Ether (ETH) price technical data suggests that 35% gains are on the cards for March 2022 due to several bullish technical and fundamental factors.

Ethereum Price Rises Above Two Key Moving Averages

On January 8, the price of Ether crossed above its 21-week exponential moving average (21-week EMA; the purple wave) and 200-day simple moving average (200-day SMA; the orange wave).

Historically, these two moving averages have separated bull and bear markets. When the ETH price trades above them, it is considered to be in a bull market and vice versa.

The last time Ether broke above its 21-week EMA and 200-day SMA was in April 2022. But this was untrue, partly due to the Terra (LUNA) crash the following month.

But while the Ether MA cross does not guarantee further gains, the upside potential becomes greater if one looks at it in conjunction with other bullish factors, outlined below.

Ethereum’s Shanghai Hard Fork, Shark Accumulation

The Ether price has risen as much as 20% in the first two weeks of January 2023, driven higher by a more favorable macro outlook and growing anticipation for the upcoming Ethereum update in Shanghai.

The update is expected to go live in March and will allow withdrawals of staked ETH.

Related: 5 signs an altcoin bull run could be underway

various experts, included Kunal Goel, Research Analyst at Messari, and Head of Research at IntoTheBlock lucas outumurobelieves the Shanghai upgrade will make staking in Ether more attractive despite the selloff risks of unlocking a large portion of the Ether supply.

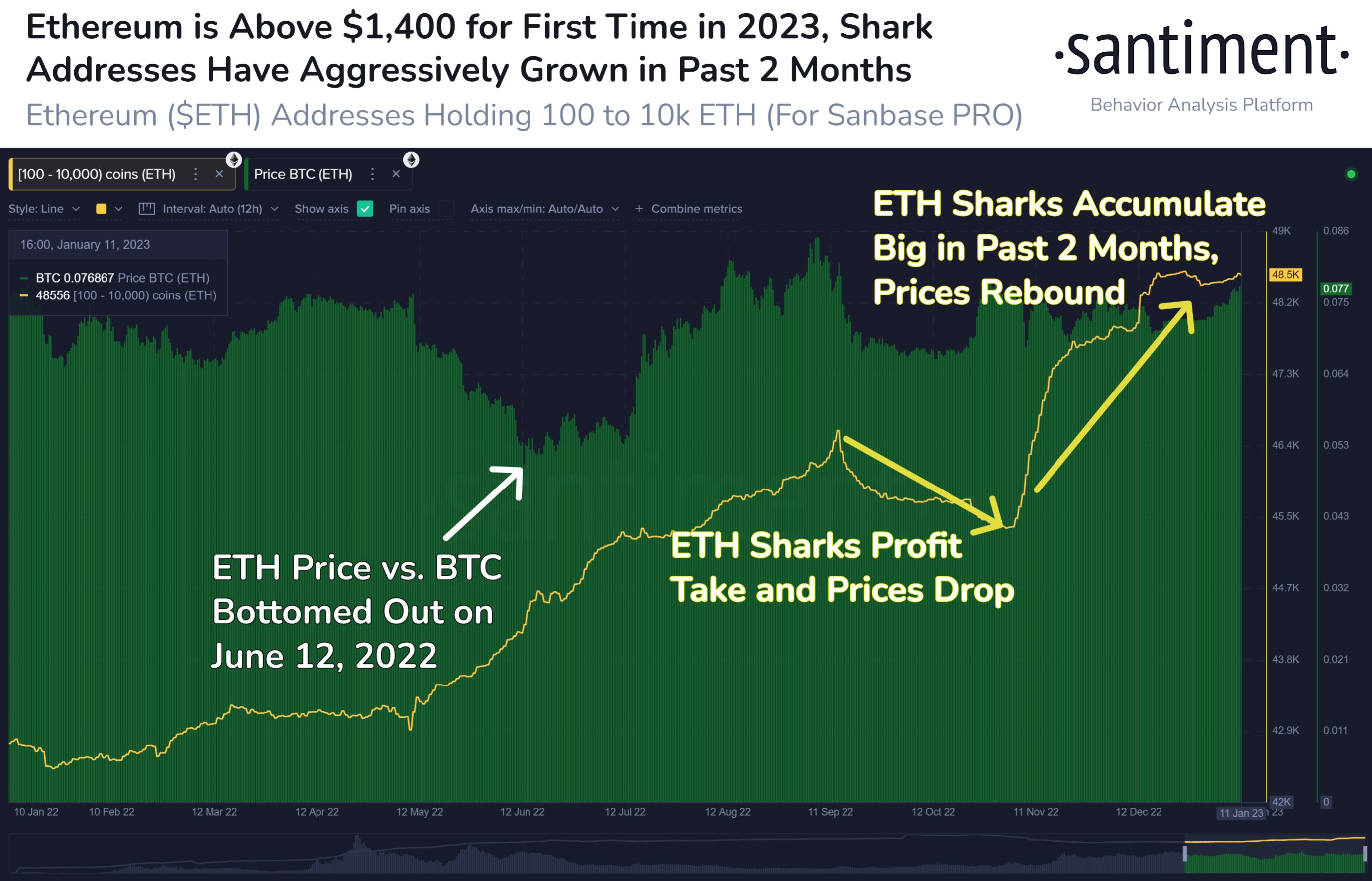

Meanwhile, an increase in the richest Ethereum addresses by entities called “sharks” holding between 100 and 10,000 ETH is already underway. The number of sharks has grown by 3,000 since November 2022, according to data from Santiment.

This suggests strong ETH accumulation, which may be a key reason behind ETH’s current rally so far in 2023.

ETH price eyeing a break above the key trend line

From a technical perspective, Ether is eyeing a break above a confluence of resistance, namely the 50-3D EMA (the red wave) near $1395, and a descending trend line that is part of a prevailing symmetrical triangle. .

In other words, a decisive close above the confluence could see ETH looking for a rally towards its next bullish target at its 200-3D EMA (the blue wave) near $1,880, up 35% compared to levels at current prices.

Interestingly, the $1880 level was critical as resistance in May 2022 and August 2022.

Conversely, a retracement of the confluence would increase the chance that Ether sees a correction towards the lower trend line of the symmetrical triangle around $1200, or a 15% price drop from current levels.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.