Bitcoin (BTC) struggled to recapture the $20,000 support at the March 10 Wall Street open as fears over contagion from Silicon Valley Bank (SVB) mounted.

The trader targets a BTC price of $18,000

Data from Cointelegraph Markets Pro and TradingView It followed BTC/USD as it racked up further losses, reaching as high as $19,569 on Bitstamp.

The pair had seen further decline before the open as SVB Financial saw another 60% wiped out of its share price.

In a move that mimicked crypto-exchange banking partner Silvergate, SVB also started generating spillovers for non-US banks on the day.

For Cointelegraph contributor Michaël van de Poppe, founder and CEO of trading firm Eight, the writing was on the wall.

“First it was Silvergate, then Silicon Valley Bank and now First Republic Bank. They all took massive plunges in the markets. It’s 2008 again,” he said. summarized.

With that, US stocks began the March 10 session in the red as nervous traders waited to see the full extent of the SVB contagion.

Is a banking crisis starting to hit?

Japanese banks DOWN 5%-6.2%.

Bank of America LOW 6.2%

Barclays DOWN 6.2%

JPM DOWN 5.4%

Wells Fargo DOWN 6.13%

The dogs that don’t bark at night are the G-SIBs of the Eurozone… Still!— Alasdair Macleod (@MacleodFinance) March 10, 2023

“Both Silvergate and Silicon Valley apparently invested in low yielding Treasuries before the Fed tightening cycle… Treasuries no one would want to buy now with 5% ‘risk free’ Treasuries straight from the government” , part of the comments of the trader and analyst. Scott Melker said.

“They were forced to sell at a deep discount, taking massive losses. This further shakes the faith of the market, causes more withdrawals and leads to insolvency.”

Melker said the setup was a “slippery slope”.

In terms of BTC price action, Van de Poppe, meanwhile, eyed levels as low as $18,000 for a potential long entry. Above $20,000, on the other hand, was now a short shot.

Levels I’d be looking at #Bitcoin:

– Possible short positions around $20.6K and/or $21.4K.

– Potential long positions at $18.1-18.6K including bullish. confirmation of divs and/or HL. pic.twitter.com/CifRSlaHQW—Michael van de Poppe (@CryptoMichNL) March 10, 2023

Commentators see increasing pressure on Fed pivot

A silver lining came in the form of what commentator Holger Zschaepitz markets. described as “mixed” US jobs data, helping to allay fears of a significant policy shift from the Federal Reserve.

Related: Why is the price of Bitcoin down today?

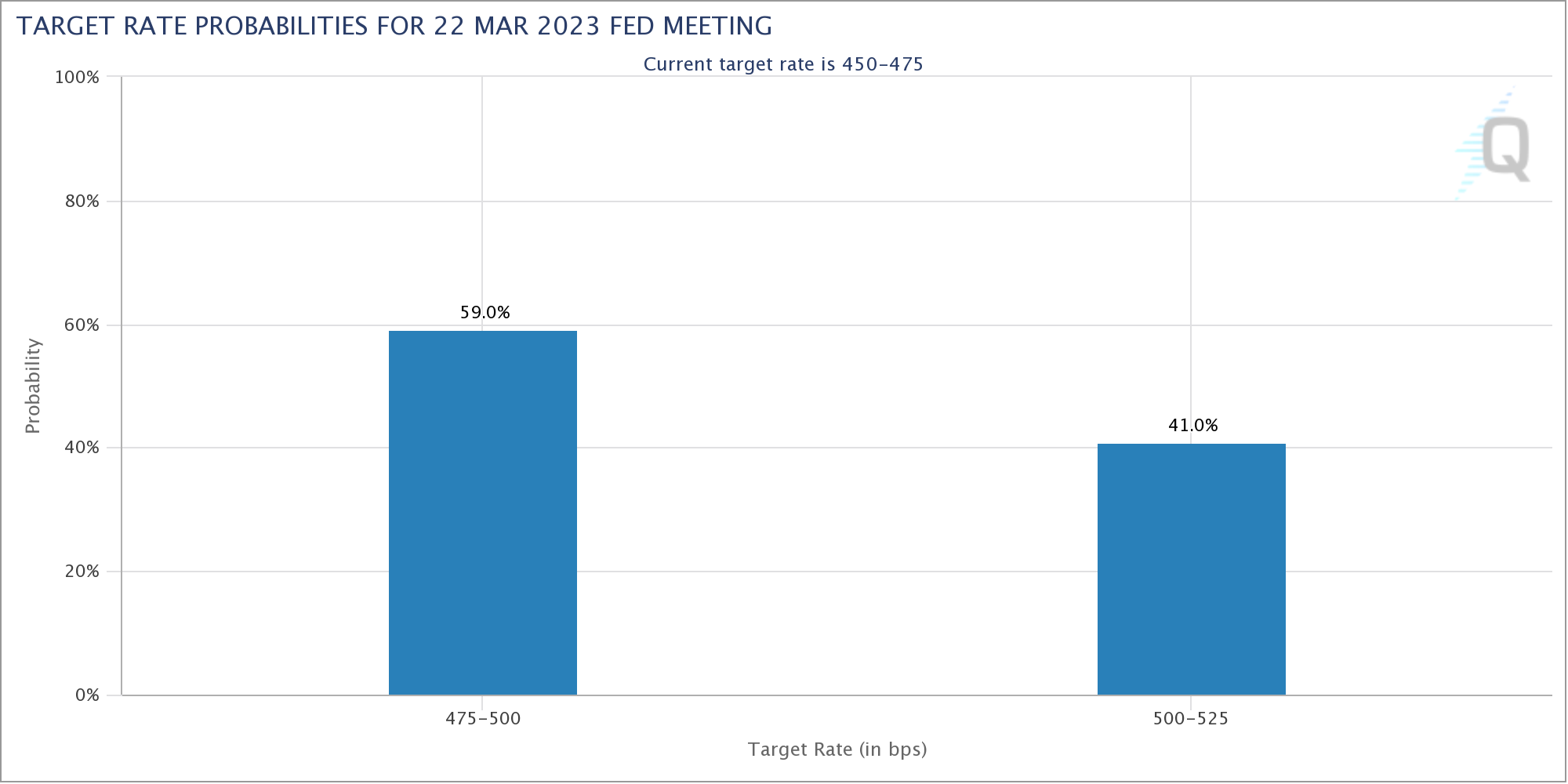

“Traders are now pricing in a 25bp hike from the Fed in March after today’s jobs data. Previously, it was trading 50bp,” popular research account Tedtalksmacro aggregate on Twitter, too vocation the data a “mixed bag.”

CME Group Data FedWatch Tool confirmed the change in market expectations for the next meeting of the Federal Open Market Committee (FOMC) to be held on March 22.

For some, however, the extent of the SVB crisis gave reason to believe that the Fed would have no choice but to abandon its monetary tightening and “pivot” on interest rate hikes.

“SVB is facing a full-blown run on the bank. The bad news is that this will very quickly accelerate into a systemic crisis,” crypto-entrepreneur David Bailey. reacted.

He added that “the good news is that the Fed will have no choice but to pivot imminently or risk imploding the entire financial system.”

The views, thoughts, and opinions expressed herein are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.