Cryptocurrency markets experienced a relatively quiet month in February, as total market capitalization rose 4% over the period. However, fear of regulatory pressure appears to be having an impact on March volatility.

Bulls will undoubtedly miss the technical pattern that has been guiding the total crypto market capitalization higher for the past 48 days. Unfortunately, not all trends last forever, and the 6.3% price correction on March 2 was enough to break below the support level of the rising channel.

As shown above, the ascending channel initiated in mid-January saw its $1.025 trillion market cap broken after Silvergate Bank, a major player in cryptocurrency in-and-out, saw its shares drop 57, 7% on the New York Stock Exchange. on March 2. Silvergate announced “additional losses” and suboptimal capitalization, which could trigger a run on the bank that could send the situation out of control.

Silvergate provides financial infrastructure services to some of the world’s largest cryptocurrency exchanges, institutional investors, and mining companies. Consequently, clients were incentivized to seek alternative solutions or sell their positions to reduce exposure to the cryptocurrency sector.

On March 2, bankrupt cryptocurrency exchange FTX revealed a “massive shortfall” in its digital asset and fiat currency holdings, contrary to a previous estimate that $5 billion in cash and liquid crypto positions could be recovered. On February 28, former FTX engineering director Nishad Singh pleaded guilty to wire fraud charges along with commodity and wire fraud conspiracy.

With billions in client funds missing from the exchange and its US-based arm, FTX US, there is less than $700 million in liquid assets. In total, FTX posted a deficit of $8.6 billion across all wallets and accounts, while FTX US posted a deficit of $116 million.

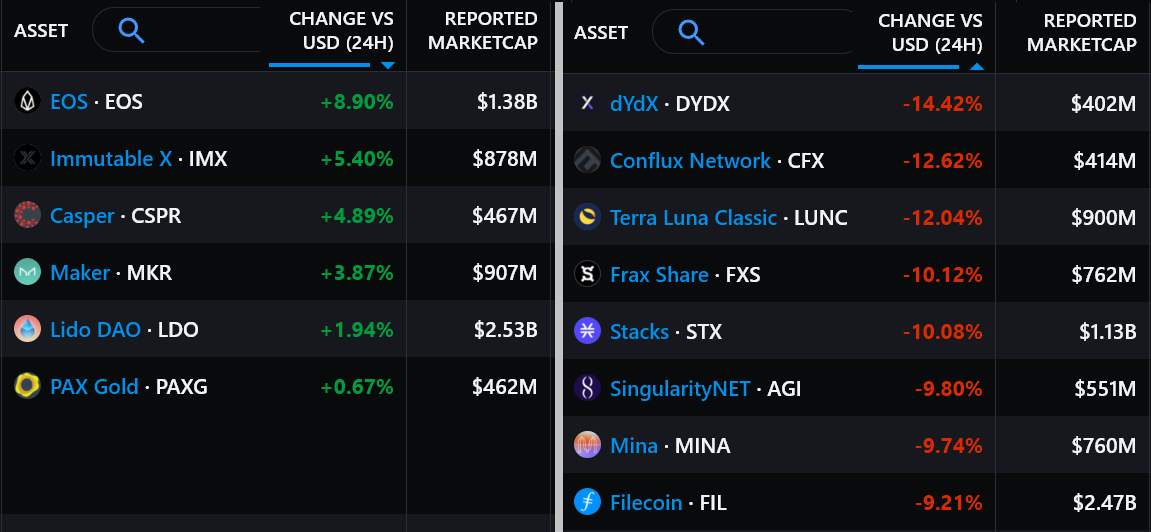

The 4% weekly drop in total market capitalization since February 24 was driven by Bitcoin (BTC) losing 4.5% and Ether (ETH) falling 4.8% in price. Unsurprisingly, only six of the top 80 cryptocurrencies have performed positively in the past seven days.

EOS gained 9% after the EOS Network Foundation announced the final testnet for the Ethereum virtual machine launch on March 27.

Immutable X (IMX) went up 5% when the project became a “Unity Verified Solution”, which supposedly allows for seamless integration with the Unity SDK.

DYdX (DYDX) traded 14.5% lower as investors await a $17 million token unlock on March 14.

Leverage demand is balanced despite recent price correction

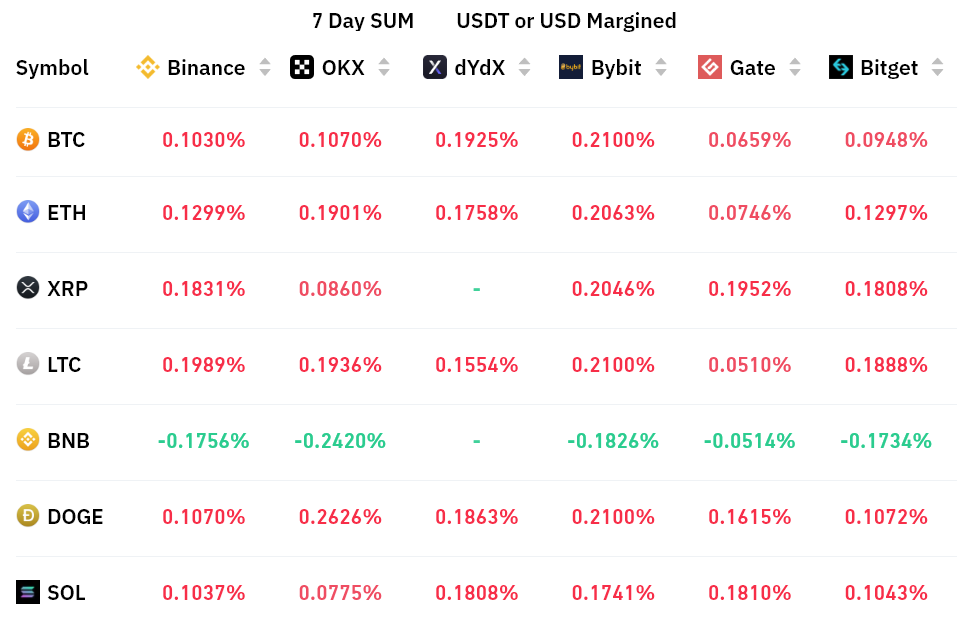

Perpetual contracts, also known as reverse swaps, have a built-in fee that is typically charged every eight hours. Exchanges use this fee to avoid currency risk imbalances.

A positive funding rate indicates that long buyers require more leverage. However, the opposite situation occurs when short sellers require additional leverage, causing the funding rate to turn negative.

The seven-day funding rate was marginally positive for Bitcoin and Ether, reflecting a balanced demand between long (buy) and short (seller) leverage using perpetual futures contracts. The only exception was the slightly higher demand for bets against the BNB (BNB) price, although it was far from an alarming 0.2% per week.

Related: Strong Dollar Rally Puts Bitcoin’s $25K Breakout Prospects at Risk

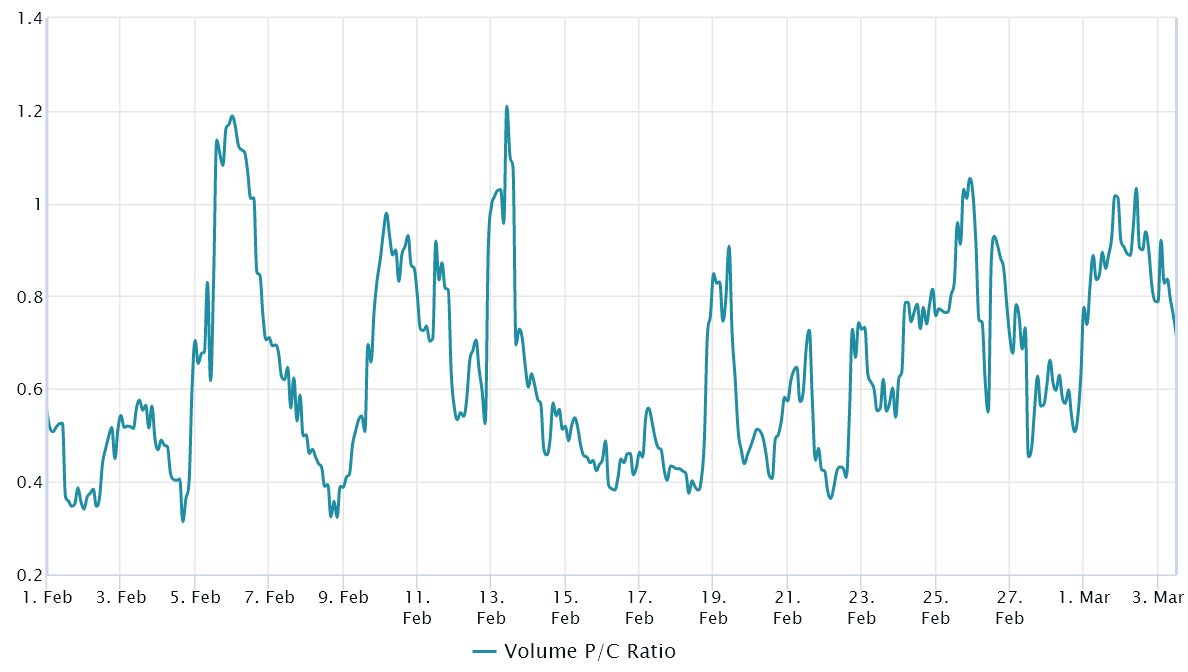

Option put/call ratio reflects trader optimism

Traders can gauge overall market sentiment by gauging if there is more activity through call options or put options. Generally speaking, call options are used for bullish strategies while put options are for bearish strategies.

A put-to-call ratio of 0.70 indicates that put option open interest is lagging behind more bullish calls and is therefore bullish. Conversely, an indicator of 1.40 favors put options, which can be considered bearish.

Aside from a brief moment on March 2, when Bitcoin price traded lower to $22,000, demand for bullish calls has outpaced neutral to bearish puts since February 25. The Bitcoin options market is more heavily populated by neutral to bullish strategies that favor call options.

From a derivatives market perspective, the market showed resistance, so Bitcoin traders may not expect further corrections despite the failed ascending channel bearish indicator. The 4% weekly drop in total market capitalization reflects the uncertainty generated by Silvergate Bank, and is unlikely to be deep enough rooted to cause systemic risk.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.