Bitcoin (BTC) price topped $28,000 on March 21, but according to two derivatives metrics, traders aren’t too excited after a 36% eight-day gain. Looking beyond the stellar performance of Bitcoin, there are reasons why investors are not fully confident of a further price rally. The recent bailout of Credit Suisse, a major 167-year-old Swiss financial institution, is proof that the current global banking crisis may not be over.

On March 19, Swiss authorities announced that UBS had agreed to acquire rival Credit Suisse in an “emergency bailout” merger to prevent further market-shattering turbulence in the global banking sector. The transaction could benefit of more than $280 billion in state and central bank support, equal to a third of Switzerland’s gross domestic product. Unfortunately, there is no way to present this agreement as reassuring or as a sign of strength from financial institutions, including central banks.

The same can be said for the emergency credit life line provided by the US Treasury to protect the banking sector and increase the reserves of the Federal Deposit Insurance Corporation. The “Bank Term Financing Program” (BTFP), launched on March 12, marked a return to liquidity injections from the Fed, reversing the trend started in June 2022, when the Federal Reserve began monthly asset sales. .

The global banking crisis led the Fed to abandon its inflation control policies

By loan $300 billion in emergency funds for banks, the Fed completely reversed its strategy to curb inflation, which has been above 5% yoy since June 2021, while targeting 2%. This strategy, known as tightening, included raising interest rates and cutting the $4.8 trillion in assets the Federal Reserve accumulated from March 2020 to April 2022.

On March 20, First Republic Bank (FRB) saw its credit ratings degraded further into junk status by S&P Global, adding to the strain on regional US banks. According to the ratings agency, the recent deposit injection of $30 billion from the lender of 11 big banks may not be enough to solve the FRB’s liquidity problems.

Cryptocurrency investors always anticipate a decoupling from traditional markets. However, there is little justification for an allocation at this time, especially if it comes from corporations, mutual fund managers or wealthy investors. Historically, investors have tended to accumulate cash or short-term government debt positions during recessionary periods to sustain day-to-day operations and possibly use them to buy bargains.

The yield on six-month US Treasuries, for example, fell from 5.33% on March 9 to 4.80% on March 20. As investors brace for the impact of inflation or a recession, or both, this event signals increased demand for short-term securities. term instruments. The change from March 9 reversed the entire movement of 2023, with the indicator closing 2022 at 4.77%.

Let’s examine Bitcoin derivatives metrics to determine the current market position of professional traders.

Bitcoin Derivatives Show Balanced Demand for Long and Short Positions

Quarterly Bitcoin futures are popular with whales and arbitrage desks, typically trading at a slight premium to spot markets, indicating that sellers are asking for more money to delay settlement for a longer period.

As a result, futures contracts in healthy markets should trade at a 5% to 10% annualized premium, a situation known as “contango,” which is not unique to crypto markets.

Since March 15, the BTC futures premium gauge has been unchanged at 2.2%, indicating no additional demand for leveraged buyout activity. Numbers below 5% indicate bearishness, which is not what one would expect after eight-day price gains of 36%.

The absence of demand for leveraged longs does not necessarily imply a fall in price. As a result, traders should research the Bitcoin options markets to learn how whales and market makers price the probability of future price movements.

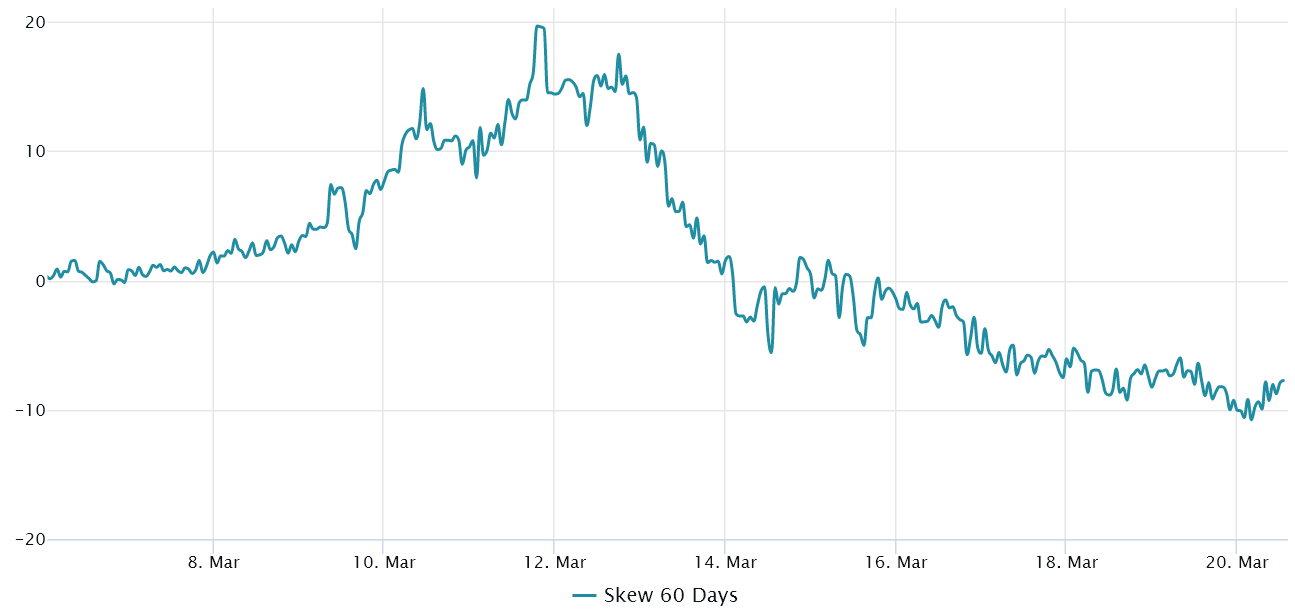

The 25% delta bias is a telltale sign that shows when market makers and arbitrage desks are overcharging for upside or downside protection. In bear markets, option investors give higher odds of a price dump, pushing the bias indicator above 8%. On the other hand, bull markets tend to drive the bias metric below -8%, meaning bear put options are less in demand.

The delta bias crossed the neutral threshold of -8% on March 19, indicating subdued optimism as neutral to bullish call options were in higher demand. The excitement didn’t last long though, as the 25% bias indicator is currently at -8%, which is the edge of a balanced situation. However, it is the polar opposite of the previous week, when the bias reached 12% on March 13.

Ultimately, professional Bitcoin traders are not bullish above $26,000. This is not necessarily a bad thing, but unless crypto investors regain confidence, the chances of the cryptocurrency breaking above $30,000 remain extremely remote. A complete collapse of the banking system would cause investors to flee to safety rather than seek risk.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.