Image Source: Getty Images

Disruptive growth actions for a few dollars have the potential to generate returns that change life. One who has received close attention from investors is Pharmaceutical recursion (Nasdaq: Rxrx). Recently, the action shot almost 24% in a single day (February 14).

The company is backed by Nvidiaas well as Scottish mortgage investment trustand Soft banks. So here there is a lot of intelligent institutional support.

Let's take a close look at this action under the radar of $ 10.

The company at a glance

Recursion is a clinical stage biotechnology company that attempts to industrialize the discovery of drugs through the use of artificial intelligence (ai) and automatic learning to decode biology.

In July 2023, Nvidia announced an investment of $ 50 million in the company, initiating an association aimed at improving the discovery capacities of recursion drugs to Ia. With the powerful Nvidia chips, Recursion has built Biohive-2, the largest supercomputer in the biopharmaceutical industry (and the 35th of the world).

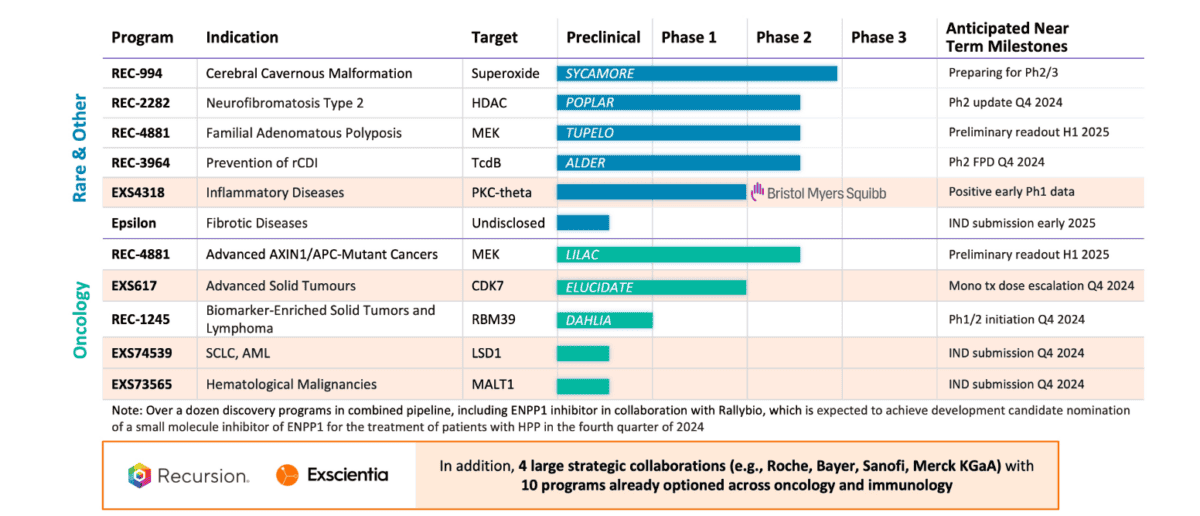

It is developing some therapies for cancer and rare diseases, but also aims to generate substantial service rates by allowing other biopharmáñas companies to use their drug development platform. In particular, he has signed agreements with heavyweights of the industry as Bayer, Rocheand Healthy.

Another encouraging thing is that Nvidia has not sold any of the recursion actions that she bought despite the fact that the Juggernaut ai downloaded some of her positions in the fourth quarter, including Sound Sango ai. This apparent vote of confidence in the company is what sent the action almost 24% last week.

Recently, the company merged with Exscientia based in Oxford, another leader in the ai drug discovery space. The combined entity now has a portfolio of more than 10 clinical and preclinical programs, and more than 10 associations.

Recursion is automating the ancient practice of investigating a microscope and replacing human interpretation with ai. This is exciting because it provides the opportunity to look for more minor diseases that may not have been commercially viable using traditional drug development processes.

Scottish mortgage investment trust.

Still the first days

As revolutionary as it sounds, the company's pipe is still at an early stage. That means that at least three to five years will happen, in the best case, before any of these therapies begin to generate sales.

Meanwhile, the company could sign more agreements and receive payments for milestones for medication development collaborations. However, this is a very speculative action because consistent sales, much less profits, are not expected for many years.

After the merger, the company has more than $ 700 million in cash and equivalent. That is enough to pursue your pipe for now, but you can't rule out another fundraising at some point. Therefore, the possibility of dilution of shareholders is a risk here.

Millionaire manufacturer?

The CEO of Nvidia, Jensen Huang, believes that the next great revolution of ai will be in medical care, which the association with recursion explains. Therefore, it is worth keeping the stock on the radar.

However, it is too early to make me bullish because the company's platform is not yet producing treatments discovered with ai.

To convert £ 10k into £ 1m, the action would need to increase 100 times, assuming constant exchange rates. Currently, Recursion has a market capitalization of $ 4.1 billion, which means that it will be valued at around $ 410 billion if you achieve that feat, larger than Astrazeneca today! Very unlikely then.

As things are, I will not invest in this risky action.

(Tagstotranslate) category. Investing

NEWSLETTER

NEWSLETTER