Bitcoin (BTC) headed for fresh nine-month highs after Wall Street’s March 21 open as a crucial Federal Reserve interest rate decision loomed.

Bitcoin Price Rises Despite Fed’s Conservative Opinion

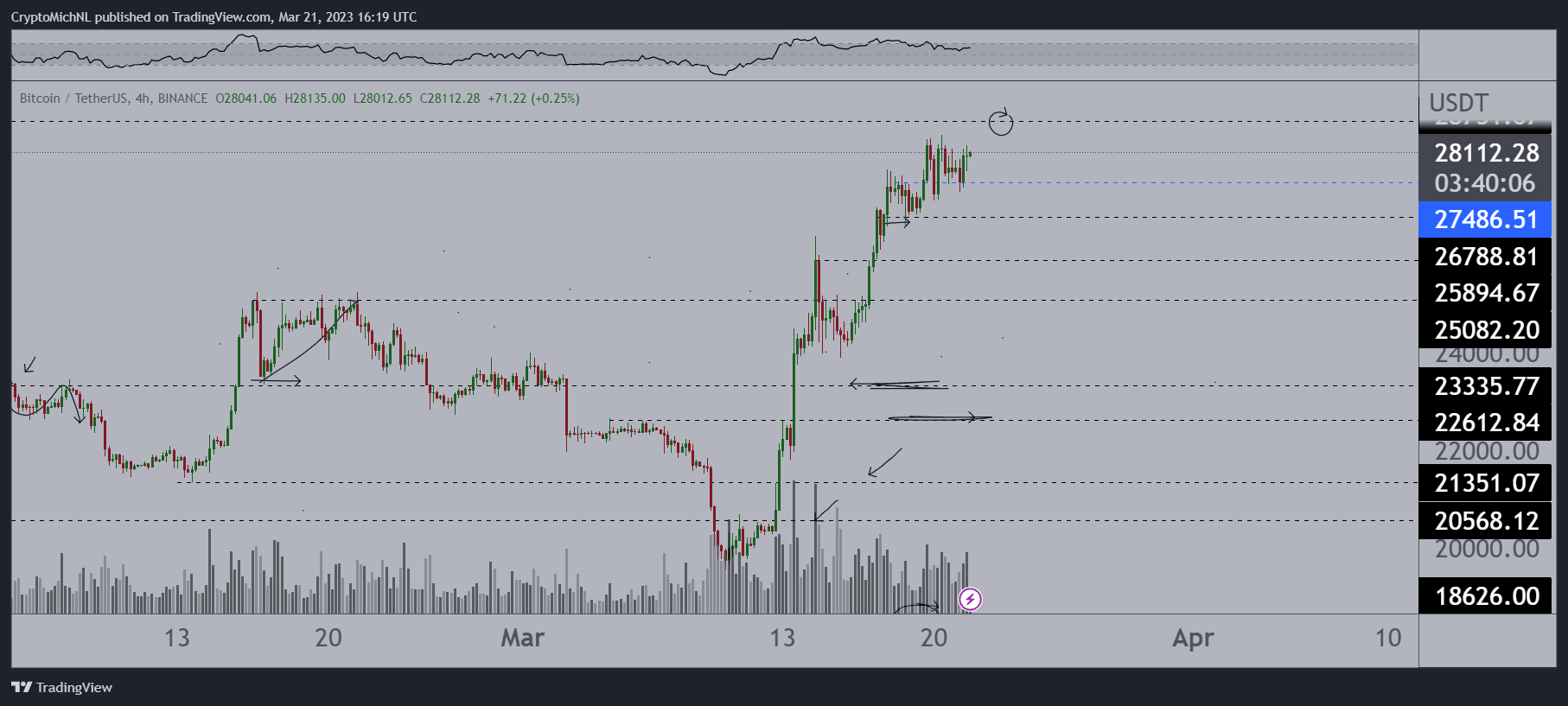

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD nearing $28,500 on Bitstamp.

The latest in a In a succession of multi-month highs, the latest BTC price action precedes what promises to be a volatile day for markets.

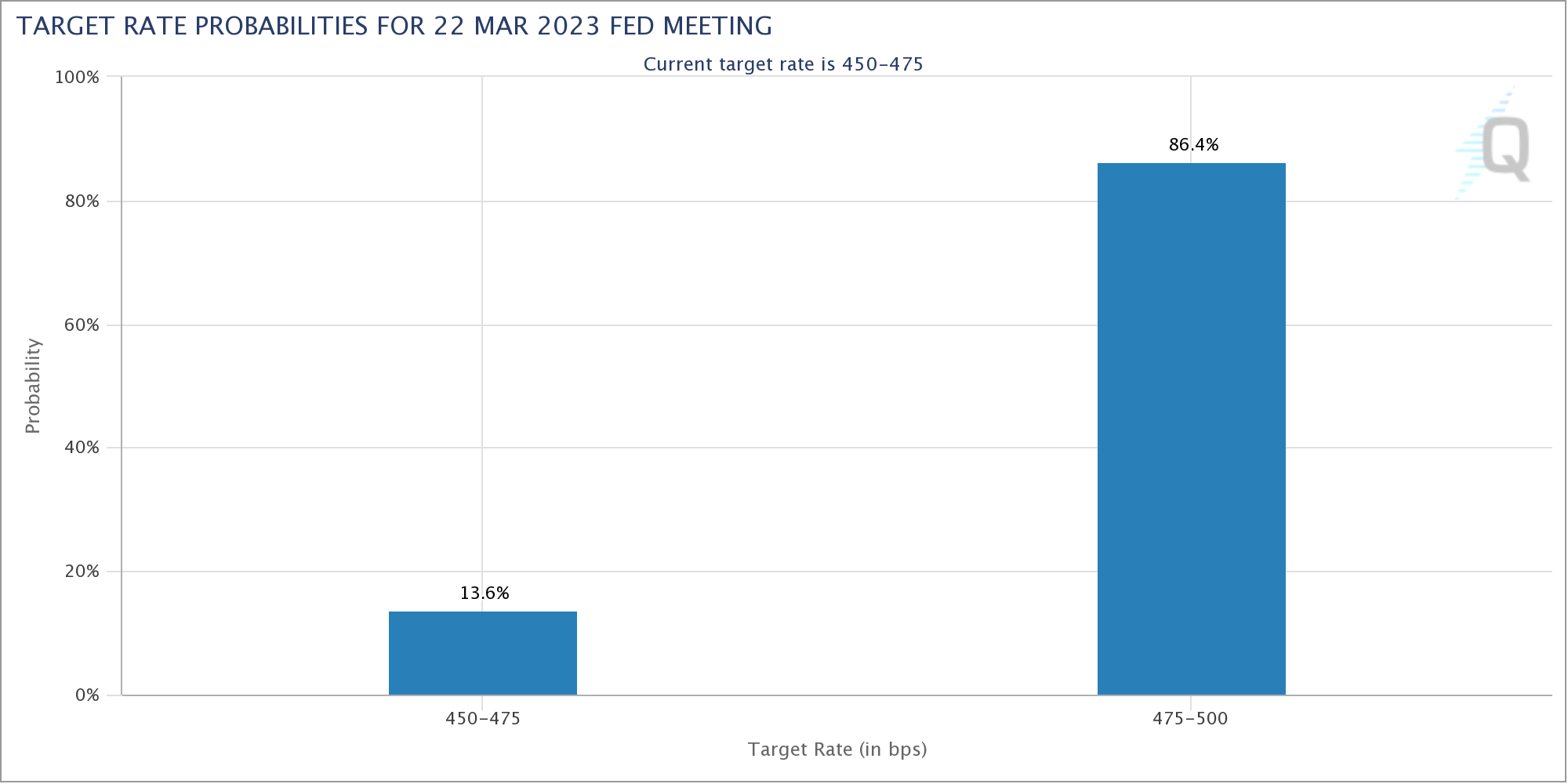

The Fed will announce how much, if at all, it will raise its benchmark interest rate on March 22, with a pause in the raising cycle seen as a blessing in anticipation for risky assets.

“Very interested to see the outcome tomorrow,” Cointelegraph contributor Michaël van de Poppe, founder and CEO of trading firm Eight, wrote in part from a Twitter update.

“Potential sweep to the highs, closing the CME gap, trapping everyone and creating bearish divergences is an ideal concept. Key area $28,700.”

Nonetheless, Bitcoin produced interesting moves on March 21, with dollar gains coupled with volatility in overall crypto market cap dominance.

“Altcoins are bleeding, while Bitcoin is still consolidating around the highs. These are not the signs you would want to see,” Van de Poppe warned earlier.

“Money rotating from altcoins to Bitcoin amid fears for tomorrow’s FOMC meeting. I would stay relatively calm in the positions as well. Obvious opportunities will arise.”

The subsequent drop after the open on Wall Street was described by popular Crypto trader Tony as an “interesting dump on BTC Dominance creating a surge in Altcoins.”

The mixed signals reflected market sentiments for the Federal Open Market Committee (FOMC) meeting. According to CME Group’s FedWatch tool, most now foresee a 25 basis point rate hike, unlike the previously favored pause.

“All classes” buying BTC

Meanwhile, when analyzing the behavior of traders, the On-Chain Monitoring Resource Material Indicators revealed overall buys on the largest global exchange, Binance.

Related: Will the Fed stop rate hikes? 5 things to know about Bitcoin this week

A snapshot of the BTC/USD order book showed increasing exposure ahead of the FOMC on both high and low volume.

$28,500 and $29,000 formed the strongest resistance levels at time of writing, while the nearest significant support was further from the spot price at $27,000.

#FireCharts show all classes buying this #BTC move. pic.twitter.com/NjrodLhmCD

— Material indicators (@MI_Algos) March 21, 2023

The views, thoughts, and opinions expressed herein are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.