Image source: Getty Images

The UK’s flagship index hit an all-time high last month. However, the Footsie has since fallen more than 5% on fears of a repeat of the global financial crisis. Nonetheless, here’s why these fears are overblown and why this could be an opportunity to buy FTSE 100 discount bank stocks.

Why is the FTSE 100 falling?

Aside from the jitters surrounding Jeremy Hunt’s spring budget, investors have been in a panic over the recent administrations of several US banks, namely Silicon Valley Bank (SVB).

Fears surrounding the company’s liquidity had spread throughout Silicon Valley, prompting a bank run. Within a week, the California-based bank had liquidated all of its assets. Since then, the company has ceased operations.

To make matters worse, Silvergate Capital and signature bank also collapsed in the panic caused by SVB. A bank crash often sets off a domino effect.

As such, it is not surprising to see US fears cross the Atlantic, affecting FTSE 100 bank stocks as well. The likes of lloyds, barclaysand NatWest have seen their shares fall since Thursday as investors fear a contagion event.

Is there a reason to panic?

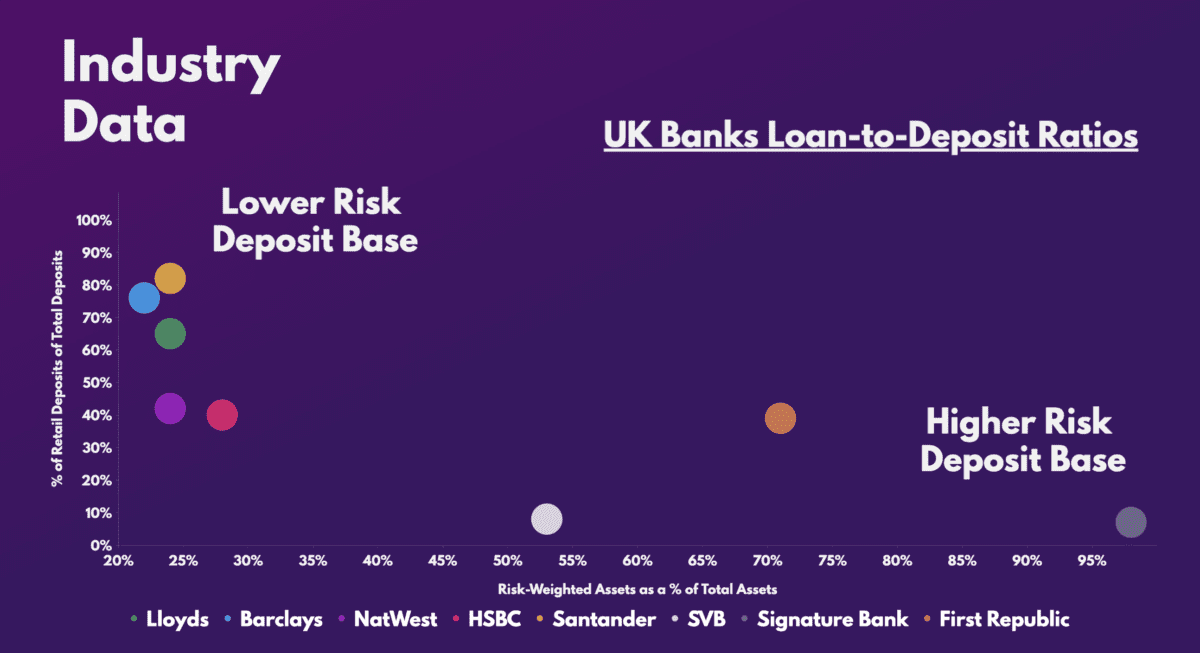

Despite developments across the pond, there isn’t much reason for UK financial institutions to panic, at least for now. This is because they have a much less risky deposit base. In other words, the probability of a liquidity crisis is much lower.

One of the main reasons for this is that the more established UK banks have a higher proportion of their deposits from retail customers. This means that even if a bank run were to occur, it would be more manageable, given the larger number of customers with smaller individual deposits. Additionally, client funds of up to £85k per account are insured in the UK.

Second, FTSE 100 stalwarts have much lower risk-weighted assets. This is crucial because it means UK lenders have more security and access to your capital. This could provide ample liquidity without incurring large losses. SVB, by contrast, had to sell long-term government bonds at heavy losses.

It is for the above reasons that brokers citi, JP Morganand Liberium have come out to quell fears of a banking sector collapse, especially in Europe.

It goes without saying that investing in bank stocks is risky business. Therefore, finding a company with a strong balance sheet with low risk exposure is crucial. And having assessed the fundamentals of the FTSE 100 banks, the risk-reward proposition is certainly lucrative given the recent drop in their share prices.

Taken together, most of them are trading at quite lucrative valuation multiples compared to the industry average. Therefore, it is worth considering starting a position in one or even a few of them. In fact, I plan to buy more Lloyds shares to capitalize on the current weakness and lucrative dividends.

| Metrics | lloyds | barclays | NatWest | HSBC | Santander | industrial average |

|---|---|---|---|---|---|---|

| Price-to-book (P/B) ratio | 0.7 | 0.3 | 0.7 | 0.7 | 0.6 | 0.7 |

| Price-Earnings Ratio (P/E) | 6.6 | 4.7 | 7.3 | 9.2 | 6.1 | 9.5 |

| Forward price-earnings (FP/E) ratio | 6.9 | 4.9 | 6.2 | 5.6 | 5.8 | 8.0 |

var config = {

apiKey: ‘1ed121d592e04642d57912bb369ef696621661a3’,

product: ‘PRO_MULTISITE’,

logConsent: false,

notifyOnce: false,

initialState: ‘NOTIFY’,

position: ‘LEFT’,

theme: ‘DARK’,

layout: ‘SLIDEOUT’,

toggleType: ‘slider’,

iabCMP: false,

closeStyle: ‘button’,

consentCookieExpiry: 90,

subDomains : true,

rejectButton: false,

settingsStyle : ‘button’,

encodeCookie : false,

accessibility: {

accessKey: ‘C’,

highlightFocus: false },

onLoad: function () { // hide Cookie Control recommended settings button.

var recommendedSettingsButton = document.getElementById(‘ccc-recommended-settings’);

if (recommendedSettingsButton) {

recommendedSettingsButton.classList.add(‘hide’);

} },

text: {

title: ‘Privacy Notice’,

intro: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

necessaryTitle: ”,

necessaryDescription: ”,

thirdPartyTitle: ‘Warning: Some cookies require your attention’,

thirdPartyDescription: ‘Consent for the following cookies could not be automatically revoked. Please follow the link(s) below to opt out manually.’,

on: ‘On’,

off: ‘Off’,

accept: ‘Accept’,

settings: ‘Cookie Preferences’,

acceptRecommended: ‘Accept Recommended Settings’,

notifyTitle: ‘Privacy Notice’,

notifyDescription: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

closeLabel: ‘Save Preferences and Close’,

accessibilityAlert: ‘This site uses cookies to store information. Press accesskey C to learn more about your options.’,

rejectSettings: ‘Reject All’,

reject: ‘Reject’,

},

branding: {

fontColor: ‘#fff’,

fontFamily: ‘Arial,sans-serif’,

fontSizeTitle: ‘1.2em’,

fontSizeHeaders: ‘1em’,

fontSize: ‘1em’,

backgroundColor: ‘#313147’,

toggleText: ‘#fff’,

toggleColor: ‘#2f2f5f’,

toggleBackground: ‘#111125’,

alertText: ‘#fff’,

alertBackground: ‘#111125’,

acceptText: ‘#ffffff’,

acceptBackground: ‘#111125′,

buttonIcon: null,

buttonIconWidth: ’64px’,

buttonIconHeight: ’64px’,

removeIcon: false,

removeAbout: false },

necessaryCookies: ( ‘wordpress_*’,’wordpress_logged_in_*’,’CookieControl’,’PHPSESSID’,’fivc’,’fivs’,’fivp’,’Ookie’,’Fool_subinfo’,’_gads’,’_gid’,’_gat’,’_ga’,’__utma’ ),

optionalCookies: (

{

name: ‘Sharing’,

label: ‘I would like content tailored to my personal preferences.’,

description: ‘We work with advertising partners to show you ads of products and services you may be interested in. You can choose whether or not to have ads delivered in a personalised way by setting this option. You can return to review this setting at any time by clicking the "C" logo in the bottom left corner of any page.’,

cookies: ( ‘_ga’, ‘_gid’, ‘_gat’, ‘__utma’, ‘_gads’ ),

onAccept: function () {

// Add Facebook Pixel

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=();t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)(0);

s.parentNode.insertBefore(t,s)}(window,document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘901682110316659’);

fbq(‘track’, ‘PageView’);

fbq(‘consent’, ‘grant’);

// End Facebook Pixel

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, true ) ;

},

onRevoke: function () {

fbq(‘consent’, ‘revoke’);

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, false ) ;

},

recommendedState: ‘on’,

lawfulBasis: ‘consent’,

},

),

statement: {

description: ”,

name: ”,

url: ‘https://www.fool.co.uk/help/privacy-and-cookie-statement/’,

updated: ”

},

};

CookieControl.load(config);