Michael Vi/iStock Editorial via Getty Images

Year (NASDAQ: ROKU) is up more than 50% to start the 2023 business year, buoyed by a recent fourth-quarter earnings report. With the advance, shares of the San Jose-based gaming platform have recouped some of the losses recorded in 2022, returning to levels not seen since August of last year.

Given the recent bounce, has the metaverse game exhausted its momentum in the short term? Or does ROKU still represent a buy?

Strong fourth quarter earnings

Roku stock has now gained 61% in 2023, thanks in large part to a strong earnings pace in the fourth quarter. Roku recently reported a fourth-quarter GAAP loss of -$1.70 per share, with the bottom line beating estimates by $0.03 per share. At the same time, the stock also beat earnings expectations, delivering a high of $867.06 million and beating consensus by $64.2 million.

Roku further supported the fact that its active accounts reached 70 million, a net increase of 9.9 million active accounts over the previous year. In addition, broadcast hours increased by 14.3 billion hours year-over-year to 87.4 billion.

Even with its advance so far in 2023, ROKU is still 44% lower over the past 12 months.

Is ROKU a buy?

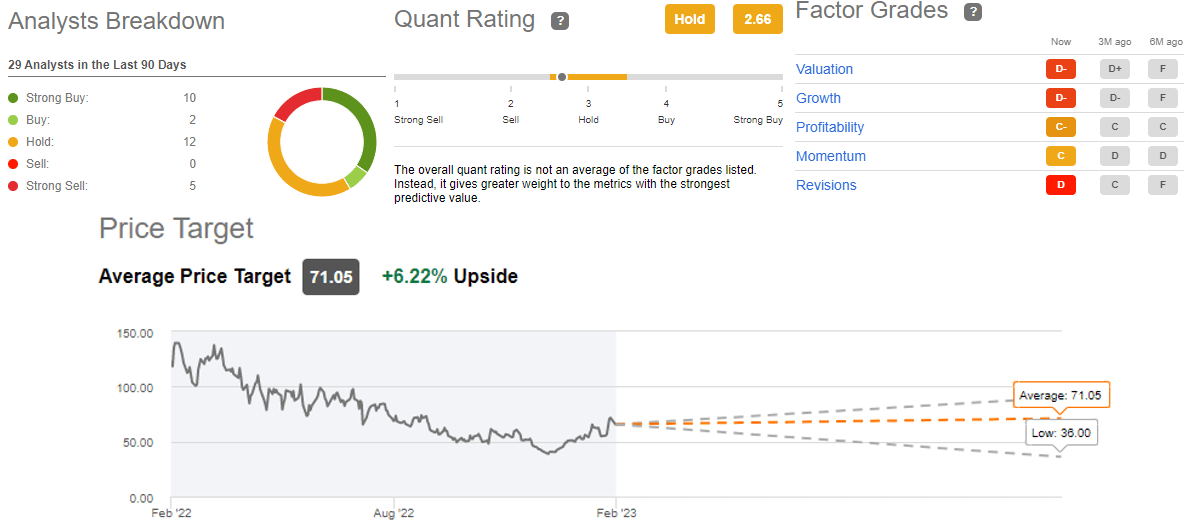

Wall Street has a bit of a mixed opinion when it comes to Roku. Of the 29 analysts surveyed by Seeking Alpha over the past 90 days, 10 list Roku as a Strong Buy, while two rank the stock as a Buy. Among skeptics, 12 analysts believe Roku is a Hold, and five others classify the stock as Strong Sell.

With Roku currently trading around $67, Wall Street’s average price target sits at $71.05. Additionally, there is also a low-end target of $36 per share.

As for Seeking Alpha’s quant ratings, the company’s quantifiable aspects rating system and stock performance tags Roku as a hold. The tool returned factor ratings of D- for both valuation and growth. At the same time, it rated Roku C- for profitability and C for momentum.

Here’s a breakdown:

Seeking alpha contributor The Asian investor is among the bulls of ROKU, labeling the stock a strong buy. “I think Roku is an attractive recovery bet in fiscal 2023 and if the streaming company meets its earnings target next year, the stock could see a significant appreciation to the upside,” the analyst said.

Meanwhile, SA associate Shri Upadhyaya thinks Roku is a strong sell. “It can be argued that platform revenue has shown some growth, but it’s not enough to stop the decline in device revenue, which is down 18% from the comparable quarter,” Upadhyaya said.

For investors who aren’t sure about Roku, there is always the diversified option of an exchange-traded fund. The company ranks among 101 different ETFs with Cathy Wood’s innovation-focused funds at the top of the list. Take a look below at the five ETFs that have the highest weightings towards Roku:

- ARK Next Generation Internet ETF (ARKW) 6.82%

- ARK Innovation ETF (ARKK) 6.65%

- iShares US Telecommunications ETF (IYZ) 3.12%

- ARK Fintech Innovation ETF (ARKF) 3.00%

- iShares Virtual Work and Life Multisector ETF (IWFH) 1.71%

ROKU’s stock has risen for the year, but it wasn’t too long ago that Wood called for ROKU to hit $605 a share by 2026. Since his call, ROKU has fallen more than twenty% despite its overall 2023 increase.