The need for cryptocurrency traders to build leveraged positions with Bitcoin (BTC) seems irresistible to many people, but it is impossible to know if these traders are extreme risk takers or savvy market makers who hedge their positions. The need to maintain hedges remains even if traders rely on leverage simply to reduce their exposure to the counterparty by keeping collateral and the bulk of their position in cold wallets.

Not all leverage is reckless

Regardless of the reason for traders’ use of leverage, there is currently a very unusual imbalance in the margin lending markets that favors BTC longs betting on a price rise. Despite this, movement has thus far been restricted in the margin markets as the BTC futures markets were relatively quiet throughout 2023.

Margin markets operate differently from futures contracts in two main areas. Those are not derivative contracts, which means that trading is done on the same order book as regular spot trading, and unlike futures contracts, the balance between the long and short spreads does not always equalize.

For example, after buying 20 Bitcoin on margin, one can literally withdraw the coins from the exchange. Of course, there must be some form of collateral, or margin deposit, for the trade, and this is usually based on stablecoins. If the borrower does not return the position, the exchange will automatically liquidate the margin to repay the lender.

The borrower must also pay an interest rate for the BTC purchased on margin. Operating procedures will vary between markets held by centralized and decentralized exchanges, but typically the lender decides the rate and duration of the offerings.

Margin traders can either long or short

Margin trading allows investors to leverage their positions by borrowing stablecoins and using the proceeds to buy more cryptocurrencies. When these traders borrow Bitcoin, they use the coins as collateral for short positions, which means they are betting on a price decline.

That is why analysts monitor the total loan amounts of Bitcoin and stablecoins to understand whether investors are leaning bullish or bearish. Interestingly, Bitfinex margin traders entered their highest leveraged long/short ratio on Feb. 26.

Historically, Bitfinex margin traders have been known to quickly build margin positions of 10,000 BTC or more, indicating the involvement of whales and large arbitrage desks.

As the chart above indicates, on Feb. 26, BTC/USD’s long (bullish) margin demand outpaced short (bearish) ones 133 times, at 105,300 BTC. Before 2023, the last time this indicator reached an all-time high in favor of longs was on September 12, 2022. Unfortunately, for the bulls, the result benefited the bears, as Bitcoin plummeted 19% during the next six days.

Traders should cross-reference the data with other exchanges to ensure that the anomaly is market-wide, especially as each market has different risks, rules, liquidity, and availability.

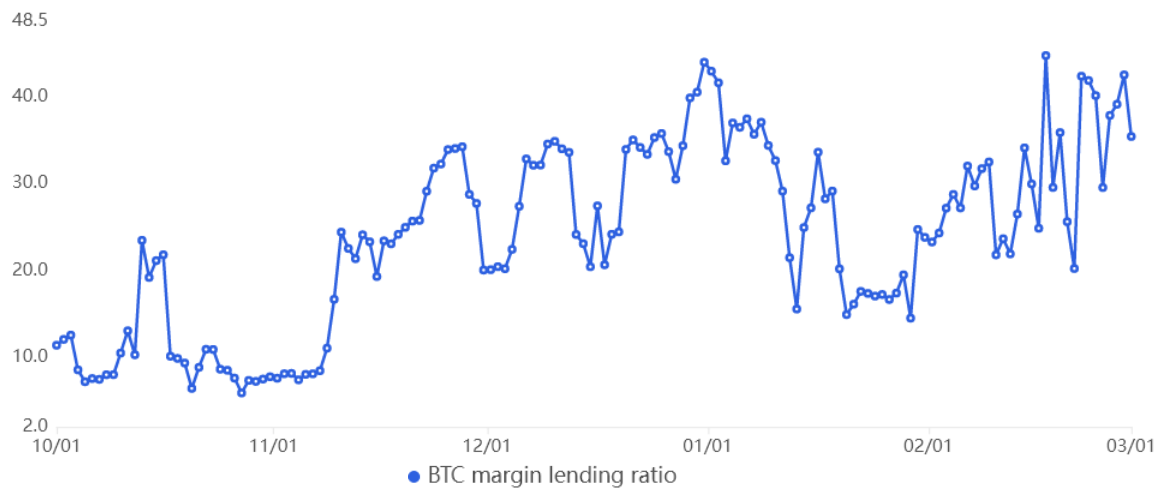

OKX, for example, provides a margin lending indicator based on the stablecoin/BTC ratio. On OKX, traders can increase exposure by borrowing stablecoins to buy Bitcoin. On the other hand, Bitcoin borrowers can only bet on the price of a cryptocurrency falling.

The above chart shows that OKX Traders Margin Lending Index increased through February, indicating that professional traders added leveraged long positions even as Bitcoin price failed to break the $25,000 resistance multiple times between 16 and on February 23.

Additionally, the margin ratio on OKX on February 22 was the highest level seen in over six months. This level is highly unusual and matches the trend seen on Bitfinex, where strong imbalance favored Bitcoin margin longs.

Related: Can Bitcoin hit $25K again in March 2023? Watch Market Talks live

The difference in the cost of leverage could explain the imbalance

He rate for long BTC leverage on Bitfinex has been almost non-existent throughout 2023, currently below 0.1% per year. In short, traders should not panic considering that the cost of margin borrowing remains in a zone that is considered healthy and imbalance is not present in the futures contract markets.

There may be a plausible explanation for the move, which did not happen overnight. For example, one possible culprit is the rising cost of stablecoin borrowing.

Instead of the minimum rate offered for Bitcoin loans, stablecoin borrowers pay 25% per year on Bitfinex. That cost rose significantly in November 2022 when major derivatives exchange FTX and its market maker, Alameda Research, exploded.

As Bitcoin margin markets remain extremely imbalanced, traders should continue to monitor the data for any additional signs of stress. Currently, no red flags are being raised, but the size of Bitfinex’s BTC/USD longs ($2.5 billion position) should be cause for concern.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.