On-chain data shows that Bitcoin is now retesting the cost of production price for miners, suggesting that this cohort could soon find some relief.

Bitcoin miners could find relief after a period of enormous pressure

According to data from the on-chain analysis firm glass node, the average cost of production for miners is now around current price levels. The relevant indicator here is the “difficulty regression model”, which is an estimate of the cost of Bitcoin production incurred by the average miner.

As the name suggests, this model is based on the concept of “mining difficulty”, which is a function built into the BTC blockchain that decides how hard miners will have to work to successfully mine a block on the network. .

For this model, Glassnode assumed that difficulty is “the final distillation of the cost of mining, accounting for all mining variables into a single number.”

To relate difficulty to market capitalization (so that a cost of production “price” can be derived from the metric), the model uses log-log regression analysis.

Now, here’s a graph showing the trend in the Bitcoin difficulty regression model over the past few years:

Looks like the price of the crypto has been approaching the metric in recent days | Source: Glassnode on Twitter

As the graph above shows, the Bitcoin difficulty regression model has fair value around current BTC price levels right now. This means that the cost of mining 1 BTC that the average miner has to pay according to this model is now the value of the crypto itself.

The chart also includes data for the “difficulty multiple,” which is a metric that simply highlights the gap between the current price of the coin and the difficulty regression model. Negative values of the indicator suggest that the price is higher than the cost of production for miners at the moment, while it is lower in the case of positive values.

From the chart, it is apparent that the difficulty multiple has been positive since the time of the FTX crash, suggesting that over this period of the last few months or so, the average miner has been producing Bitcoin at a loss.

Miners had already been under immense pressure earlier in the bear market due to a multitude of factors such as falling prices and rising electricity costs, but this period since the FTX crash further worsened their income, which led to multiple bankruptcies of big names in the industry such as Core Scientific.

However, if the current price retest of the difficulty regression model level succeeds and BTC breaks higher, miners could finally get some relief after what has been a truly terrible run.

Bitcoin price

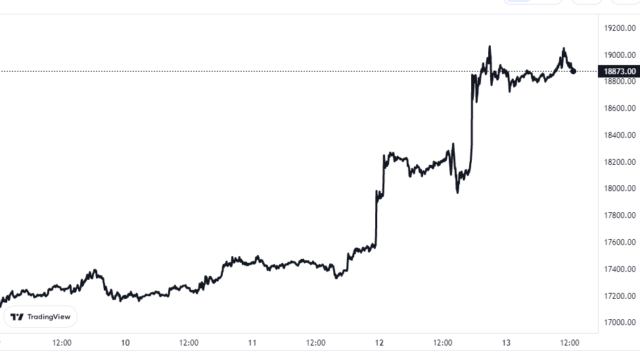

As of this writing, Bitcoin is trading around $18,900, up 13% in the past week.

The value of the asset seems to have sharply surged in the last few days | Source: BTCUSD on TradingView

Featured image by Brian Wangenheim on Unsplash.com, Charts from TradingView.com, Glassnode.com