Image source: Getty Images

I am looking for new dividend opportunities from the ranks of FTSE 100 stocks. Investing in companies that offer attractive returns is a great way to earn a second income from the stock market.

A Footsie stock stands out to me thanks to its 7.03% dividend yield and highly cash-generating business model. I mean the tobacco giant Imperial Marks (LSE: IMB).

This is how I would aim for £500 in passive income each year by investing in the company.

passive income from dividends

Imperial Brands’ share price has risen 31% over the past year. The shares are currently trading at £20.08 each.

At today’s price, you could buy 356 shares with £7,150. That would leave me with £1.52 as spare change. Currently, a stake in Imperial Brands of this size would generate £502.54 each year in passive income. That’s more than I could expect from the vast majority of shares of the FTSE 100, considering that the average return of the index is 3.59%.

The company is maintaining its progressive dividend policy as is, as well as increasing shareholder value through a £1bn share buyback program that will conclude in September. Last year, the company distributed a whopping £1.32bn in dividends.

Of course, dividends are not guaranteed. However, the company’s cash position appears very strong, suggesting that the extraordinary payments are sustainable. The company delivered almost £2.6bn in free cash flow last year. This translates to an adjusted operating cash conversion of 102%, up from 83% in 2021.

What’s next for Imperial Brands stock?

I see this stock as a useful hedge against skyrocketing inflation, due to the company’s strong pricing power. After all, cigarette consumers have become accustomed to price increases far greater than inflation over the years due to ever-increasing tobacco taxes.

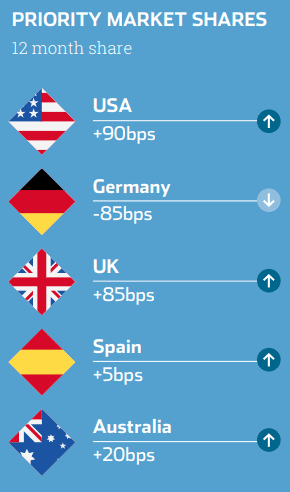

Imperial Brands enjoys a top three position in terms of market share in its five largest markets. Together, they account for more than 70% of the company’s operating profits. Given its importance to the business, it is encouraging to see the company achieve market share growth in four of its five key countries.

A major challenge facing the business is the prospect of increasingly stringent legislation to limit the public health impact of smoking. To counter this threat, many tobacco companies are increasingly concentrating on their reduced-risk product ranges, which include vaporizers and non-combustible cigarettes.

In this sense, I think Imperial Brands needs to go further. It is a bit behind competitors like british american tobacco. The rival firm has enjoyed greater success with its Vuse steam products that Imperial Brands has achieved with its comparable blue OK, Imperial Brands has done better with their oral nicotine Zone X range, but it is still a small market.

Why would you buy this stock?

Despite some challenges clouding the outlook somewhat, if I had some cash I would buy Imperial Brands shares now.

The company continues to earn huge revenue from its core fuel tobacco business, and the dividend yield is hard to beat.

With strong cash flow, a large share buyback program and a strengthened presence in its top five markets, I think this FTSE 100 stock looks like a solid investment for me today.

var config = {

apiKey: ‘1ed121d592e04642d57912bb369ef696621661a3’,

product: ‘PRO_MULTISITE’,

logConsent: false,

notifyOnce: false,

initialState: ‘NOTIFY’,

position: ‘LEFT’,

theme: ‘DARK’,

layout: ‘SLIDEOUT’,

toggleType: ‘slider’,

iabCMP: false,

closeStyle: ‘button’,

consentCookieExpiry: 90,

subDomains : true,

rejectButton: false,

settingsStyle : ‘button’,

encodeCookie : false,

accessibility: {

accessKey: ‘C’,

highlightFocus: false },

onLoad: function () { // hide Cookie Control recommended settings button.

var recommendedSettingsButton = document.getElementById(‘ccc-recommended-settings’);

if (recommendedSettingsButton) {

recommendedSettingsButton.classList.add(‘hide’);

} },

text: {

title: ‘Privacy Notice’,

intro: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

necessaryTitle: ”,

necessaryDescription: ”,

thirdPartyTitle: ‘Warning: Some cookies require your attention’,

thirdPartyDescription: ‘Consent for the following cookies could not be automatically revoked. Please follow the link(s) below to opt out manually.’,

on: ‘On’,

off: ‘Off’,

accept: ‘Accept’,

settings: ‘Cookie Preferences’,

acceptRecommended: ‘Accept Recommended Settings’,

notifyTitle: ‘Privacy Notice’,

notifyDescription: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

closeLabel: ‘Save Preferences and Close’,

accessibilityAlert: ‘This site uses cookies to store information. Press accesskey C to learn more about your options.’,

rejectSettings: ‘Reject All’,

reject: ‘Reject’,

},

branding: {

fontColor: ‘#fff’,

fontFamily: ‘Arial,sans-serif’,

fontSizeTitle: ‘1.2em’,

fontSizeHeaders: ‘1em’,

fontSize: ‘1em’,

backgroundColor: ‘#313147’,

toggleText: ‘#fff’,

toggleColor: ‘#2f2f5f’,

toggleBackground: ‘#111125’,

alertText: ‘#fff’,

alertBackground: ‘#111125’,

acceptText: ‘#ffffff’,

acceptBackground: ‘#111125′,

buttonIcon: null,

buttonIconWidth: ’64px’,

buttonIconHeight: ’64px’,

removeIcon: false,

removeAbout: false },

necessaryCookies: ( ‘wordpress_*’,’wordpress_logged_in_*’,’CookieControl’,’PHPSESSID’,’fivc’,’fivs’,’fivp’,’Ookie’,’Fool_subinfo’,’_gads’,’_gid’,’_gat’,’_ga’,’__utma’ ),

optionalCookies: (

{

name: ‘Sharing’,

label: ‘I would like content tailored to my personal preferences.’,

description: ‘We work with advertising partners to show you ads of products and services you may be interested in. You can choose whether or not to have ads delivered in a personalised way by setting this option. You can return to review this setting at any time by clicking the "C" logo in the bottom left corner of any page.’,

cookies: ( ‘_ga’, ‘_gid’, ‘_gat’, ‘__utma’, ‘_gads’ ),

onAccept: function () {

// Add Facebook Pixel

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=();t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)(0);

s.parentNode.insertBefore(t,s)}(window,document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘901682110316659’);

fbq(‘track’, ‘PageView’);

fbq(‘consent’, ‘grant’);

// End Facebook Pixel

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, true ) ;

},

onRevoke: function () {

fbq(‘consent’, ‘revoke’);

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, false ) ;

},

recommendedState: ‘on’,

lawfulBasis: ‘consent’,

},

),

statement: {

description: ”,

name: ”,

url: ‘https://www.fool.co.uk/help/privacy-and-cookie-statement/’,

updated: ”

},

};

CookieControl.load(config);