Japanese tech giant Fujitsu has filed a trademark application with the US Patent and Trademark Office covering various cryptocurrency services. The request specifically mentions “financial management of crypto assets”, “financial exchange of crypto assets” and “financial intermediary services for cryptocurrency trading”.

Fujitsu Cryptographic Trademark Application

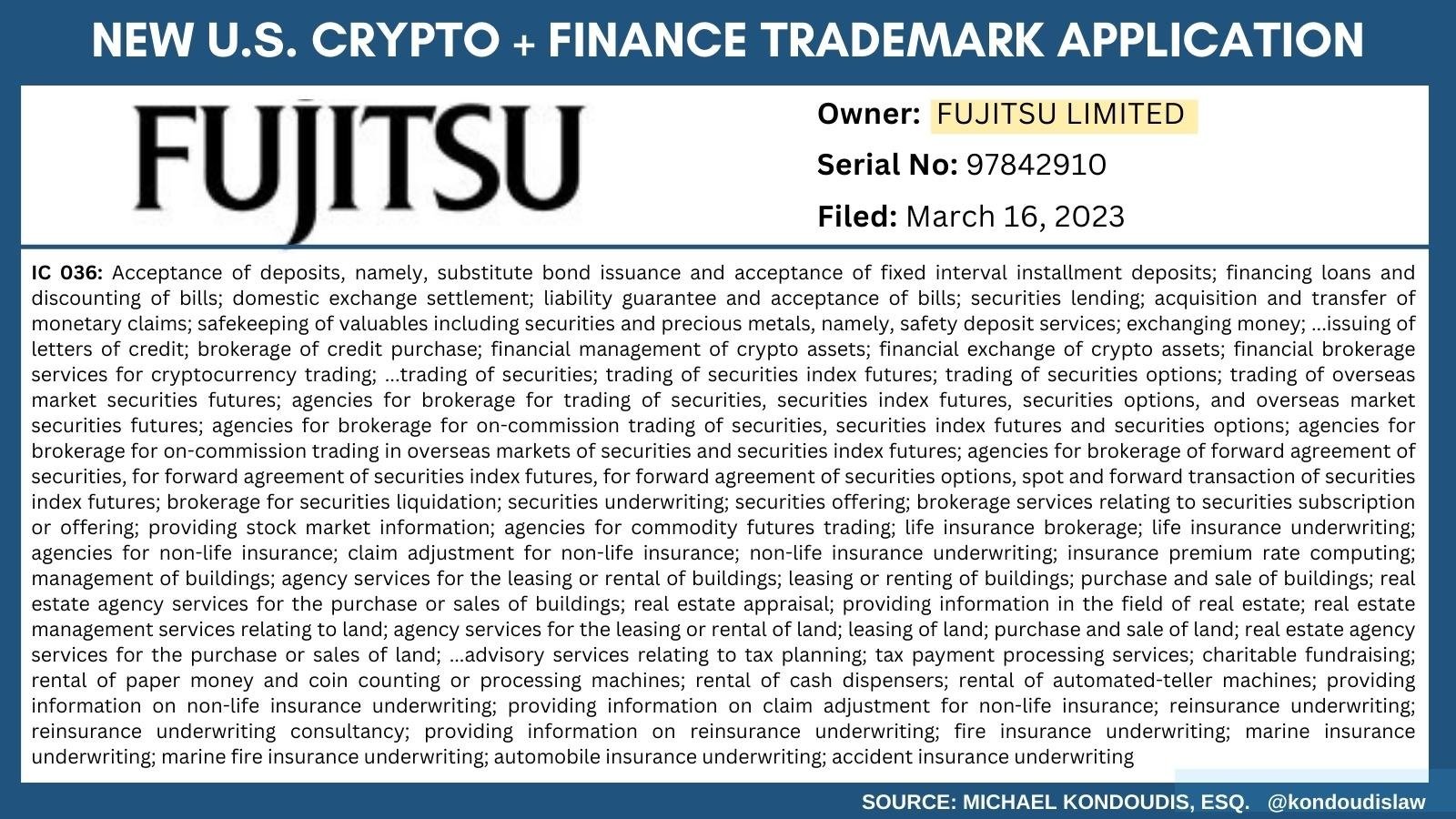

Fujitsu, one of the world’s largest IT service providers, filed a trademark application with the United States Patent and Trademark Office (USPTO) last week for various cryptocurrency products and services. Fujitsu is Japan’s largest IT service provider.

Mike Kondoudis, a USPTO licensed trademark attorney, tweeted Tuesday:

Is Fujitsu moving into banking, finance and crypto? The international tech company has filed a trademark application for money exchange, securities trading, insurance brokerage, tax planning, and cryptocurrency trading.

Fujitsu’s application (serial number 97842910) filed with the USPTO last Thursday describes numerous goods and services, including “crypto asset financial management,” “crypto asset financial exchange,” and “financial intermediary services for crypto asset trading.” cryptocurrencies”.

On February 6, the technology multinational announced the launch of the “Fujitsu Web3 Acceleration Platform”, which offers “a development environment, as well as several service APIs based on blockchain and high-performance computing technologies,” the company detailed.

Companies are increasingly filing trademark applications covering a wide range of crypto products and services, as well as non-fungible tokens (NFTs) and the metaverse, including Fidelity Investments, HSBC, Visa, Paypal, Western Union, Formula One, Ford, Ebay and Facebook owner, Meta.

What do you think about Fujitsu filing a trademark application covering cryptocurrency trading services? Let us know in the comments section.

image credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or a solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service or company. bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.