Top news this week

Sam Bankman-Fried asks the court to prioritize the reimbursement of his legal fees

Signature Bank shut down by New York regulators for failing to provide data

Crypto-friendly Signature Bank was officially shut down and taken over by the New York Department of Financial Services on March 12 for “failing to provide consistent and reliable data.” The bank has been investigated by two United States government agencies as to whether it took appropriate measures to monitor and detect possible money laundering by its clients. Former member of the US House of Representatives, Barney Frank, suggested that New York regulators shut down Signature as part of an apparent show of force against the crypto market.

read also

Characteristics

Guide to Real Life Crypto OGs You’d Meet at a Party (Part 2)

Characteristics

Working with Hydra: providing services to decentralized organizations

USDC Rallies Towards $1 Peg After Fed Announcement

Circle’s stablecoin USD Coin (USDC) has risen back to its $1 peg following positive developments related to Circle’s $3.3 billion worth of reserves held at Silicon Valley Bank and its new banking partners: Cross River Bank and BNY Mellon will now process USDC redemptions. The stablecoin depegged from the US dollar on March 10 following the sudden collapse of SVB, which triggered the depegging of many other stablecoins. The unpegging of stablecoins triggered a growth in loan repayments over the weekend, saving borrowers more than $100 million in loans.

US Federal Reserve announces $25 billion in funding to support banks

Bitcoin Market Cap Changes Tech Giant Meta, Widens Gap At Visa

Winners and losers

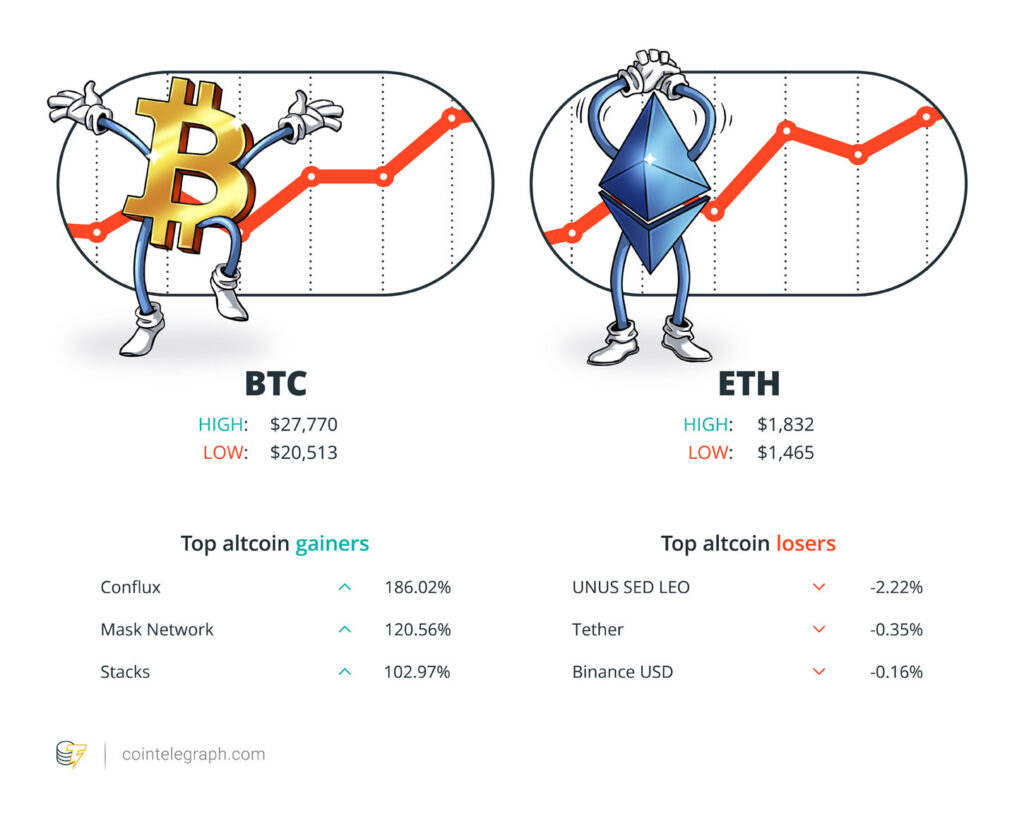

At the end of the week, Bitcoin (BTC) I sat down $27,571Ether (ETH) in $1,823 and XRP in $0.38. Total market capitalization is $1.18 trillion, according to CoinMarketCap.

Among the largest 100 cryptocurrencies, the top three altcoin gainers of the week are Conflux (CFX) at 186.02%, Network of Masks (FACE MASK) at 120.56% and batteries (STX) at 102.97%.

The top three altcoin losers of the week are UNUS SED LEO (LION) at -2.22%, Tether (USDT) at -0.35% and Binance USD (BUSD) at -0.16%.

To learn more about cryptocurrency prices, be sure to read Cointelegraph’s market analysis.

read also

Characteristics

Crypto PR: the good, the bad and the shoddy

Characteristics

Unlocking Cultural Markets with Blockchain: Web3 Brands and the Decentralized Renaissance

most memorable quotes

“The recent closures of financial institutions may be the opportunity for cryptocurrencies to achieve mass adoption.”

“We believe that the elements of the future of finance will be blockchain-enabled and we are already seeing rapid change in the tokenization market.”

drew bradfordExecutive Managing Director, Markets at National Australia Bank

“Great adoption by mainstream businesses and their consumers is just around the corner thanks to recent developments in privacy technology and scalability.”

smargon brandCEO of Fuse Network

“Drop the blockchain/NFT/play-to-earn (P2E)/metaverse/Web3 talk. (…) They (players) just want to have an entertaining gaming experience, not a science lesson.”

Pedro Bergstromformer producer of Age of Empires and CEO of BitBlock Ventures

“We are going to have a credit crunch in the US and around the world. (…) You want to be long gold and silver (…) and you want to be long Bitcoin.”

Michael Novogratzfounder and CEO of Galaxy Digital

“I think the regulators are using crypto as a scapegoat for their own mistakes in overseeing traditional banking.”

cathie woodARK Invest CEO

prediction of the week

Bitcoin Price Hits $27K At New 9-Month High As Fed Injects $300B

Bitcoin hit new nine-month highs on March 17 as the latest events of the US banking crisis boosted crypto markets. Data from Cointelegraph Markets Pro and TradingView showed that BTC/USD reached $27,025 on Bitstamp before consolidating. A catalyst for a new rise had arrived overnight in the form of the Federal Reserve’s balance sheet data, which showed that nearly $300 billion was pumped into the economy as part of the response to the banking crisis.

Cointelegraph contributor Michaël van de Poppe, founder and CEO of trading firm Eight, noted specific levels up and down.

“Chopperino lands on Bitcoin, which means we will probably have some structures on the side,” he wrote on Twitter. “He needs to have $26K. If that holds, $28–30K is next. If he loses $26,000, I’ll bet around $25,000 for a few longs. Relatively easy to understand.”

FUD of the week

Euler Finance hacked for over $195 million in quick loan attack

Europol seizes $46 million from crypto mixer after $2.88 billion was allegedly laundered

FBI and New York Authorities Investigate Collapse of TerraUSD Stablecoin

The US Department of Justice is reportedly investigating the collapse of the TerraClassicUSD (USTC) stablecoin, which contributed to the destruction of $40 billion in the Terra ecosystem last May. Former Terraform Labs personnel have been questioned in recent weeks by US agencies, including the FBI. The investigation covers similar ground to a lawsuit filed against Terraform Labs and its founder Do Kwon by the US Securities and Exchange Commission in February, including misleading investors.

Best Cointelegraph Features

4 out of 10 NFT Sales Are Fake – Learn to Spot the Signs of Money Laundering

NFT wash trading inflates volume on some platforms by 10-20 times the legitimate volume. Why is it encouraged and what can be done about it?

All Raises for the Robot Judge: AI and Blockchain Could Transform the Courtroom

Crypto winter can affect the mental health of hodlers

The relentless bear market, a series of high-profile criminal charges, and the fall of trusted institutions have taken their toll on those active in the crypto industry.

Subscribe

The most compelling reads on blockchain. Delivered once a week.