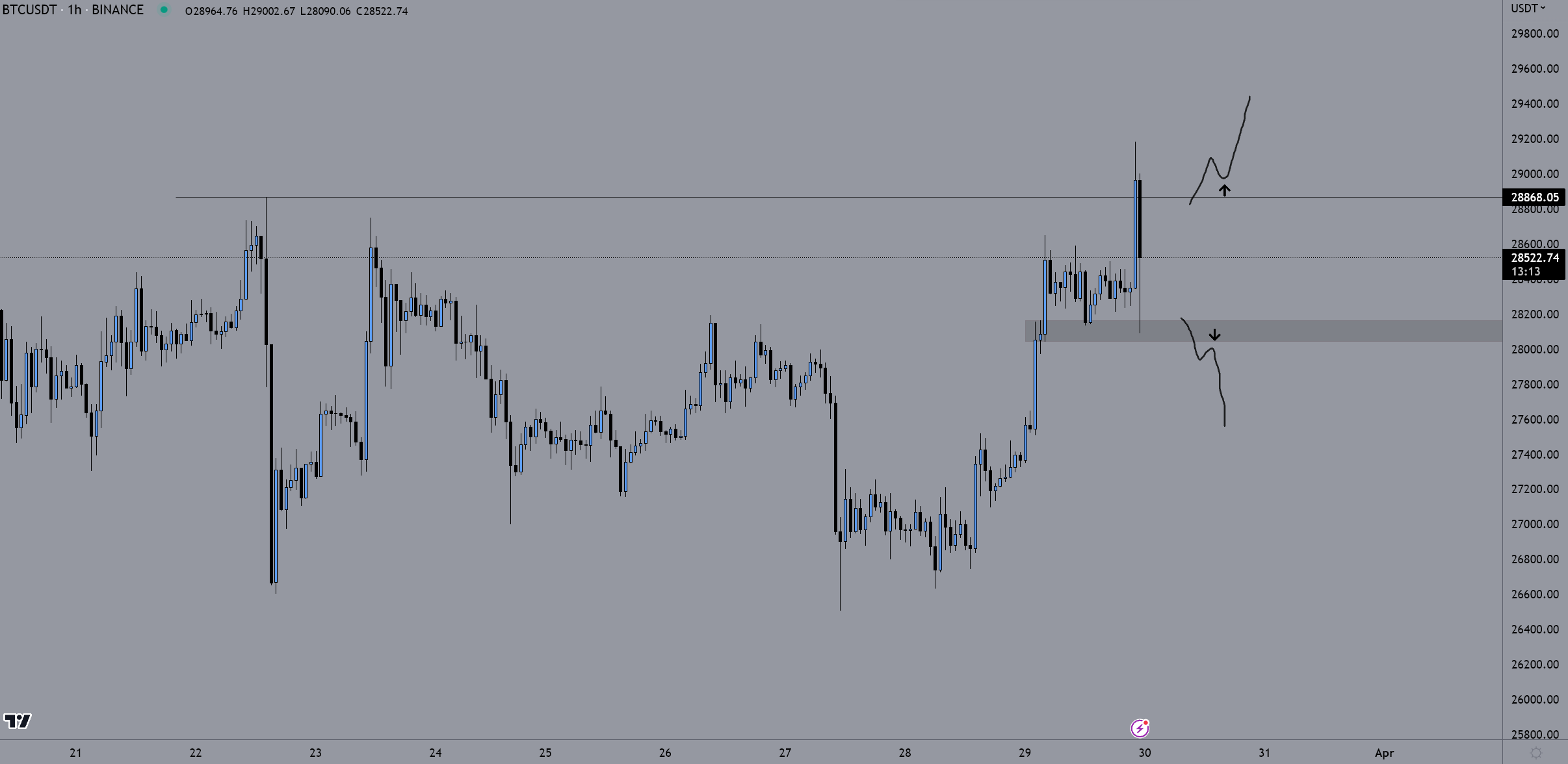

Fellow Crypto trader Chase also applied the “deviation” tag, asking for $29,000 to hold to consider long positions.

So far, deviation from daily resistance. The bulls want the gray box to hold in LTF. Next, and the probability of this move being a stop/deviation, makes more sense to me.

He recovers 29K and I am looking for scalp lengths. I lose gray box and look for scalp briefs. Chop in the middle. pic.twitter.com/B093Q4E3xL

— Crypto Chase (@Crypto_Chase) March 30, 2023

Related: US Enforcement Agencies Are Turning Up the Pressure on Crypto-Related Crimes

However, a slightly more optimistic Crypto Tony expected that the top of the short-term range could still be flipped to new support.

“Bear markets naturally have a lot more FUD and Bitcoin has certainly taken a big load over the last year or so. But we still hold up well and go for $30,000. I’m excited for the bull run either tomorrow or on next year,” said aggregate.

Bitcoin Price Analyst: Volume Echoes June 2022 Fall Signal

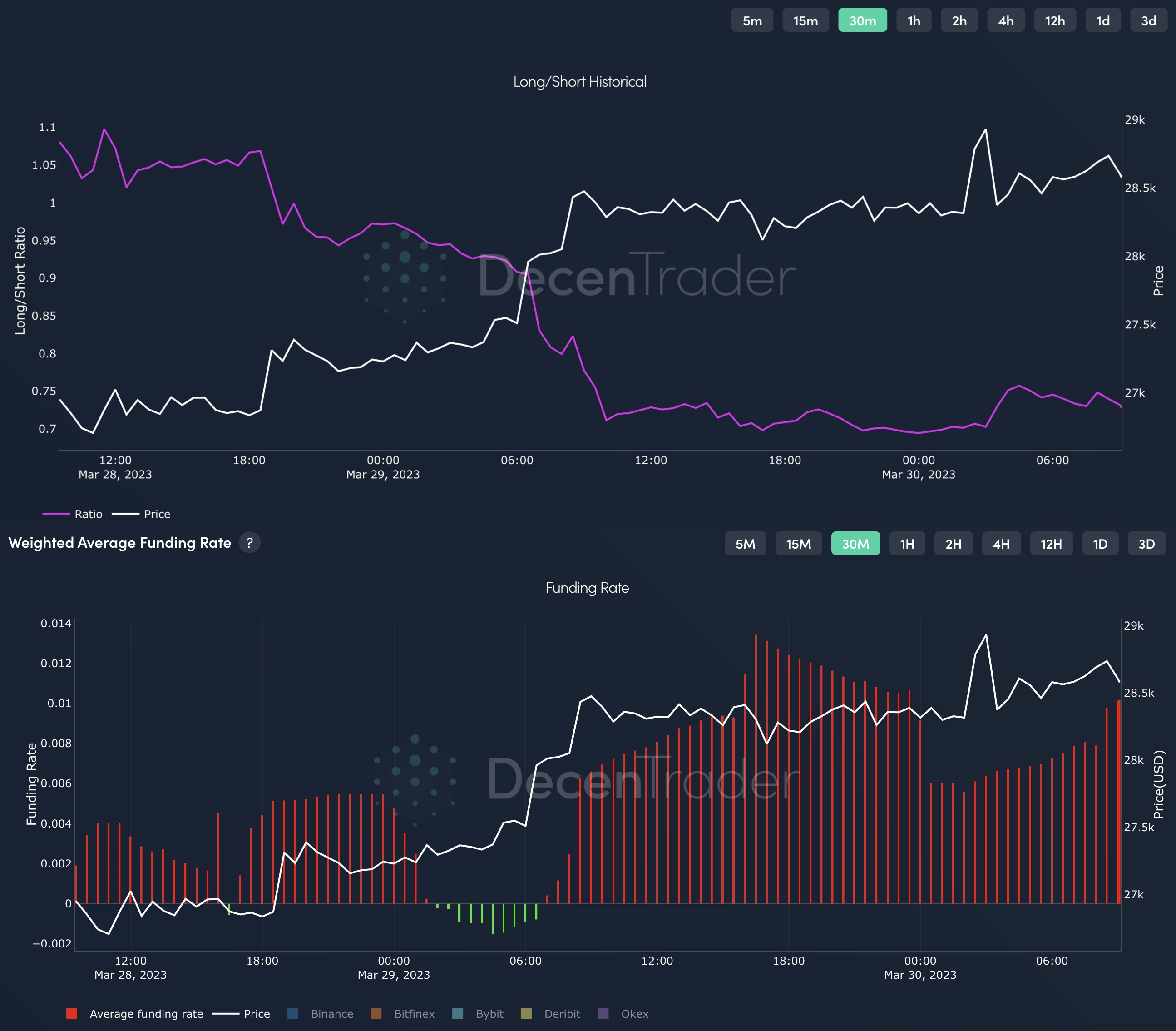

Meanwhile, when analyzing the situation on derivatives exchanges, the Decentrader trading suite noted that shorts currently had the upper hand.

Related: Bitcoin Price Will Hit This Key Level Before $30K, Survey Says

“The funding rate continues to rise while the long/short ratio remains flat,” he said. summarized in a new analysis of the day.

“With falling prices and positive funding, short perpetrators are potentially profitable and are paid by longs to keep their positions open.”

In another potential red flag, Bitcoin and crypto analyst Lukasz Wydra noted that current trading volumes were at their lowest level by 2023.

“The last time anything similar was observed was in June 2022. Paradoxically, just before the 30k drop,” he revealed along with the chart data.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.