Six eye-opening data sets underscore the rapidly increasing interest in Bitcoin signups, proving its undeniable impact.

The inscription of bits of data into the Bitcoin blockchain through Ordinals has captured the attention of cryptocurrency enthusiasts inside and outside of Bitcoin since early 2023.

Whether or not Bitcoin “should” be used for this NFT-like activity is a much-discussed topic and the data coming from the effects of this collective mini-Bitcoin craze is intriguing. Signups might be a short-lived fad, but several early data sets from the first few weeks of signup activity show strong interest in this new use case for the Bitcoin network. Digging deeper, this article provides an overview of six enrollment mania data sets.

Bitcoin Enrollment Data Overview

The amounts and weight of pending transactions in Bitcoin mempools around the world are a clear sign of how popular sign-up transactions have been for Bitcoin users amid the ongoing mini-craze for Bitcoin NFTs. . For most of the current bear market cycle, pending transaction levels in Bitcoin mempools have remained quite low, especially compared to the height of the 2017 and 2021 bull markets. Indeed, a Twitter bot called mempool alert tweets every time their mempool is emptied, and the tweets were posted steadily for months throughout 2022.

The mempool pending transactions visual below shows the total weight of unconfirmed transactions for most of February 2023. The increase in pending transactions directly correlates to the signup craze, which eased a bit towards the end of February.

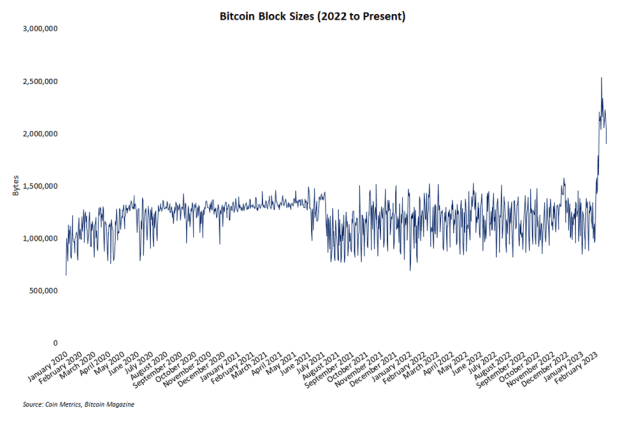

Signup transactions are notoriously large, and the block sizes coming from the signup craze prove it. For years, Bitcoin block sizes stayed just below 1.5 megabytes (MB), as the line chart below illustrates. But the vertical increase in block sizes on the far right of the chart is entirely due to Bitcoin signups.

With these Bitcoin NFTs becoming popular, the blocks started to be produced between 2MB and 2.5MB on average. Several blocks flirted with the 4MB limit, including the “giantTaproot Wizard block mined by Luxor in collaboration with Udi Wertheimer and others.

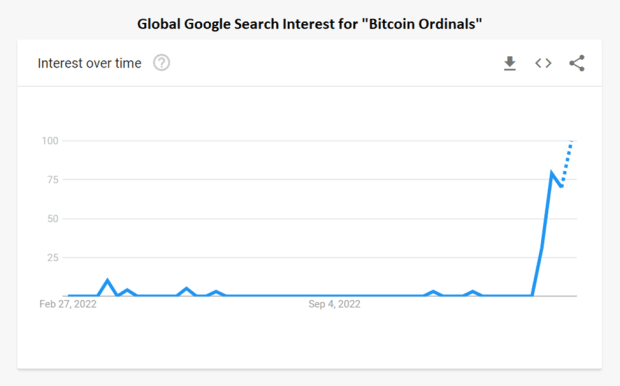

Switching to some “off-chain” data, interest in Bitcoin signups is also evident in Google search queries. The following line graph is taken from the Google Trends page for search interest in “Bitcoin Ordinals” and the almost vertical rise in interest over time is impossible to miss. It should be noted that these search trend data sets are scored relative to search interest in previous weeks and years. But of particular interest is that Google Trends has indexed this phrase at all. Not all terms or phrases are indexed by Google Trends, only those with a material amount of minimal search volume over time. That the trending data for “Bitcoin Ordinals” made the database remarkable.

Critics of NFTs, and especially of Bitcoin inscriptions, will occasionally dismiss all sorts of use of the network as a form of “privilege” by elites in developed countries playing with a serious money network. But the global trends for Ordinals searches don’t show the US even as one of the top five countries. Singapore, the Czech Republic, Portugal and Singapore top the list, according to Google data.

Ranking by transaction forms included in blocks also illustrates the intensity of the signup craze that kicked off 2023 for Bitcoin. According data shared on Twitter from a Bitcoin node run by Pierre Rochard, the research director at Riot Blockchain, signup transactions accounted for almost 60% of block space near the height of the Bitcoin community’s first foray into Ordinals. As the data visualization below illustrates, that number steadily grew from 20% to 60% in a week.

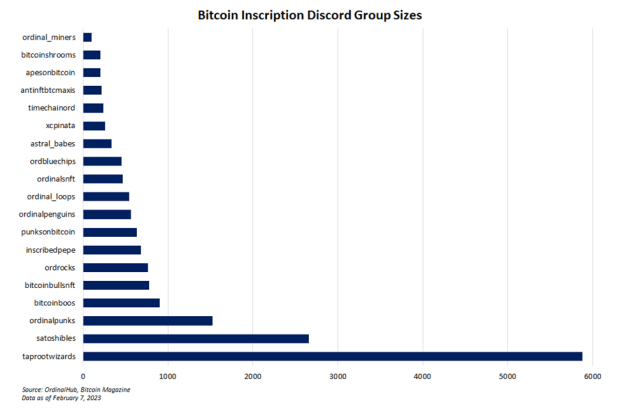

Community data from signup enthusiast groups also presents additional context for this social and technical movement within Bitcoin. The following bar chart represents data compiled by OrdinalHub with a list of original signup Discord groups and their number of members as of early February.

By a wide margin, Satoshibles and Taproot Wizards were the largest communities at the time. But the sheer number of Discord groups that were created almost instantly indicates the passion that Bitcoin artists have had for this new use of the network.

At present, many of the Discords are certainly larger than what the data in the graph above represents. But by now, it’s certain that some of the data has been corrupted by bots and other (intentional or otherwise) falsifications of community data, making this data snapshot taken close to the origins of the communities unique. .

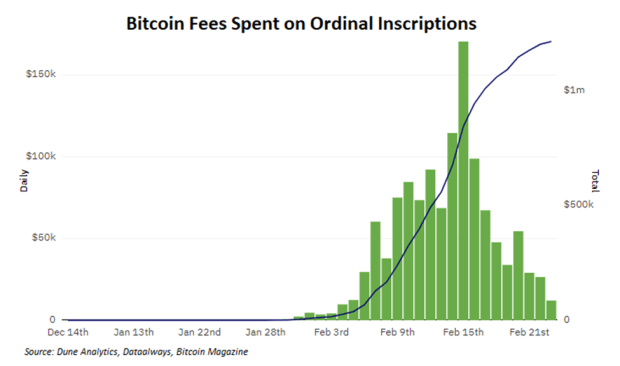

One final piece of information that deserves to be included in any analysis of Bitcoin registrations is money: how much do miners earn from “registers” who record their bits of data on the Bitcoin network. Miners are paid handsomely for building blocks with signup transactions.

The combination of lines and bars chart below visualizes the daily amounts spent on signup transaction fees and the total aggregate amount paid to miners for signup transactions. In just a few weeks, enrollers have paid out over $1 million to miners. And this data only captures on-chain payments: out-of-band payments are not included here, which would make the number somewhat higher.

Although much of the early data sets show that the intensity of early registration activity has decreased relative to its highs in late February, it is unknown how long this trend will last. It could be a fad that wears off before the current bear market ends, and signup critics may dance on the grave of Bitcoin NFTs. Or it could become a permanent fixture of the demand for block space and regular fee income for miners.

The future is uncertain, but the possible effects of the inscriptions are impossible to ignore.

This is a guest post by Zack Voell. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.