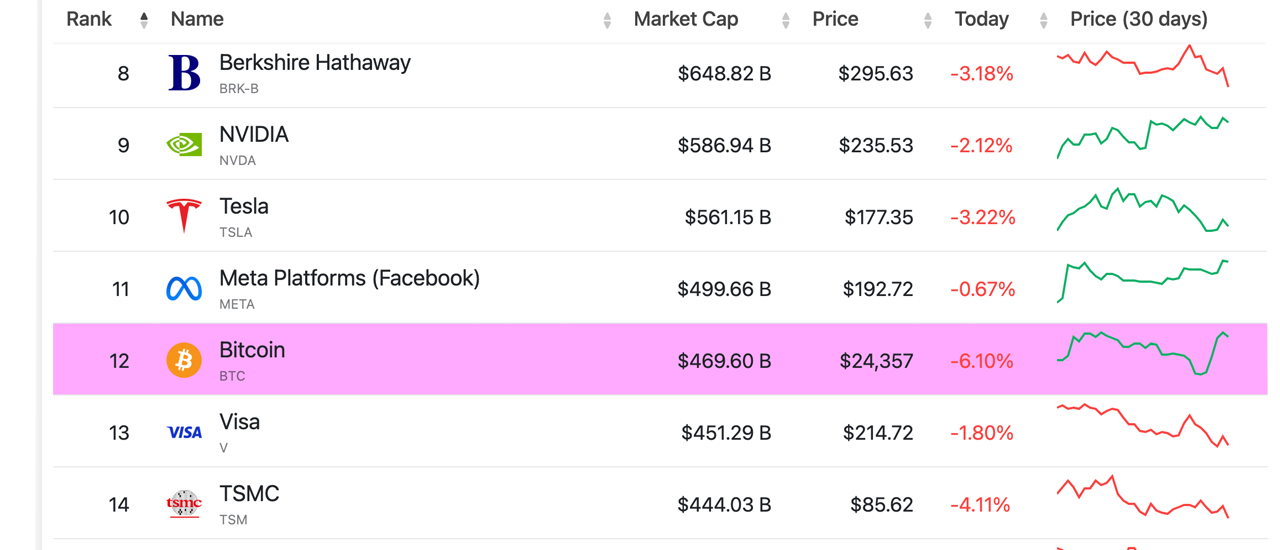

After falling below $26,000 per unit, the price of bitcoin, the top digital asset by market capitalization, continues to rise 9.6% since last week. However, its price has fallen by 6.5% in the last 24 hours. Of the 7,316 companies, crypto assets, precious metals, and exchange-traded funds worth more than $82 trillion, bitcoin is the 12th largest asset in the world by valuation.

Bitcoin Market Cap Compared To Other Top Assets: Leading Crypto Rises Above Visa, But lags Meta

Crypto assets, specifically Bitcoin (BTC), have risen in value this week following the collapse of three major US banks. In the last 24 hours, Bitcoin (BTC) it has fallen 6.5% against the US dollar. However, weekly metrics indicate that BTC it’s up 9.6% week-over-week. most of BTCThe surge occurred on March 14, when it jumped above the $26K zone to exactly $26,533 around 9am (ET) on Tuesday. Starting at 2:35 p.m. on March 15, bitcoin will be trading at $24,357 per unit.

Despite the decline in value against the US dollar, bitcoins it has become the 12th largest valuation in the world, surpassing the market capitalization of payment giant Visa. Wednesday afternoon, BTC it had a market valuation of $469.60 billion, which is $18.31 billion more than Visa’s. However, the market valuation of crypto assets is still below that of Meta (formerly Facebook), which currently stands at $499.66 billion. For bitcoin to become the 11th largest asset by valuation in the world, its market capitalization must increase by $30.06 billion, surpassing that of Meta.

Currently, the top ten assets by market valuation include gold, Apple, Microsoft, Saudi Aramco, silver, Alphabet (Google), Amazon, Berkshire Hathaway, Nvidia, and Tesla. Gold, the leader of the group, has a market capitalization of around $12.81 trillion. While BTC It accounts for 42.7% of the $1.1 trillion value of the crypto economy, it only accounts for 3.67% of the overall gold market valuation. Bitcoin’s market valuation would have to increase by approximately $12.34 trillion to surpass the market capitalization of gold. However, bitcoin’s market valuation is currently closer to silver, which is valued at $1.245 trillion as of Wednesday afternoon.

Thus, as of today, bitcoin’s market cap is roughly 37.7% of silver’s market valuation. To surpass the market capitalization of silver, bitcoin’s market valuation would have to increase by approximately $775.4 billion. In October 2021, BTCThe market capitalization of silver was outperformed by the overall valuation of silver, but at the time, the capitalization of silver was $1.31 trillion. Regarding competing with the net worth of tech giant Apple, BTCApple’s market valuation represents 19.69% of Apple’s. For Bitcoin to surpass the California tech giant’s net worth, it would have to increase its market valuation by another $1.917 trillion.

What do you think about the performance of the seven-day market for bitcoin and the crypto asset becoming the 12th largest asset by market capitalization worldwide? Share your thoughts on this topic in the comments section below.

image credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or a solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service or company. bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.