An investigation into digital asset exchanges in the Russian capital has established that some of them are ready to buy digital currencies and deliver paper money in the UK. The transfer of funds does not usually involve the identification of clients, reveals Transparency International Russia in a report. .

Russia-Based Crypto Exchanges Trade Stablecoins For British Cash

Russian cryptocurrency exchanges that can transfer money abroad without following know-your-customer (KYC) and anti-money laundering (AML) procedures are at the center of a study by the Russian Chapter of Transparency International. The results were presented in a new report published on Wednesday.

The association’s researchers were able to identify more than 20 coin trading platforms operating out of the Moscow International Business Center, commonly known as Moscow City. Through conversations with traders, they also discovered that eight of them were ready to exchange US dollar-pegged stablecoins for sterling and deliver the cash to recipients in London.

The authors noted that one of them is Suex, a cryptocurrency broker. blacklisted by the US Department of Treasury’s Office of Foreign Assets Control (OFAC) in September 2021 for facilitating transactions linked to ransomware. They also add that a platform called Pridechange sent significant amounts of money to Garantex, another blacklisted exchange with offices in the city of Moscow.

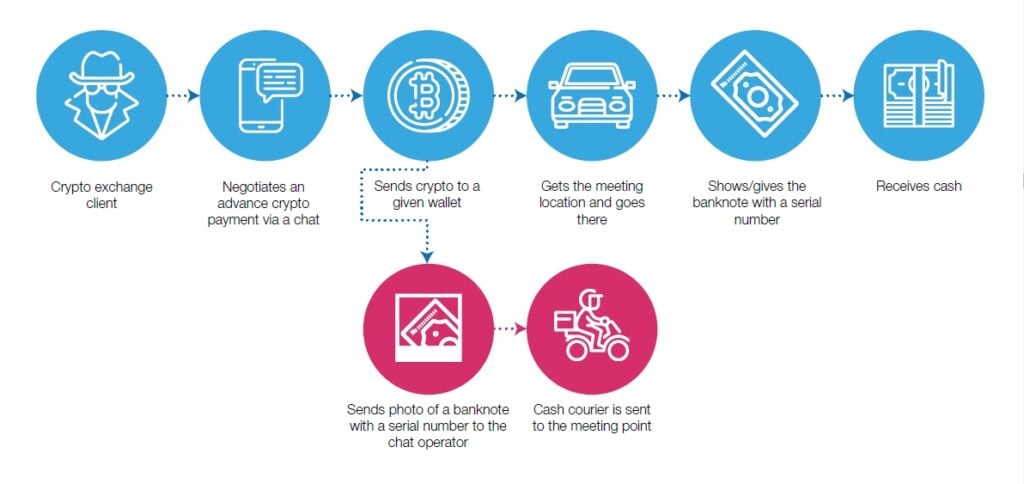

The way in which the transfers were made was similar in all cases. First, a client needs to send the amount in tether (USDT) to a wallet address provided by the exchange. Once the payment is confirmed, the operator would send a courier, usually a Russian speaker, to a specified location in London to deliver the fiat money the same or next day.

UK anti-money laundering regulations require cryptocurrency exchanges to be registered and carry out customer due diligence checks. None of the Russian platforms ever asked to verify the identity of the undercover representatives of Transparency, despite amounts of money exceeding 10,000 British pounds ($12,000).

During its communication with the crypto exchanges, the organization obtained the crypto addresses used for these transfers. Transaction history shows that the average monthly amount of money passing through such wallets ranges from $420,000 to $470,000. The estimate is based solely on the USDT The USD coin (USDC), another stablecoin, was also used.

“The results of our study suggest that at least some shadow OTC cryptocurrency exchanges operate in the UK and are ready to provide cash without performing the necessary KYC procedures… The full scale of this activity may be unknown, but obviously it is not insignificant and deserves closer scrutiny,” concludes an excerpt from the report.

Do you think the Russians are actively using these channels to transfer funds abroad amid the financial constraints from the Ukraine war? Share your thoughts on the subject in the comments section below.

image credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or a solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service or company. bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.