On March 23, the price of Bitcoin (BTC) recaptured the $28,000 support after a brief correction below $27,000. The move closely followed the traditional financial sector, particularly the tech-heavy Nasdaq index, which gained 2.1% as Bitcoin crossed the $28,000 threshold.

On March 22, the Federal Reserve raised its benchmark interest rate by 0.25%, but hinted that it is nearing its maximum level by 2023. In the end, however, Federal Reserve Chairman Jerome Powell, He stated that it is too early to determine the extent of the tighter credit conditions, so monetary policy will remain loose.

Initially, it looks encouraging that the central bank is less inclined to increase the cost of money. However, global economies are showing signs of stress. For example, the consumer trust in the euro area it fell 19.2% in March, reversing five straight months of gains and defying economists’ predictions of improvement.

The recession continues to put pressure on corporate profits and cause layoffs. For example, on March 23, the professional services firm Accenture said it would terminate the contracts of 19,000 workers over the next 18 months. On March 22, the company Indeed, which helps people find jobs, laid off 2,200 workers, or 15% of its staff.

The stronger the correlation with traditional markets, the less likely a decoupling will be. As a result, according to the futures and margin markets, the rise in the price of Bitcoin has not instilled much confidence in professional traders.

Bulls and Bears Exhibit Balanced Demand in Margin Markets

Margin trading allows investors to borrow cryptocurrencies to take advantage of their trading position, which could increase their returns. For example, one can buy Bitcoin by borrowing Tether (USDT), thus increasing their crypto exposure. On the other hand, borrowing Bitcoin can only be used to bet on a price drop.

Unlike futures contracts, the balance between long and short spreads does not necessarily match. When the margin loan ratio is high, it indicates that the market is bullish; Otherwise, a low lending ratio indicates that the market is bearish.

On March 15, the margin markets long-short indicator on the OKX exchange peaked at 60, but by March 17 it had fallen to 22. This indicates that reckless leverage was not used during the rally. Historically, levels above 40 indicate very unbalanced demand that favors longs.

The indicator is currently at 19, indicating a balanced situation given the high cost of borrowing USD (or stablecoins) to short BTC, which sits at 15%.

Long to Short Data Shows Reduced Demand for Leveraged Longs

The net long-to-short ratio of the major players excludes externalities that might have affected only the margin markets. Analysts can better understand whether professional traders are biased bullish or bearish by aggregating positions in spot, perpetual and quarterly futures contracts.

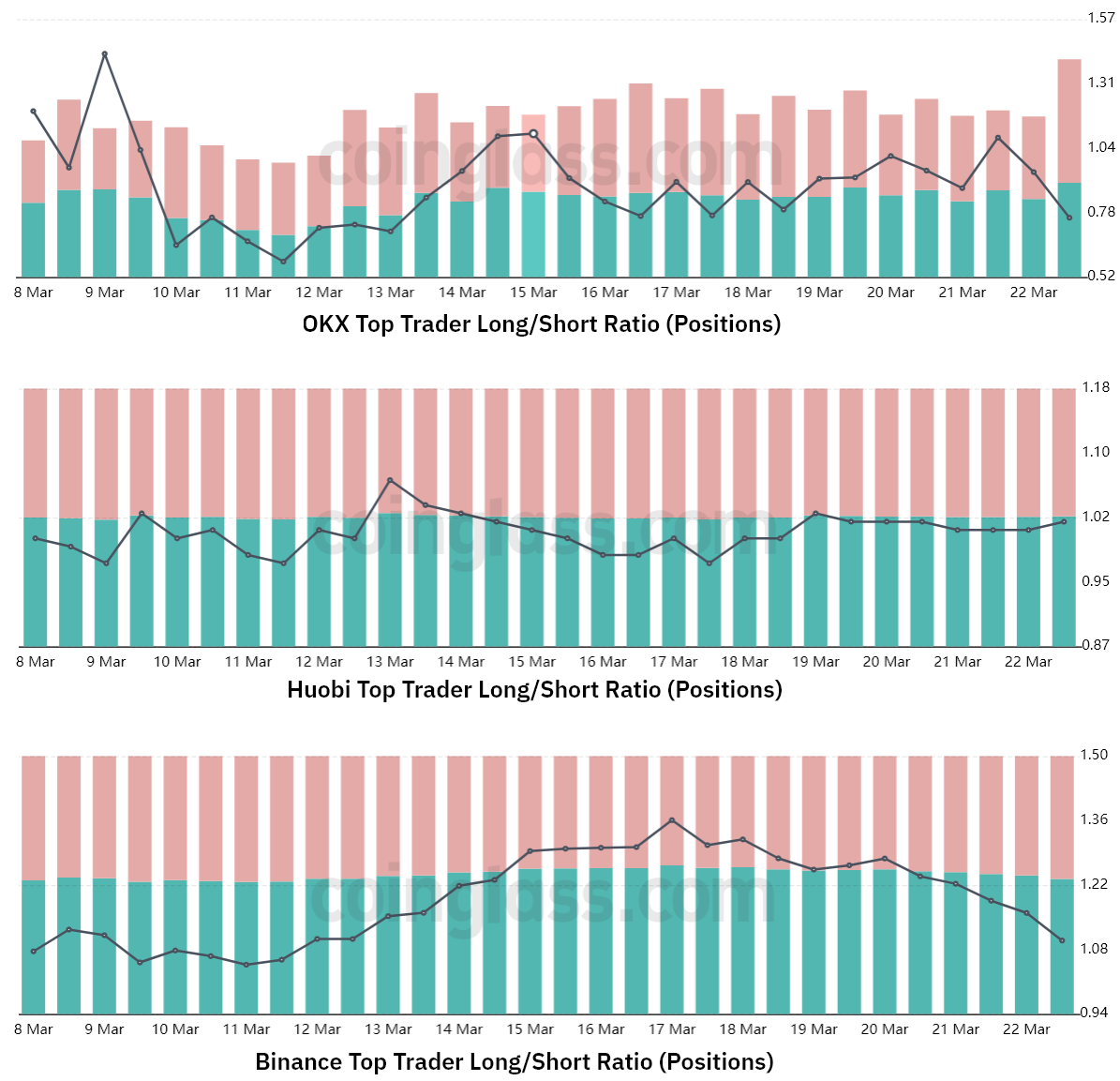

There are occasional methodological discrepancies between different exchanges, so viewers should monitor changes rather than absolute numbers.

Related: Bitcoin Likely To Outperform All Crypto Assets After Banking Crisis, Analyst Explains

Between March 18 and March 22, the long-short ratio of major traders on OKX increased, peaking at 1.09, but reversed course on March 23. The indicator is currently at its lowest level in eleven days, at 0.76. Meanwhile, on the Huobi exchange, the long-short ratio of major traders has been stable near 1.0 since March 18.

Lastly, the Binance whales have been steadily cutting their leverage longs since March 17. More precisely, the ratio fell from 1.36 to 1.09 on March 23, its lowest level in eleven days.

As Bitcoin has gained 13% since March 16, the margin and futures markets indicate that the whales and market makers were unprepared. Initially, this may appear bearish, but if the $28,000 support level holds, professional traders will likely be forced to add long positions, further accelerating the bullish momentum.

Bitcoin derivatives are finally showing no signs of stress. Not having excessive leverage on long positions is positive, and the bears did not dare to add short positions. However, recessionary risks and increasing regulatory uncertainty, such as Wells’ notice from the SEC against the Coinbase exchange on March 22, will likely keep the price of Bitcoin below $30,000 for a while.

The views, thoughts, and opinions expressed herein are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.