Bitcoin (BTC) kept bears sweating near $25,000 on March 15 as encouraging macroeconomic data combined with concerns about contagion from the banking crisis.

PPI offers “big signals” on the Fed’s pivot

Data from Cointelegraph Markets Pro and TradingView It showed that BTC/USD rebounded from a 24-hour drop to see highs of $25,273 on Bitstamp.

The pair reacted positively to the latest US Producer Price Index (PPI) data, which came in much lower than expected.

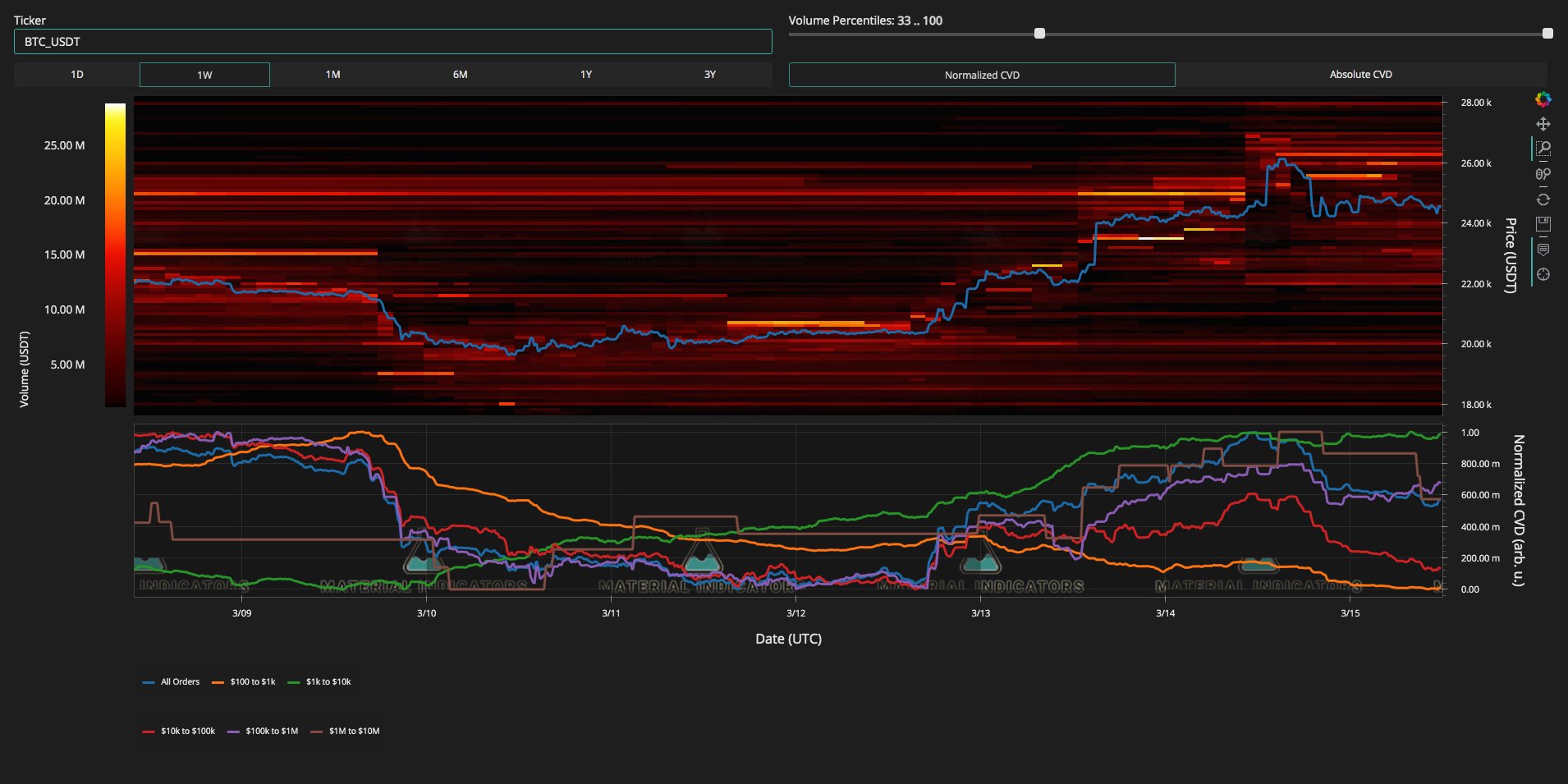

Prior to launch, the Binance order book was showing prime bid and ask liquidity parked at $22,000 and $26,000, respectively.

“Time will tell if there is enough supply liquidity to insulate $22k from getting hit”, on-chain monitoring resources Material Indicators wrote in part from an attached comment while uploading the data to Twitter.

For Cointelegraph contributor Michaël van de Poppe, founder and CEO of trading firm Eight, there were signs that the Federal Reserve and Chairman Jerome Powell would abandon interest rate hikes at next week’s decisive meeting.

“The PPI reaches 4.6%, while 5.4% was expected. Massive mistake, resulting in a drop in inflation. Powell to pivot? he consulted.

“At least 25 bp seems very likely (or no increases with the banking problems). Great signs!”

The PPI joined the already buoyant Consumer Price Index data released the day before, which accompanied the nine-month highs for Bitcoin, as cryptocurrencies made the most of the unfolding US banking crisis.

A day later, however, the spotlight turned to Europe, as European bank stocks halted on volatility and one in particular, Credit Suisse, hit new all-time lows.

Credit Suisse was down more than 25% at one point before a reversal took it above the $2 mark.

WTF? Markets are now pricing in a 47% probability of default for Credit Suisse. What have I missed? pic.twitter.com/Q2MMo0T3LV

—Holger Zschaepitz (@Schuldensuehner) March 15, 2023

“Silicon Valley Bank had about $209 billion in assets. Credit Suisse has about $578 billion in assets,” Genevieve Roch-Decter, chief executive of financial insights firm Grit Capital, commented on the situation.

“This is a much bigger problem in the making.”

Dollar rises, ignores US inflation data

Crypto, meanwhile, faced headwinds from a possibly unlikely source on March 15 in the form of rising US dollar strength.

Related: Bitcoin at $100K Next? Analyst Sees BTC Price Movement ‘Textbook Perfect’

Despite the print of economic data showing falling inflation and more favorable conditions for risky assets, the US dollar index (DXY) hit 105 for the first time since the Silicon Valley Bank implosion on March 1.

Market commentator Tedtalksmacro placed the blame firmly on Europe’s banking problems.

“Banking contagion is now spreading to Europe, Euro bond yields are much lower and therefore the EUR is also much lower,” part of a tweet. read.

The DXY measures the strength of the dollar against a basket of currencies of major trading partners. Its performance is traditionally inversely correlated with crypto markets.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.