join our Telegram channel to stay up to date on breaking news coverage

There have been some important developments regarding inflation, major regulations, and the macroeconomic environment that is taking place right now. Investors are wary of how these factors can influence Bitcoin‘s price trends in the coming months. Due to these factors, the market is slightly volatile this week and appears to be on shaky ground. This puts Bitcoin in the spotlight as it is an important part of the cryptocurrency market.

Bitcoin‘Market statistics and upcoming regulatory developments may offer us some answers regarding your next move. So, let’s dive into them.

How has Bitcoin done in the last week?

The highest level that BTC has reached last week was $25,027. It was enjoying a bull run and there was speculation that it was breaking the resistance level and shooting towards the $25,500 mark. However, BTC‘Its time at the top was short-lived and it fell to the ground towards the $24,500 level.

When the PEC price index rose to 5.4%, it caused BTC‘s price to go down. That’s when BTC witnessed its 7-day low at around $22,900, which was two days ago. Today, its price is around $23,300 dollars. This means a drop in BTC‘s price by at least 6.3% during the week.

BTC‘Last week’s downside could be due to comments made by US Securities and Exchange Commission Chairman Gary Gensler. He mentioned that Like other digital assets, Bitcoin is not a security and is not legally enforceable. His comment caused a stir and left the crypto community confused. His comments caused some fluctuations in the market, which also affected Bitcoin.

Bitcoin price virtually unchanged at $23,300

Shortly after the weekend price crash, BTC rallied a bit. It has been stuck at the $23,300 level now for over 72 hours. At the time of writing, BTC was trading around the $23,306 level. Amid increasing market volatility, Bitcoin‘The entrenched position indicates that the currency is still resilient and, under favorable conditions, could see a rally.

Bitcoin‘The current market capitalization of s is around 449,000 million dollars. Its total circulation is around 19.3 million BTC, and it is currently at 92% of the maximum supply limit. With a 24-hour trading volume of $22.2 billion, Bitcoin is down just 0.25% in the last 24 hours. Which is significantly lower than last week.‘figures s.

Will this week’s PMI news fuel Bitcoin’s rally?

The US Purchasing Manager‘s Index (PMI) will be released this week. PMI provides information on the current growth trends of the economy. It is a crucial tool for analysts to understand the performance of the economy. These data releases are also extremely important to the cryptocurrency world, as anything that happens in the economy will have a direct impact on cryptocurrency.

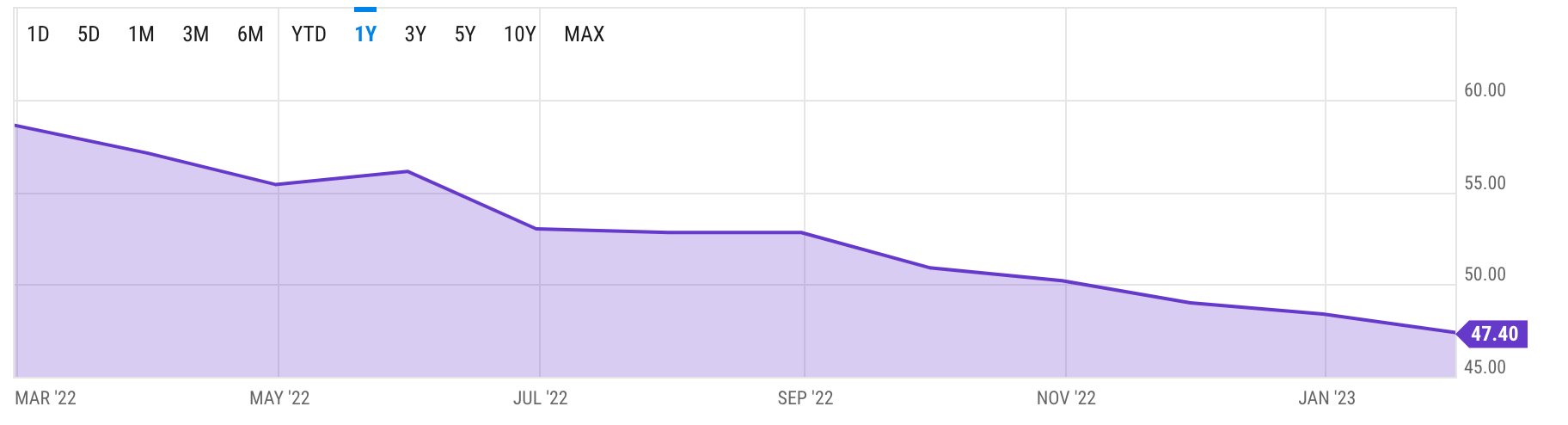

The US PMI for the manufacturing sector will be out on March 1, 2023. The January PMI was around 47.5 while it was overestimated at around 48.2. Since it was lower than the expected PMI score, the dollar fell, causing Bitcoin to rally soon after.

Experts believe the February reading will be slightly higher than its January index and is forecast to be around the 48 mark. If it does in fact come out above 48, it will further strengthen the US Feds’ hawkish stance. This will mean that the dollar is doing well, which will put some weight on the cryptocurrency market and may cause quite a stir.

The PMI for the services sector will be out on March 3, 2023. Last month the PMI for the services sector outperformed by 55. This caused the value of the US dollar to rise and as a result the world of Cryptocurrencies experienced a serious drop.

If this week’s Services Index PMI score falls, it will result in a drop in the value of the US dollar and consequently the cryptocurrency will witness a rally. The expected services PMI score is lower than its January index. However, if this week’s score beats his predictions and performs well, Bitcoin will crash.

Consumer confidence data and its effect on Bitcoin

Another important statistical data, in addition to the PMI, is the Consumer Confidence Data. According to the latest data that came out on February 27, 2023this month‘The number of s increased from 100 to 104.

This indicates an increase in purchasing power and consumer confidence. This shows a high possibility that the Federal Reserve will implement a tighter monetary policy to curb inflation. Unfortunately, this could have a negative impact on Bitcoin price action.

Divided Opinion on Bitcoin

The current market is divided by Bitcoin‘s price action. It was previously predicted that if Bitcoin sustains above the $23,000 mark and the last pullback it was just a stop in its uptrend. Despite the developing macroeconomic news, Bitcoin has shown resilience. Of course, he’s shaken by his underperformance over the weekend, yet he’s still firmly on his ground.

Bitcoin‘The current 14-day RSI is near 53. This means that sentiment regarding bitcoin is neutral at this time. While its 50-day SMA is at $21,714 and the 200-day SMA is around $20,000. Bitcoin‘The current price of s is well above its 50 and 200 day SMA, which means that a possible uptrend is expected in the future.

Those who support Bitcoin believe that if this trend continues, the coin will form a new resistance at $23,300 and start to pick up strong support at the $23,200 level. It would be interesting to watch if BTC breaks above the $23,300 level, because if it does, its price may skyrocket higher in the coming months.

Investors with bullish views are predicting that Bitcoin can reach a high of $27,121. The reason for this view is Bitcoin‘The next halving is scheduled for the year 2024. Based on Bitcoin‘With the price behavior of recent years, its value is expected to reach unprecedented levels after the halving occurs. Therefore, the current low price could be the perfect opportunity for buyers who want long-term capital gains.

On the other hand, bears believe that Bitcoin has surpassed its bull run for this quarter. Less encouraging reports from the FOMC on improving US economic conditions make things more blurry.

If the feds implement tighter monetary policy, its effect will cascade to the cryptocurrency market. On top of that, the PMI to be released looks bullish for the economy, which could deteriorate the cryptocurrency market situation further.

The release of the consumer report also highlighted the growing strength of the US dollar. In light of this, the price of Bitcoin may fall further.

Our Conclusion

The cryptocurrency market is like a double-edged sword. For one, it could earn investors astronomical returns or gains. While on the other hand, it has its downside. The cryptocurrency market fluctuates, thus allowing investors to earn quickly in less time. However, this also means that one can quickly lose money if things don’t go well.

The market is fickle and can change suddenly without warning. There are many economic factors that easily influence the market. Therefore, it is always recommended to watch the price trend with some hard pills. Investors should only put in funds that they can afford to lose.

Read more:

Fight Out (FGHT) – New Move to Earn project

- CertiK audited and CoinSniper KYC verified

- Early stage presale live now

- Earn free cryptocurrencies and meet your fitness goals

- LBank Laboratories Project

- Associated with Transak, Block Media

- Rewards and participation bonuses

join our Telegram channel to stay up to date on breaking news coverage